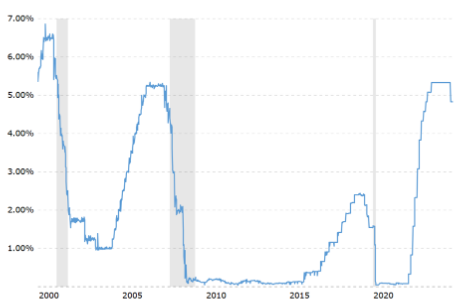

The Federal Reserve recently trimmed its benchmark interest rate by 25 basis points, lowering it to 4.50%-4.75%, in a strategic move to stimulate the economy as inflation cools. Following 2 years of aggressive rate hikes, inflation has moderated from a peak of 9.1% in June 2022 to 2.4%, close to the Fed’s 2% target. This policy shift signals a more accommodative stance that could have far-reaching effects on global markets, including India.

Source:Macrotrends

A study by Capitalmind highlights the market’s nuanced response to rate cuts. Following a 50 bps cut, the Nifty has shown a median return of +1.6%. In contrast, a 25 bps cut historically correlates with a median loss of 0.5%. The Fed’s approach has varied over the years, with multiple rate reductions in times of economic distress, such as after the dot-com crash in 2001 and the financial crisis in 2008.

| Year | Nifty’s 1-Year Return Post 1st Rate Cut | Nifty 6 months Return Before 1st rate cut |

| 2001 | -23% | -10% |

| 2008 | -12% | 26% |

| 2019 | 1% | 6% |

Historically, Nifty often rallies before a rate cut in anticipation (except for 2001). However, post-cut performance tends to moderate as the economic landscape remains challenging, as seen in 2001 and 2008. The lesson here is that while a rate cut can boost sentiment initially, the underlying economic conditions may temper its long-term impact.

Generally, a US rate cut bodes well for Indian markets, signalling a supportive global monetary stance. However, reactions may vary depending on domestic economic conditions and investor sentiment. A more accommodative Fed policy can be favourable for Indian equities, but local factors will play a crucial role in shaping market responses.

Gold often shines in low-interest environments. The Fed’s rate cut could support gold prices as investors seek safe-haven assets during economic uncertainty. Historically, periods of sustained low interest, such as after the 2008 financial crisis and the rate cuts in 2020, saw gold prices climb significantly. Recently, gold touched $2,700 per ounce, reflecting a similar sentiment.

Sectors like infrastructure, real estate, and metals stand to gain from reduced borrowing costs, likely spurring increased investment. Defensive sectors such as FMCG could experience stable demand with minimal volatility.

Lower US interest rates make Indian markets more attractive to foreign investors by widening the interest rate differential. This capital influx can boost stock prices, benefiting sectors that thrive with increased liquidity, and enhancing overall market sentiment.

The Reserve Bank of India (RBI) may consider a rate cut of its own, especially if inflation remains manageable. Such a move would further stimulate India’s economy and could support a rally in equity markets, reinforcing the positive sentiment from the Fed’s action.

The rate cut could strengthen the Indian rupee against the dollar, making imports cheaper but potentially impacting exports by rendering Indian goods pricier abroad. This dual effect could influence sectors reliant on exports and play a role in shaping RBI’s future policies.

The recent Fed rate cut may serve as a catalyst for Indian markets, potentially attracting foreign investment, driving up gold prices, and strengthening the rupee. Sectors like infrastructure, real estate, and metals could benefit from this favourable shift. However, potential moderation in IT exports and RBI’s monetary decisions may temper the broader impact, underscoring the need for a balanced market outlook.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Nov 8, 2024, 3:18 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates