When the world was hit by the COVID-19 pandemic, not only did the overall financial markets experience a significant decline, but so did the stock market. Those investors who had purchased stocks at their peak likely saw a substantial decrease in their overall capital. Conversely, investors who entered the market at its low point and patiently held onto their investments witnessed a more than twofold increase in the value of their investments.

Investing can be both straightforward and challenging. To clarify, it’s relatively easy to invest small amounts regularly, with consistency being the key requirement. On the other hand, it can be difficult to identify the right investment options, especially when investing in equities, as selecting the right company to grow your investments is a complex task.

For passive investors, index funds can be an excellent investment option compared to actively trading individual stocks. Let’s first delve into understanding what index funds are.

An index fund is a type of mutual fund that is designed to replicate the performance of a specific stock market index, such as the Nifty 50 or any other index. Instead of relying on active management and individual stock selection, index funds passively invest in the same stocks and in the same proportions as the underlying index they are tracking. You can think of index funds as your virtual assistant, akin to JARVIS, that not only filters through the investment choices but also ensures that you stay invested in the top companies in India.

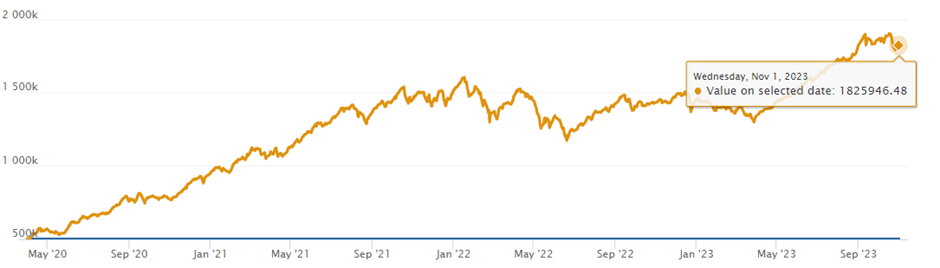

Numerous index funds are available, such as small-cap, mid-cap, and Nifty 50 index funds. In this article, we will analyze an individual’s investment scenario where they placed five lakhs in a lump sum into the Nifty SmallCap 250 fund managed by Motilal Oswal Asset Management Company Limited at the beginning of FY21, specifically on April 01, 2020.

| Date | Investment in Rs | Investment Value in Rs | % Return |

| 01-04-2020 | 5,00,000 | 5,00,000 | 0% |

| 01-04-2021 | – | 10,96,248 | 119% |

| 01-04-2022 | – | 14,47,461 | 189% |

| 01-04-2023 | – | 13,40,844 | 168% |

| 01-11-2023 | – | 18,25,946 | 265% |

Based on the data above, the Nifty Small Cap 250 fund has delivered a remarkable multibagger return of 265%. This means that if you had initially invested Rs 5 lakh, the value of your investment would have grown by 265% over a period of 1310 days or approximately 3.5 years.

However, the investment value doubled in the very first year, with a remarkable 119% return. The following year saw even more impressive growth, with returns of 189%. However, in the third year, the return dipped slightly to 168%. Nevertheless, the investment eventually generated an impressive return over the entire measurement period.

Every investor should bear in mind that a key secret to achieving success is maintaining patience and consistency in their investment approach.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Nov 2, 2023, 4:03 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates