As the political landscape gears up for the 2024 Lok Sabha elections in India, discussions surrounding the country’s financial planning take centre stage. Central to this discourse are the distinctions between the interim budget and the full union budget, two crucial fiscal documents that guide the nation’s economic trajectory. Finance Minister Nirmala Sitharaman is set to present the Union Budget 2024, which follows the 53rd GST Council meeting’s recommendations to refine tax rates and service exemptions.

An Interim Budget and a Full Budget serve distinct purposes in the financial governance of a nation. The Interim Budget is a temporary measure presented by the government to meet financial requirements until a new government assumes office. Typically introduced when an incumbent government’s term is ending or during a transition of power, it ensures the smooth functioning of the government without introducing significant policy changes. Its primary focus is on essential expenditures necessary to sustain governmental operations, maintaining continuity and stability.

In contrast, the Full Budget represents the comprehensive financial roadmap of the ruling government for the entire fiscal year. It encompasses all aspects of fiscal policy, including revenue generation, expenditure allocation, and policy initiatives. Presented annually, the Full Budget delineates the financial priorities and goals for the upcoming fiscal year, covering expenditures, developmental projects, and ongoing schemes. Unlike the Interim Budget, which garners approval for a short interim period, the Full Budget requires parliamentary endorsement for the entire fiscal year. This underscores its significance as the principal fiscal document of the government, reflecting its long-term vision and objectives.

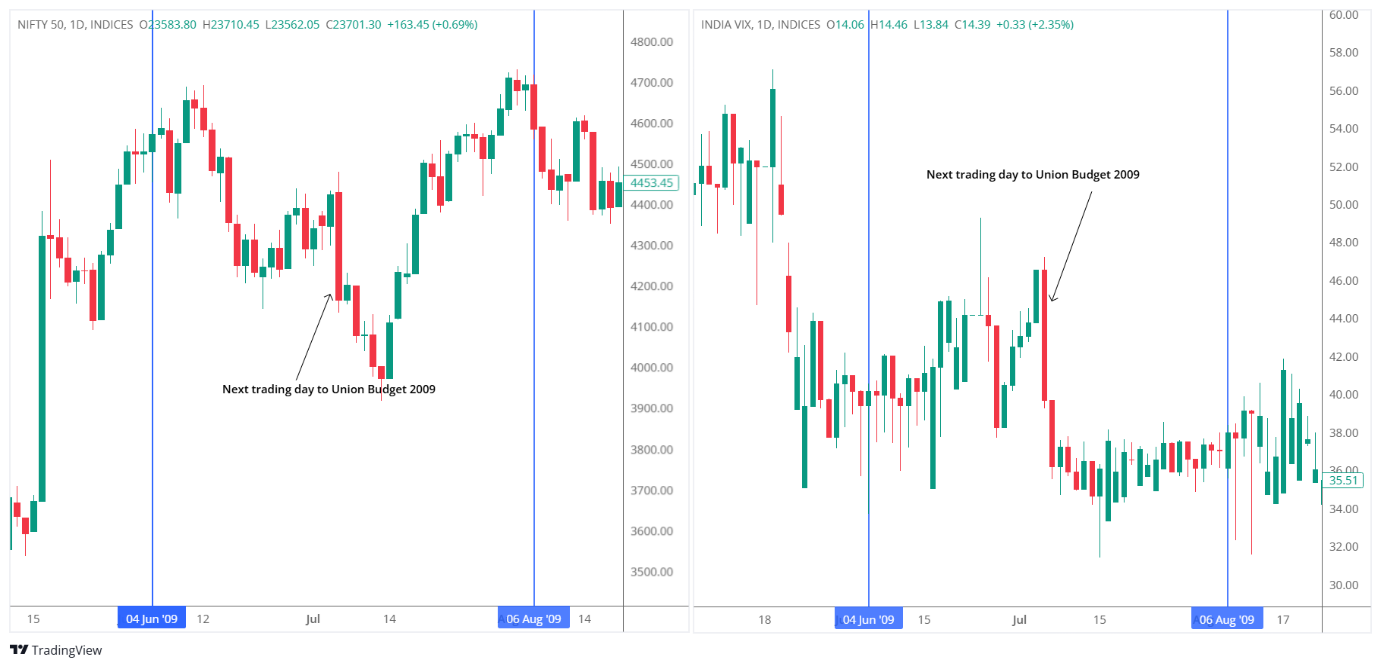

Reflecting on past Budget Days provides valuable insights into market behavior amidst fiscal policy announcements. In 2009, the Interim Budget presented by Finance Minister Pranab Mukherjee lacked a stimulus package, disappointing markets anticipating economic boosts. The subsequent Union Budget, presented on July 6, 2009, marked a turnaround in market sentiments, influenced by the clarity provided post-elections. Leading up to the budget, markets had experienced a downtrend, but post-budget, the India VIX, indicating market volatility, stabilized as uncertainty diminished, reflecting renewed investor confidence.

Similarly, the 2014 Union Budget presented on July 10, 2014, under Finance Minister Arun Jaitley saw significant volatility in the Nifty50 index, with intraday movements of around 251 points. This volatility was coupled with a notable decline in the VIX, indicating reduced fear among traders post-budget announcements. The market trended upwards in the month preceding and following the budget, bolstered by optimistic market reactions to policy clarity and economic projections.

In 2019, the Interim Union Budget presented by Acting Finance Minister Piyush Goyal preceded the Union Budget presented by Finance Minister Nirmala Sitharaman. On Budget Day July 5, 2019, the Nifty50 moved approximately 184 points intraday, settling 1.14% lower than the previous close. Concurrently, the VIX decreased by 3.3%, reflecting reduced investor apprehension despite global economic slowdown concerns. However, the Nifty50’s downward trajectory before and after the budget underscored ongoing market volatility and economic uncertainties.

As India awaits the Union Budget 2024, scheduled for presentation in July by Finance Minister Nirmala Sitharaman, anticipation looms high following the interim budget earlier in February. The run-up to the budget has been marked by significant market dynamics, including a notable rise in the VIX index during the election period, peaking at 31.75 due to heightened investor uncertainty. However, post-election results favouring the ruling government saw the VIX index decline to approximately 14, signaling a return to calmer market conditions.

Nifty went through a volatile phase during and after election results as the NDA government continued to be elected but with a lower mandate. How the market reacts to the Union Budget 2024 is a big question as markets are near all-time highs and investor optimism is also higher. Given the historical trends, it is plausible that the market may exhibit volatility around the budget announcement. The impact of the budget on market indices like Nifty50 could be influenced by various factors including the specifics of fiscal policies introduced, investor sentiment, and broader economic conditions.

Conclusion

Examining past Budget Days offers valuable clues for navigating potential market movements in 2024. Volatility seems to be a recurring theme, with the Nifty experiencing significant swings in 2014 (251 points) and 2019 (184 points) on Budget Day. Interestingly, these periods often coincided with a decline in the VIX, indicating that fear subsided somewhat after the announcements. This suggests that clarity on policy direction can mitigate some of the initial jitters.

The current market situation, with the Nifty hovering near all-time highs and investor sentiment being positive, could also play a role in dampening volatility. However, the specific measures outlined in the budget will undoubtedly influence market reactions. Measures promoting economic growth or tax breaks could be met positively, while tax hikes or increased spending could trigger a sell-off.

Published on: Jun 25, 2024, 6:46 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates