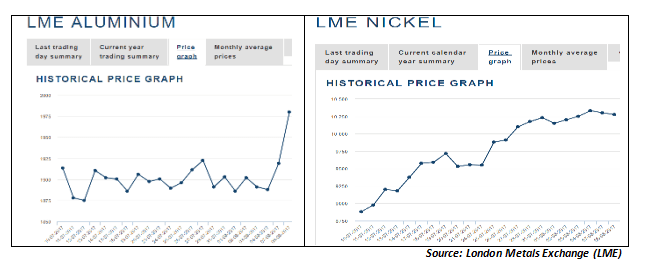

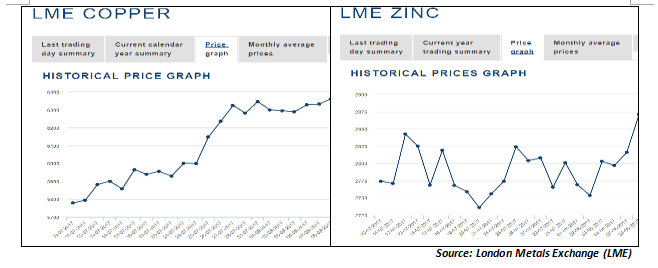

Base metal prices have been on a roll, especially over the last one month. Be it aluminium, nickel, copper or zinc; most of these non-ferrous base metals have seen a rally. Let us look at four such non-ferrous metals and their performance, since July 2017.

Aluminium and Nickel…

After a fall in aluminium prices in 2015, China (the world’s largest manufacturer and consumer of aluminium) had put curbs on supply, resulting in a sharp spike in prices, which became more pronounced in the last one month since July 2017. In addition, there was also a seasonal pick-up in demand for aluminium as well as greater accumulation of aluminium inventories by base metal speculators. The supply cuts have worked for China because at the current elevated prices of aluminium, most of the domestic Chinese aluminium makers are turning profitable.

When it comes to nickel it needs to be remembered that nearly 65-70% of the demand for nickel comes from manufacturers of stainless steel. Thus the demand and price pattern of Nickel will largely be predicated on the trend in stainless steel. In case of nickel, despite the sharp fall in Nickel prices between 2011 and 2016, the supply cuts were not forthcoming. That is more because, nickel mining is in the hands of large corporates which have the deep pockets to absorb losses in the hope that weaker hands will fold up first. The immediate trigger for Nickel prices could be if the Philippine government imposes curbs on nickel mining due to environmental reasons.

Copper and Zinc…

Like nickel, copper saw a rally of 7% in July 2017 supported by favourable economic numbers from China. On one hand some macro funds have been buying copper while Chinese companies have been heavily stockpiling copper. Investments in copper capacity have seen a slowdown and that has kept the demand / supply balance for copper in favour of higher prices. The big trigger for copper could be if China continues to encourage the domestic industries to keep building copper inventories. At least, that could create a base for copper prices.

Zinc has also seen production cuts since late 2015 and the overall demand/supply situation is near a deficit which has worked in favour of stronger prices. Like in case of copper, many macro funds are stocking up on Zinc expecting it to benefit substantially from infrastructure investments expected in the US and in China. Remember, Trump had promised a big push to US infrastructure and the China Railways is planning a major restructuring. Zinc prices have already rallied 51% from the lows of January 2017 and that is expected to encourage hedging and profit taking at higher levels. Zinc got into net deficit only in late 2016 and that has attracted higher prices.

Fundamentally, what is driving the rally in base metal prices?

There are 4 key factors that have driven this rally in base metal stocks…

In a nutshell, it may be too early to judge whether the base metals super-cycle that peaked around 2011 is close to bottoming out. Remember, that commodity super-cycle began in 2002 and lasted a full 9 years. We do estimate that in the short to medium term, most of these non-ferrous metals are likely to see deficit in supply. That should keep prices buoyant. But a real demand push will only come when global growth (especially in China) picks up rapidly. Metal cycles have rarely shown a V-shaped recovery and there is more likely to be a broader consolidation with a positive bias. At least, for the next 2 quarters, the prospects of Non-ferous metals look promising

Published on: Aug 11, 2017, 12:00 AM IST

We're Live on WhatsApp! Join our channel for market insights & updates