In real estate investment, Embassy Office Parks REIT, Mindspace Business Parks REIT, and Brookfield India Real Estate Trust REIT have faced a challenging year marked by declining returns and market uncertainty. Several factors, including a global economic slowdown, increasing interest rates, and rising borrowing costs, have contributed to the struggles of these Real Estate Investment Trusts (REITs).

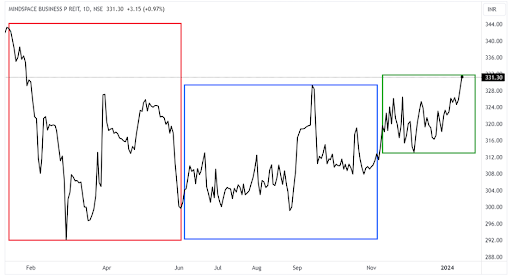

The technology sector plays a significant role in the portfolios of Embassy REIT, Mindspace REIT, and Brookfield REIT, with major multinational corporations as key tenants. However, recent times have witnessed a 1% return for Embassy REIT, a 2.56% decline for Mindspace REIT, and a substantial 16.25% negative return for Brookfield REIT.

One of the primary concerns is the global economic slowdown, which has sparked fears of non-renewal on lease agreements by major technology tenants. With a considerable portion of the REITs’ portfolios relying on the technology sector (36%, 45%, and 30% for Embassy, Mindspace, and Brookfield REITs, respectively), the impact of a slowdown is particularly pronounced. As economic uncertainties persist, the market is wary of potential tenant exits, posing a threat to the stability of these REITs.

| Sector | Embassy REIT | Mindspace REIT | Brookfield REIT |

| Technology | 36% | 45% | 30% |

| Financial | 21% | 20% | 22% |

Another significant challenge facing Indian REITs is the surge in interest rates, leading to an unfavourable impact on property valuations. Rising interest rates tend to drive up capitalization rates, resulting in lower real estate valuations and a decline in Net Asset Value (NAV).

The recent performance of the three REITs reflects this trend, with Mindspace REIT experiencing a 2.56% decline, while Brookfield REIT faces a substantial 16.25% negative return. The shift in investor focus towards fixed-income securities as interest rates climb further exacerbates the challenges for these real estate trusts. Higher discount rates lower future cash flow values, affecting the attractiveness of REIT investments in comparison to fixed-income alternatives.

REITs traditionally rely on debt to finance their real estate holdings and future developments. However, the rising interest rate environment has led to an increased cost of borrowing for these trusts. This uptick in borrowing costs not only raises concerns about the financial health of the REITs but also has broader implications for their profitability and, consequently, their stock prices.

In conclusion, the challenges facing Embassy Office Parks REIT, Mindspace Business Parks REIT, and Brookfield India Real Estate Trust REIT are multifaceted, encompassing a global economic slowdown, increasing interest rates, and heightened borrowing costs. Navigating these hurdles will require strategic decision-making, proactive tenant management, and financial prudence. As the Indian real estate market grapples with uncertainties, investors and stakeholders must closely monitor these developments and adapt their strategies to ensure resilience in an evolving landscape.

During the initial period of 2023, the REIT sector experienced a significant shift in tax regulations with changes announced in Budget 2023. Subsequently, there was a relaxation in the Finance Bill, providing the industry with a more flexible and conducive tax environment.

The REITs grappled with a confluence of challenges, including the global economic slowdown, escalating interest rates, and an increased cost of borrowing. These factors collectively contributed to subdued returns and heightened uncertainties for Embassy Office Parks REIT, Mindspace Business Parks REIT, and Brookfield India Real Estate Trust REIT.

Amidst the challenges, positive developments emerged as floor-wise denotification initiatives bolstered occupancy rates and rental yields. Furthermore, strategic measures, such as inclusion in equity indices, not only enhanced liquidity but also instilled investor confidence in REITs. These initiatives aligned with global best practices, presenting new opportunities for growth and higher tax revenues in the Indian real estate market.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. The information is based on various secondary sources on the internet and is subject to change. Please consult with a financial expert before making investment decisions.

Published on: Jan 11, 2024, 4:38 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates