When it comes to wealth creation, small-cap mutual funds are proving to be the rising stars of the investment landscape. Regardless of an investor’s time horizon, these funds have consistently delivered substantial returns, earning them a special place in the portfolios of many.

Market experts argue that small-cap mutual funds have the potential to generate the highest returns over the long run, and here’s why.

Small-cap funds have gained recognition for their dynamic nature and ability to outperform their larger counterparts, namely large-cap and mid-cap funds. These funds specialize in investing in lesser-known, smaller companies that exhibit promising growth prospects. As these companies make their mark in the market, investors have the opportunity to reap substantial gains.

What sets small-cap funds apart is their adeptness at diversification. When integrated into a portfolio, they contribute to overall diversification, mitigating the impact of underperforming larger companies. This diversification taps into various market niches, providing insulation from market fluctuations.

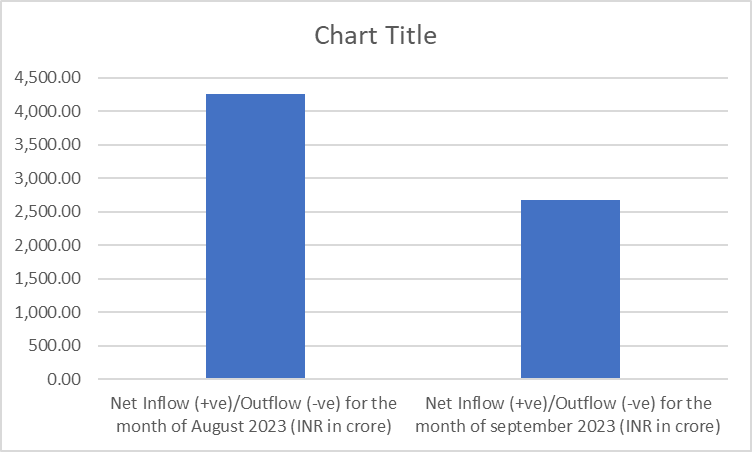

The data indicates that the net inflow into small-cap funds for September amounted to Rs 2678.47 crore, in contrast to the Rs 4264.82 crore recorded in August.

Small-cap fund investments have always been a playground for risk-takers seeking higher returns. But in September, the tide seemed to change. Investors witnessed a dip in the net inflow of small-cap funds. What were the key factors driving this downturn? Let’s delve into the reasons behind this shift.

One of the major factors contributing to the dip in net inflows into mid- and small-cap funds was profit booking by investors. After a period of substantial gains, many investors decided it was time to lock in profits. As a result, they started withdrawing their investments, causing a decline in the overall inflow.

Furthermore, concerns about inflated valuations in some segments of the small-cap market played a role in the dip. Investors became cautious, worried that some small-cap stocks might have become overpriced, making them vulnerable to corrections.

It was observed as a month-on-month trend. This could be attributed to certain fund houses temporarily halting inflows. This move may have been motivated by a desire to manage the fund’s size more effectively or to maintain a balance between inflows and their investment strategies.

| Sr.No. | Scheme Name | AuM (Cr) | 1W | 1M |

| 1 | Quant Small Cap Fund – Direct Plan – GrowthSmall Cap Fund | 9,089.12 | 2.58% | 0.34% |

| 2 | Nippon India Small Cap Fund – Direct Plan – GrowthSmall Cap Fund | 37,374.40 | 2.38% | 0.48% |

| 3 | Franklin India Smaller Companies Fund – Direct – GrowthSmall Cap Fund | 9,719.31 | 2.75% | 2.10% |

| 4 | Tata Small Cap Fund – Direct Plan – GrowthSmall Cap Fund | 6,134.53 | 2.31% | 2.47% |

| 5 | ICICI Prudential Smallcap Fund – Direct Plan – GrowthSmall Cap Fund | 6,054.27 | 2.06% | 0.01% |

| 6 | HDFC Small Cap Fund – Direct Plan – GrowthSmall Cap Fund | 23,251.04 | 1.79% | 0.71% |

| 7 | HSBC Small Cap Fund – Direct Plan – GrowthSmall Cap Fund | 11,650.11 | 3.22% | 1.03% |

| 8 | Bank of India Small Cap Fund – Direct Plan – GrowthSmall Cap Fund | 684.8 | 2.74% | 2.97% |

| 9 | Canara Robeco Small Cap Fund – Direct Plan – GrowthSmall Cap Fund | 7,821.22 | 1.96% | 0.56% |

| 10 | Axis Small Cap Fund – Direct Plan – GrowthSmall Cap Fund | 16,175.33 | 1.91% | 0.16% |

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet, and is subject to changes. Please consult an expert before making related decisions.

Published on: Oct 17, 2023, 7:16 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates