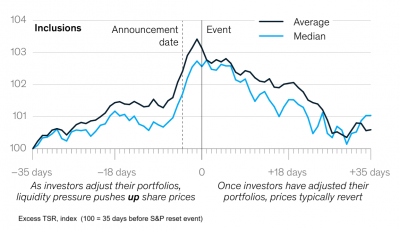

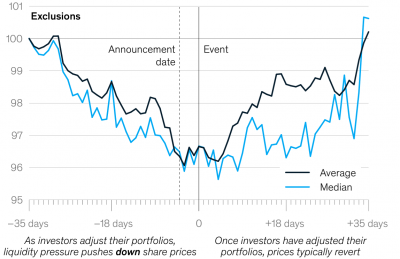

Imagine you are researching stock investments and discover that you missed a golden opportunity with a stock that was recently included or excluded from an index. Relax; there’s no need to stress. Research by McKinsey indicates that while the inclusion or exclusion of a stock in an index may cause its price to jump or drop initially, it typically settles back to its true value within about two months.

An analysis conducted by experts on hundreds of companies in the S&P 500 confirms that the price impact of such index changes is short-lived, with stocks reverting to their intrinsic value after a period of time. Thus, investors should recognize that the fundamental business drivers ultimately determine a company’s stock price, not the temporary effects of index inclusion or exclusion.

Investors should not base their investment strategies solely on index movements. It’s important to remember that companies do not make management decisions based solely on whether their stock will qualify for index inclusion, nor do they halt divestment decisions simply because they might not be included in an index. Decisions regarding risk capital and organic or inorganic acquisitions are made based on sound business reasons rather than the desire for index inclusion.

When considering tips from analysts and research reports about potential stock price changes due to index inclusion or removal, investors should maintain rational expectations. The stock price of any company is ultimately derived from its intrinsic value, which hinges on factors such as future growth potential, return on invested capital (ROIC), management quality, and overall sector trends. After all, no one builds a valuation model with the “index” as the primary focus.

Disclaimer: This blog has been written exclusively for educational purposes. http://bit.ly/3usSGoH

Source: McKinsey Report

Date: May 2024

Published on: Oct 4, 2024, 6:05 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates