Imagine two companies in the same business, selling similar products, yet valued differently by the market. This is the intriguing story of Public Sector Banks (PSBs) and Private Sector Banks (Pvt Banks) in India, as revealed by their Price-to-book (PB) ratio over the past 2 years (July 2022 – Feb 2024). Buckle up, as we delve into this financial mystery!

Price to Book Ratio

Think of the PB ratio as a quick way to assess a company’s valuation. It compares the company’s market price per share (think, what you’d pay to buy it) to its book value per share (the net worth of its assets minus liabilities). A higher PB ratio suggests investors are willing to pay more for each rupee of its book value, indicating optimism about future growth.

PSBs vs Pvt Banks

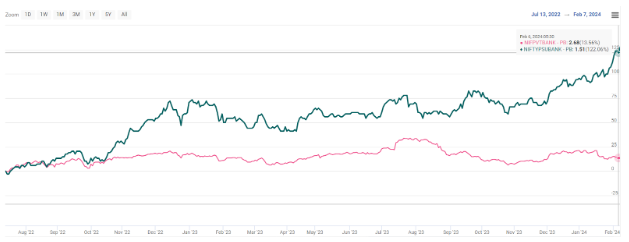

Trendlyne Chart

(Blue line: PSU; Pink line: PVT, PB ratio)

Now, let’s look at the data. During our period, the Nifty PSU Bank index consistently traded at a lower PB ratio compared to the Nifty Pvt Bank index. On average, the gap was a significant 1.65 times! This means, that for every rupee of book value, investors were willing to pay ~1.65 times more for Pvt Banks than PSBs.

Why the Difference? Decoding the Mystery

Several factors contribute to this PB gap:

Profitability: Pvt Banks historically boast higher profitability compared to PSBs. This translates to better returns for investors, justifying a higher PB ratio.

Asset Quality: Pvt Banks generally have lower levels of Non-Performing Assets (NPAs) compared to PSBs. Lower NPAs mean less money stuck in bad loans, making Pvt Banks financially healthier.

Operational Efficiency: Pvt Banks are often seen as more efficient in their operations, leading to better cost control and higher margins.

Governance: Concerns about government interference and slower decision-making processes in PSBs can weigh down their PB ratio.

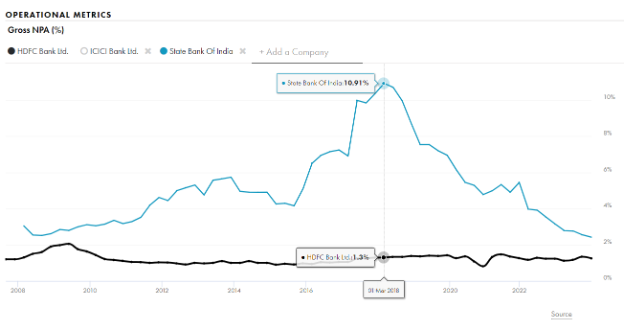

Comparing Industry Leaders

(source: tijorifinance)

The contrasting dynamics between the two banking giants, SBI and HDFC Bank, are evident in their gross NPA percentages. Notably, while SBI leads among PSU banks with a higher gross NPA percentage compared to HDFC Bank, the volatility in SBI’s gross NPA far surpasses that of HDFC Bank, making for an intriguing comparison.

(SBI had a gross NPA of 10.91% as compared to HDFC’s 1.3% in 2018)

Beyond the Numbers: The Story Unfolds

The lower PB ratio of PSBs doesn’t necessarily paint a bleak picture. They often play a crucial role in financial inclusion, reaching unbanked segments that Pvt Banks might not prioritize. Additionally, government initiatives aimed at strengthening PSBs, like capital infusions and reforms, could bridge the PB gap in the future.

Investing Insights: Not a Black and White Picture

While the overall PB trend paints a clear picture, individual banks within each category might deviate. Analyzing individual bank fundamentals, growth prospects, and specific risk factors is crucial before making investment decisions. Remember, past performance is not always indicative of future results.

The Final Chapter

The Indian banking landscape is constantly evolving. As PSBs implement reforms and Pvt Banks face their own challenges, the PB gap could narrow or widen in the future. Keeping an eye on these trends and understanding the underlying factors will be key to informed investment decisions.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Feb 8, 2024, 6:44 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates