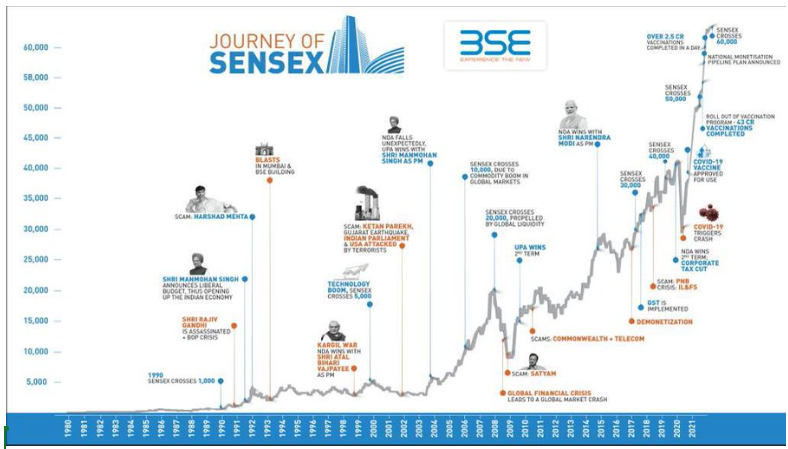

Since 1979, the average annual return of Sensex is 17% per annum. This is not just the case with Sensex; the market generally had an upward trajectory, creating a growth pattern, as shown in the image below.

But have you ever wondered why, even after daily ups and downs, the stock market generally goes up over time?

In this blog, let’s understand the stock market’s upward movement and the reasons behind it. And answer one of the most important questions: Will it always go up? But before moving ahead, let’s have a look at history first.

The Indian stock market’s story began in 1875 with the establishment of the BSE. Since then, it has been a barometer of the country’s economic health. Liberalising the Indian economy in the 1990s marked a turning point, ushering in foreign investments and corporate growth. This era also saw the rise of the IT sector, positioning India as a global player in technology.

Significant milestones include the Sensex first crossing the 1,000 mark in 1990 and later breaching 60,000 in 2021, reflecting economic growth and evolving investor confidence in India’s future. These numbers, more than just milestones, are testaments to the resilience and potential of the Indian economy.

India’s GDP is the backbone of the stock market’s growth. With an average growth rate of around 6-7% per annum over the past two decades, India stands as one of the fastest-growing major economies. This growth translates directly into stock market performance as companies benefit from a booming economy.

During a bullish market phase, stock prices generally increase. This often leads to heightened economic confidence. As a result, consumer spending tends to grow, with people feeling more optimistic and purchasing more goods and services. This, in turn, encourages businesses to ramp up production and sales.

The rising market attracts more investors, potentially driving higher stock prices. These positive trends in the stock market can aid in economic development. However, this correlation is not guaranteed.

For instance, the period of 2021-22 saw record-breaking highs in stock markets and a surge in new Demat accounts, yet this did not translate into economic growth. During this financial year, GDP growth actually declined each quarter, largely due to the pandemic’s impact.

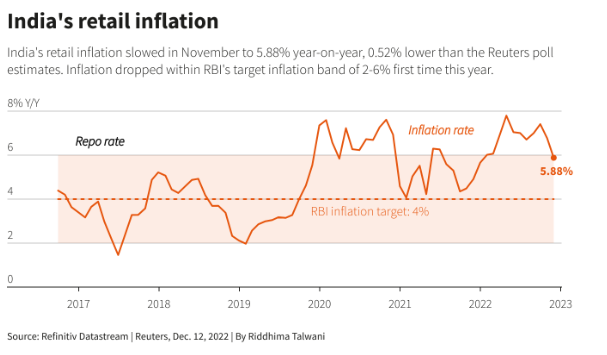

Inflation refers to the widespread increase in the cost of goods and services within an economy. When this happens, businesses usually make more money because they sell their goods and services at higher prices. This can cause the value of their stocks to go up. This is one reason why stock markets worldwide might show increases; some of it is just because of inflation.

This directly explains why investing can be better than just saving money. If you invest, the value of your investments can go up with inflation. But if you just save, your money might lose value over time because things cost more.

However, this only works well when inflation isn’t too high. The Reserve Bank of India thinks that if prices increase by about 4% a year, it’s good for the economy. But if the inflation is really high, like in Venezuela and Zimbabwe (which can cross 6-figures yearly), it can cause many problems. It makes the economy unstable, and investors might start looking for safer places to put their money.

The primary reason for the long-term growth of stock indices like the Sensex is their composition, which includes only the top-performing companies in the market. A company needs to meet certain criteria to be part of the Sensex, such as being in the top 100 listed companies of the Bombay Stock Exchange and should be listed for at least a year. The standards are not so stringent to make it for Sensex. So, emerging, more competitive ones replace companies that no longer meet these standards, increasing the market cap of the index.

This dynamic nature of the index reflects the rapid pace of technological and economic advancements. As a result, companies’ presence in the Sensex has changed over time. For instance, the leading sectors in the Sensex have changed significantly over the years.

Currently, sectors like Healthcare, Renewable Energy, IT, Real Estate, Finance, and Infrastructure dominate the top spots. In contrast, just a decade ago, the list was led by IT, Healthcare, FMCG, Auto and Oil & Gas sectors. The identity of the largest companies might change over the next two decades. Still, the structure of the index ensures that it will always represent the most successful companies at any given time.

As of January 2021, the world’s population is approximately 7.8 billion, which is projected to reach 11 billion by 2100. This growth presents a larger business market, often leading to increased company value over time.

There’s a trend towards more specialised industries in economies with larger populations. For example, a small economy might focus on agriculture and manufacturing, while a larger one diversifies into technology, finance, and entertainment.

India’s demographic profile, with a large and young population, fits well with consumer demand, directly benefiting businesses. This demographic dividend has been a key driver in India’s consumption-led growth story, reflecting positively on stock market trends.

Despite exceptions like Singapore and Switzerland, generally, a bigger population correlates with greater economic productivity and growth, fostering the development of larger, more valuable companies.

The Indian stock market has seen significant diversification over the years. New sectors like renewable energy, e-commerce, and fintech have emerged, offering investors a broader investment canvas. Additionally, government policies encouraging Foreign Direct Investment (FDI) have brought in fresh capital, further enriching the market.

Mutual funds and the growing participation of retail investors have also played a crucial role in market expansion. These avenues have democratised stock market investments, allowing more people to partake in India’s growth story.

The advent of technology, particularly in the form of online trading platforms, has revolutionised the Indian stock market. It has opened the gates for a larger section of the population to invest, breaking barriers of geography and socio-economic status. Fintech innovations have simplified trading and enhanced investor education, leading to more informed investment decisions.

Despite its long-term growth, the stock market is not without risks and periods of volatility. Economic downturns, global crises, and internal market dynamics can cause short-term disruptions. However, a long-term investment horizon can help mitigate these risks, as historically, the market has shown a tendency to recover and grow over time.

This might be the case for a developing or dominant economy like India and the US. But it’s not always the case.

Japan’s stock market has struggled since the 1990s due to various economic challenges. Following its asset bubble burst in 1991, Japan experienced a prolonged period of stagnation, often called the “Lost Decade,” which has extended over three decades.

During this time, Japan, once known for innovations like the Walkman and Shinkansen, hasn’t seen major new technological breakthroughs. Meanwhile, countries like the U.S. have spearheaded the Information Age, and China is advancing in areas like fintech and 5G technology.

These issues, combined with an ageing population and a deflationary economy, have impacted Japan’s stock market performance. The Nikkei 225, Japan’s key stock index, has shown minimal growth, with a Compound Annual Growth Rate (CAGR) of only 0.73% from 1991 to 2020. This contrasts sharply with the growth in other global markets over the same period.

The Indian stock market’s long-term growth trajectory is anchored in solid economic fundamentals, a diverse and expanding market, technological advancements, and a favourable demographic profile. While short-term volatility is part and parcel of market dynamics, the long-term outlook remains robust.

Whether the market goes up or down, the importance of patience and a strategic long-term view is a primary requirement for investors. So what you’re waiting for? Build your wealth over the long term. Open your demat account with Angel One and start investing today.

Published on: Jan 2, 2024, 2:12 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates