Certainly! With technology, life has become so much easier, hasn’t it? With just one click, we can call or text someone, and even buy groceries online. Ordering food has also become incredibly convenient these days. We can order for ourselves or even for relatives who are far from our locations.

Probably, you’ve ordered food for self-consumption at home or at your workplace. With just one click, you can order and get busy with your own work, whereas earlier, it would have taken a lot of time to go outside, find a restaurant, and spend hours consuming food.

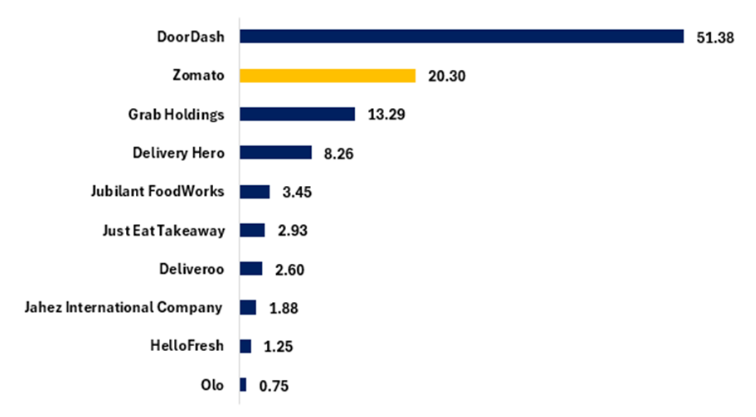

But did you know that the Indian food delivery giant, Zomato, ranks second globally in terms of market capitalization? In this article, we will explore the top companies engaged in the food delivery business around the world, along with their ranking based on market capitalization. Additionally, we will include the stock performance of these companies over the last year.

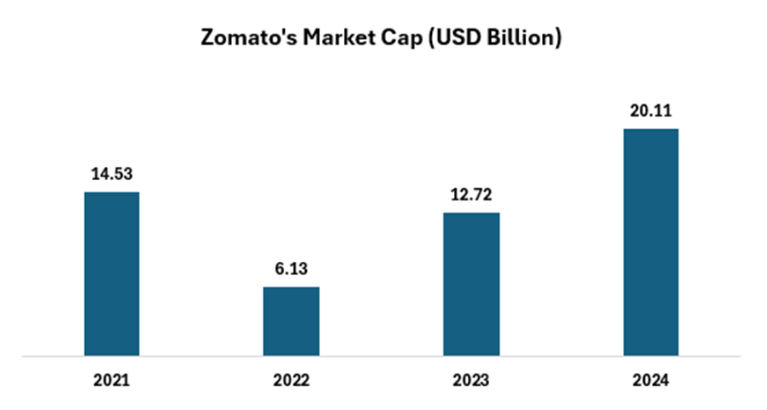

Zomato experienced a significant drop in market capitalization in 2022, falling from 14.53 USD billion to 6.13 USD billion, but has since rebounded to an all-time high of around 20.11 USD billion. Now, let’s delve into the top ten players worldwide based on market capitalization.

| Rank | Company Name | Country | M Cap USD Billion | Price in USD | 1- Year Return % |

| 1 | DoorDash | USA | 51.38 | 127.18 | 107.51 |

| 2 | Zomato | India | 20.30 | 2.34 | 241.18 |

| 3 | Grab Holdings | Singapore | 13.29 | 3.37 | 15.02 |

| 4 | Delivery Hero | Germany | 8.26 | 31.26 | -14.92 |

| 5 | Jubilant FoodWorks | India | 3.45 | 5.24 | -2.41 |

| 6 | Just Eat Takeaway | Netherland | 2.93 | 14.24 | -15.71 |

| 7 | Deliveroo | UK | 2.60 | 1.56 | 14.71 |

| 8 | Jahez International Company | Saudi Arabia | 1.88 | 9.14 | -8.49 |

| 9 | HelloFresh | Germany | 1.25 | 7.35 | -73.31 |

| 10 | Olo | USA | 0.75 | 4.67 | -40.05 |

* Market cap in USD Billion

As per the data above, Zomato is the second-largest food delivery company in the world in terms of market capitalization. The largest food delivery company is DoorDash, based in the USA, with a market capitalization of 51.38 USD billion. The shares of this company have delivered an impressive return of around 108% to their shareholders in the past year.

However, despite being the second largest in terms of size, Zomato’s shares have delivered a remarkable multibagger return of around 241% in the past year to their shareholders. Clearly, the company has rewarded its shareholders impressively compared to other players around the world, where the majority of the shares among these ten companies have generated negative returns during the same period.

In Q3 FY24, Zomato reported a revenue of Rs 3288 crore, representing a year-on-year growth of 69% from Rs 1948 crore in the same quarter last year. The operating profit of the company stands at Rs 51 crore, with an operating profit margin of 2% compared to an operating loss of Rs 366 crore in the same quarter last year. The net profit of the company stood at Rs 138 crore in the December quarter, an improvement compared to a net loss of Rs 347 crore. The company has been posting net profits for the last three quarters.

Zomato raised its platform fee by 25% to Rs 5 per order. In August 2023, it introduced a Rs 2 platform fee to enhance its margins and achieve profitability. Subsequently, the fee was raised to Rs 3 before another increase to Rs 4 on January 1. On December 31, the platform fee was temporarily hiked to Rs 9.

Furthermore, Zomato processes approximately 85-90 crore orders annually. An increase of Re 1 in the convenience fee across all regions could potentially impact operating profits positively by Rs 85-90 crore, representing around a 5% increase in Operating profits. However, this increase is currently effective only in some selected cities.

Disclaimer: This post has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Apr 22, 2024, 6:08 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates