Technical & Derivatives Report

May 26, 2016

Sensex (25881) / Nifty (7935)

Exhibit 1: Nifty Daily Chart

After such a prolonged consolidation, we witnessed an amazing

trading day (especially for the bulls) as the index opened with a

decent upside gap mirroring to extremely positive global cues and

then a strong follow up buying to conclude the day with whopping

single day gains of 2.40%.

To be honest, we were not so surprised with yesterday’s move as

we have been repeatedly mentioning about a probable bounce

after Nifty entering the 9th ‘Time Zone’ (34 Days) as per the

‘Fibonacci Time Series’. Our mentioned targets have been met;

but, still the momentum is quite strong and thus, traders should

not expect any fall immediately. Since, the May series derivative

expiry is slated today, traders need to keep a close watch on two

key levels, which are 7950 and 8000. Sooner or later, we expect

it to be broken; but, whether it’ll happen tomorrow or not is very

difficult to comment on. However, having said that we maintain

our positive stance on the market and expect 7900 - 7880 to act

as an immediate support in the coming session.

Key Levels

Support 1 - 7900

Resistance 1 - 7950

Support 2 - 7880

Resistance 2 - 8000

Exhibit 2: Nifty Bank Daily Chart

Nifty Bank Outlook - (16997)

The Nifty Bank index opened gap up and rallied throughout the

session to end the day with enormous gains of 3.29% over its

previous close.

The Nifty Bank index has formed a bullish 'Marubozu' candle on

daily charts, indicating that buyers were in complete control right

from the opening tick. The pullback was much on our expected

lines as we had already mentioned in our previous reports that

the banking index has formed 'Bullish AB=CD' pattern around

16370 no hourly chart and an up move should eb there. In recent

past, 17000-17080 zone has acted as resistance several times

since December 2015. Hence, for continuation of the positive

momentum, the bulls need to lead the index above the mentioned

resistance zone. Traders are advised to continue with the long

positions in the index unless any signs of reversal seen. The

intraday support for the index is placed around 16870 and

16750 whereas resistance are seen around 17080 and 17210.

Key Levels

Support 1 - 16870

Resistance 1 - 17080

Support 2 - 16750

Resistance 2 - 17210

1

Technical & Derivatives Report

May 26, 2016

Comments

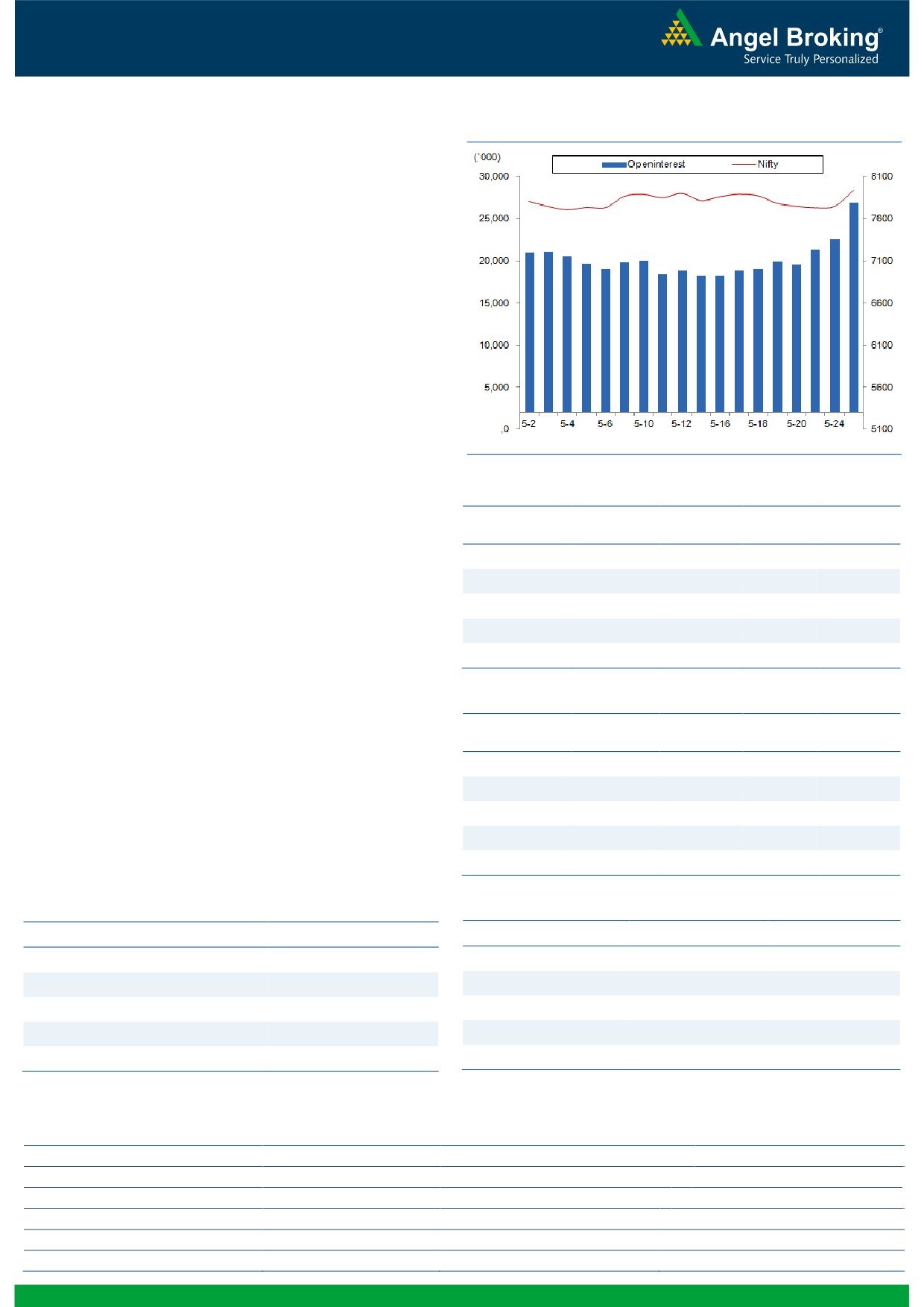

Nifty Vs OI

The Nifty futures open interest has increased by 18.92%

BankNifty futures open interest has increased by 12.58%

as market closed at 7934.90 levels.

The Nifty May future closed at a premium of 8.10 points

against a premium of 10.45 points. The June series

closed at a premium of 19.05 points.

The Implied Volatility of at the money options has

decreased from 15.05% to 14.99%.

The total OI of the market is Rs. 2,64,058/- cr. and the

stock futures OI is Rs. 68,938/- cr.

Few of the liquid counters where we have seen high cost

of carry are IDBI, CEATLTD, GMRINFRA, GODREJIND

and BANKBARODA.

Views

Nifty bounced more than 2 percent yesterday; FIIs too

participated in this move in a big way. They bought

OI Gainers

equites to the tune of Rs. 495 crores. While in Index

OI

PRICE

SCRIP

OI

PRICE

Futures, they bought significantly of Rs. 3343 crores with

CHG. (%)

CHG. (%)

GODREJCP

402000

33.11

1459.60

4.58

huge amount of rise in OI, suggesting long formation.

On the other hand in options front, they were net buyers

VOLTAS

8335600

28.98

337.80

3.13

of worth Rs. 2392 crores with marginal change in open

IBREALEST

28694000

25.72

94.65

5.28

interest. We believe FIIs have covered most of the short

RECLTD

36524000

18.12

155.50

0.45

formed in 7800 and 7900 call options. 8200 and 8300ng.com

INFRATEL

5496400

17.97

395.95

3.10

call options of June series were most active and they also

added good amount of OI yesterday. While in put

OI Losers

options, 8000-7950 strikes added meaningful build-up,

OI

PRICE

these positions are mostly on the short side. Seeing

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

yesterday’s statistic, we believe Nifty may continue to

CANBK

10030000

-14.95

193.55

7.35

show strength, one can expect Nifty testing 7980-8000

JUSTDIAL

2511400

-14.75

640.80

0.16

levels today. Rollover in Nifty is below its averages at

CASTROLIND

9177100

-14.25

372.55

1.91

55.35% and of BankNifty is in line at 46.64%. Rollover

TATAGLOBAL

22138500

-13.00

119.50

-2.05

percentage in NIFTY suggests shorts which were formed

in May series are not getting rolled for next series.

UNIONBANK

15110000

-12.47

109.55

2.48

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

TECHM

52.83

NIFTY

1.03

0.94

INDUSINDBK

31.07

BANKNIFTY

1.20

0.88

CIPLA

34.13

SBIN

0.45

0.50

AMARAJABAT

36.01

RELIANCE

0.51

0.61

ASHOKLEY

34.24

ICICIBANK

0.65

0.41

Strategy Date

Symbol

Strategy

Status

02-05-2016

NIFTY

Long Strangle

Active

09-05-2016

RELIANCE

Long Put

Loss Booked on 17th May

16-05-2016

LT

Short Strangle

Marginal Profit Booked on 24th May

23-05-2016

RCOM

Long Straddle

Active

2

Technical & Derivatives Report

May 26, 2016

FII Statistics for 25-May 2016

Turnover on 25-May 2016

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Value

Contracts

( in Cr. )

(%)

Contracts

Change (%)

(in Cr.)

INDEX

INDEX

10952.14

7608.73

3343.42

384841

22504.78

26.96

605062

34280.87

95.79

FUTURES

FUTURES

INDEX

INDEX

48552.77

46160.32

2392.45

1241305

72943.48

(0.60)

8115185

468933.20

67.63

OPTIONS

OPTIONS

STOCK

21558.96

21391.33

167.63

1140354

54593.42

3.33

STOCK

FUTURES

1539763

74093.91

36.41

FUTURES

STOCK

STOCK

3965.70

4162.00

(196.30)

111602

5403.65

2.79

OPTIONS

521828

26044.93

41.33

OPTIONS

TOTAL

85029.58

79322.38

5707.20

2878102

155445.32

4.13

TOTAL

10781838

603352.90

63.07

Nifty Spot = 7934.90

Lot Size = 75

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

7900

53.80

Buy

8000

66.05

45.15

54.85

7945.15

52.55

47.45

7947.45

Sell

8000

8.65

Sell

7900

13.50

Buy

7900

53.80

Buy

8000

66.05

53.00

147.00

7953.00

63.95

136.05

7936.05

Sell

8100

0.80

Sell

7800

2.10

Buy

8000

8.65

Buy

7900

13.50

7.85

92.15

8007.85

11.40

88.60

7888.60

Sell

8100

0.80

Sell

7800

2.10

Note: Above mentioned Bullish or Bearish Spreads in Nifty (May Series) are given as an information and not as a recommendation.

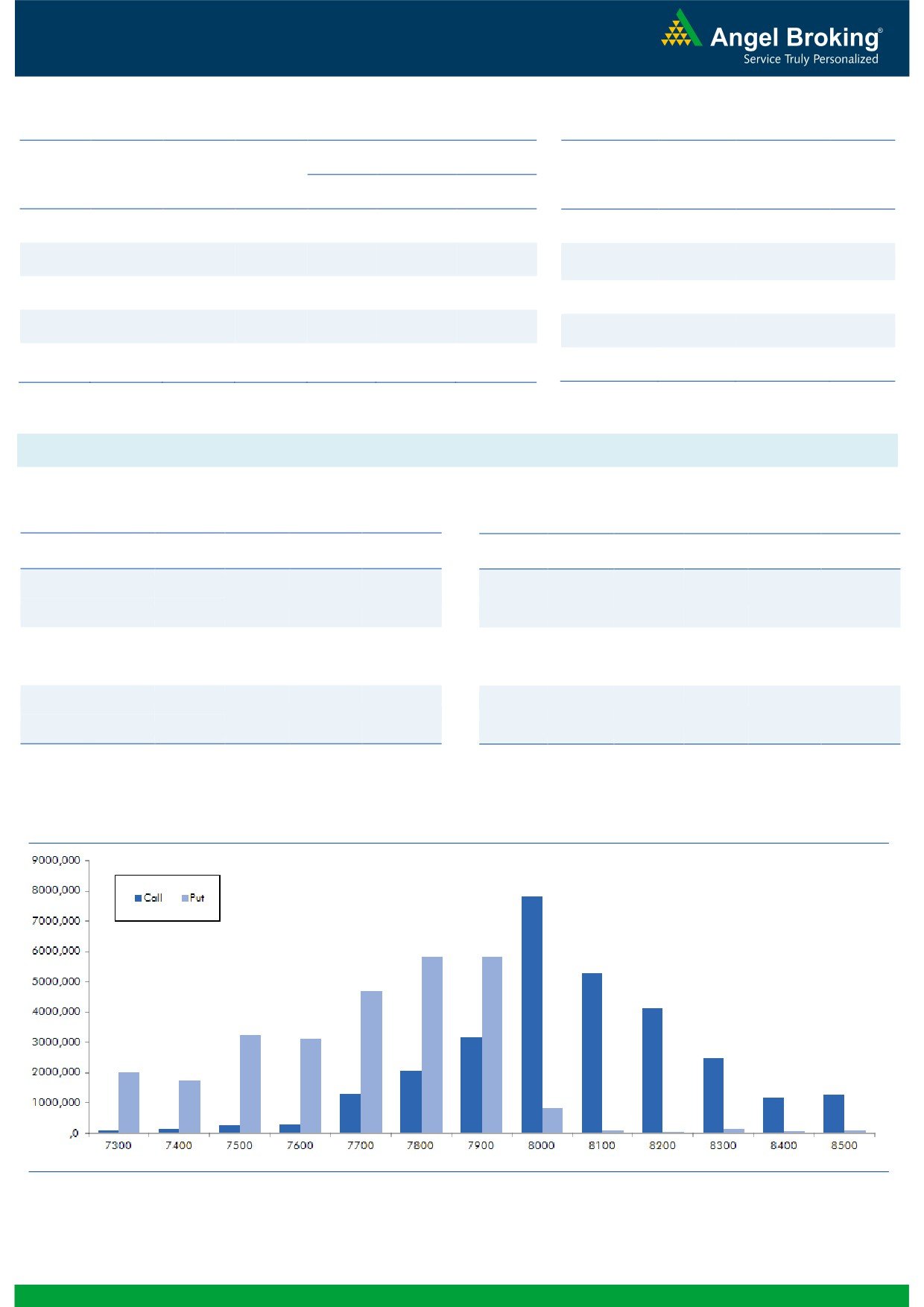

Nifty Put-Call Analysis

3

Technical & Derivatives Report

May 26, 2016

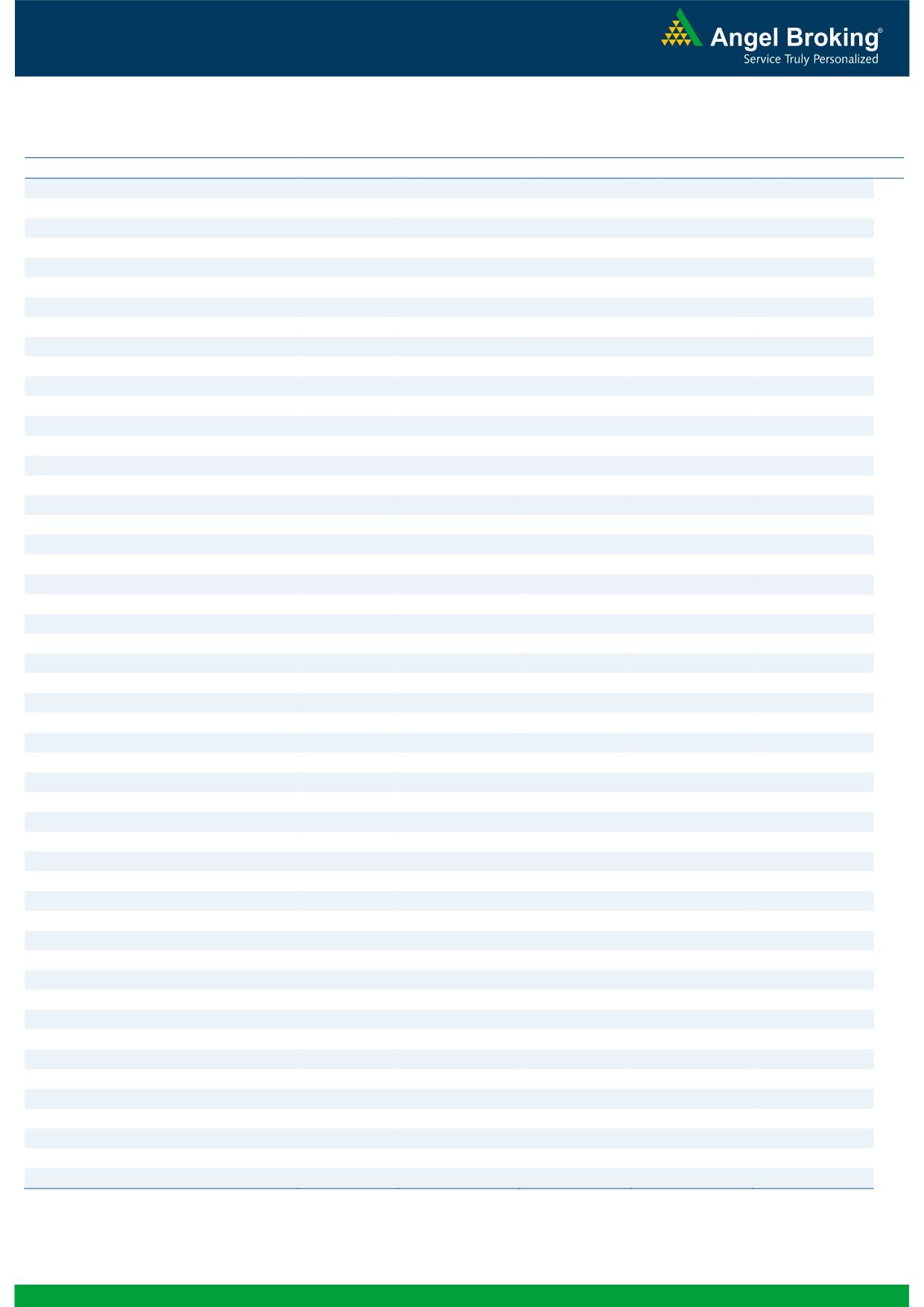

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ACC

1,436

1,455

1,472

1,492

1,509

ADANIPORTS

180

181

183

184

185

AMBUJACEM

214

218

221

225

228

ASIANPAINT

954

968

977

991

999

AUROPHARMA

714

728

736

751

759

AXISBANK

490

496

500

506

509

BAJAJ-AUTO

2,324

2,400

2,452

2,528

2,581

BANKBARODA

129

131

133

135

136

BHEL

117

120

122

124

126

BPCL

854

885

913

945

973

BHARTIARTL

345

348

350

354

356

INFRATEL

382

388

393

399

404

BOSCH

20,802

21,348

21,746

22,293

22,691

CIPLA

447

458

469

481

492

COALINDIA

276

279

280

282

284

DRREDDY

2,994

3,023

3,049

3,078

3,104

EICHERMOT

18,159

18,345

18,452

18,638

18,746

GAIL

369

375

380

386

391

GRASIM

4,270

4,307

4,331

4,368

4,392

HCLTECH

736

743

747

753

757

HDFCBANK

1,136

1,154

1,165

1,184

1,195

HDFC

1,170

1,189

1,201

1,219

1,231

HEROMOTOCO

2,889

2,908

2,924

2,943

2,959

HINDALCO

87

88

89

89

90

HINDUNILVR

822

831

836

845

851

ICICIBANK

223

229

232

238

241

IDEA

103

106

108

112

114

INDUSINDBK

1,040

1,068

1,083

1,112

1,127

INFY

1,186

1,197

1,205

1,216

1,224

ITC

347

351

354

359

362

KOTAKBANK

695

704

710

719

725

LT

1,233

1,262

1,280

1,310

1,328

LUPIN

1,452

1,462

1,479

1,489

1,505

M&M

1,292

1,302

1,310

1,320

1,328

MARUTI

3,892

3,977

4,024

4,109

4,156

NTPC

138

140

141

143

144

ONGC

207

209

210

211

212

POWERGRID

146

148

149

151

152

RELIANCE

937

944

948

956

960

SBIN

170

172

174

177

178

SUNPHARMA

763

774

782

793

801

TCS

2,462

2,494

2,513

2,546

2,565

TATAMTRDVR

261

266

269

273

276

TATAMOTORS

391

394

397

400

403

TATAPOWER

71

72

73

74

74

TATASTEEL

315

320

323

328

331

TECHM

481

505

518

542

556

ULTRACEMCO

3,170

3,190

3,201

3,221

3,232

WIPRO

536

541

544

549

552

YESBANK

979

988

993

1,002

1,008

ZEEL

435

439

443

447

452

4

Technical & Derivatives Report

May 26, 2016

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and MCX Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

5