Technical & Derivatives Report

November 16, 2017

Sensex (32760) / Nifty (10118)

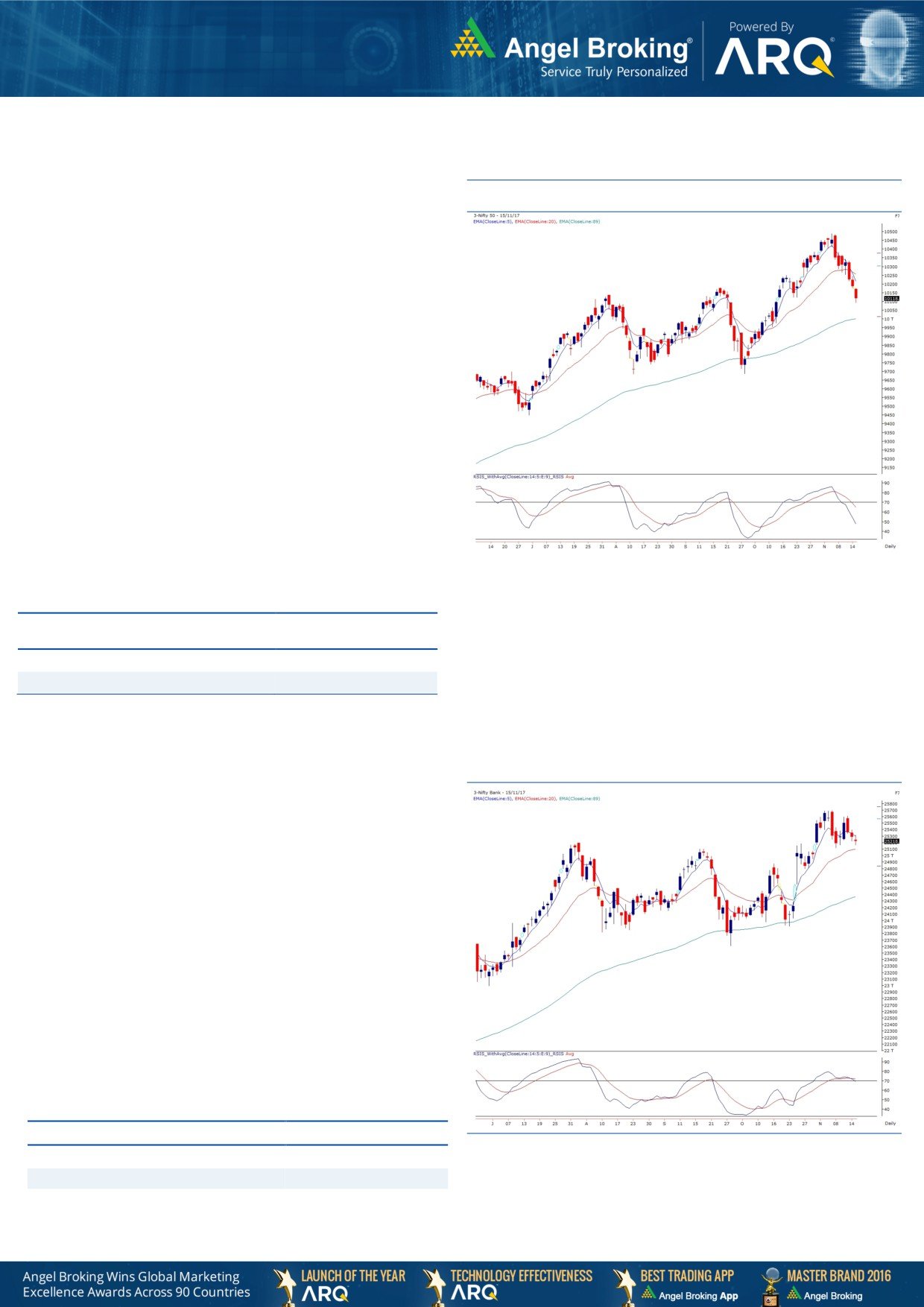

Exhibit 1: Nifty Daily Chart

Yesterday, our markets kick started with a downside gap

taking cues from the Asian bourses. There was no respite for

the third straight session as we saw Nifty sneaking below the

10100 mark. Undoubtedly, the entire ADAG pack was the

biggest culprit in spoiling traders’ sentiments yesterday. All

stocks from this group kept falling like a pack of cards.

As far as index is concerned, we would continue with our

latest stance and after anticipating sub-10200 levels, we are

now heading towards the next junction of 10000 (daily 89

EMA). With reference to previous articles, multiple technical

evidences like, the ‘5&20 EMA’ crossover and falling ‘RSI-

Smoothened’ are providing conviction to our stance. In

addition to this, yesterday we saw a decisive breach of

previous breakout points placed around

10180, which

certainly does not bode well for the bulls. The resistance zone

has now shifted lower towards 10175 and 10223. One needs

to be very watchful while picking up a stock specific trade.

Key Levels

Support 1 - 10067

Resistance 1 - 10175

Support 2 - 10000

Resistance 2 - 10223

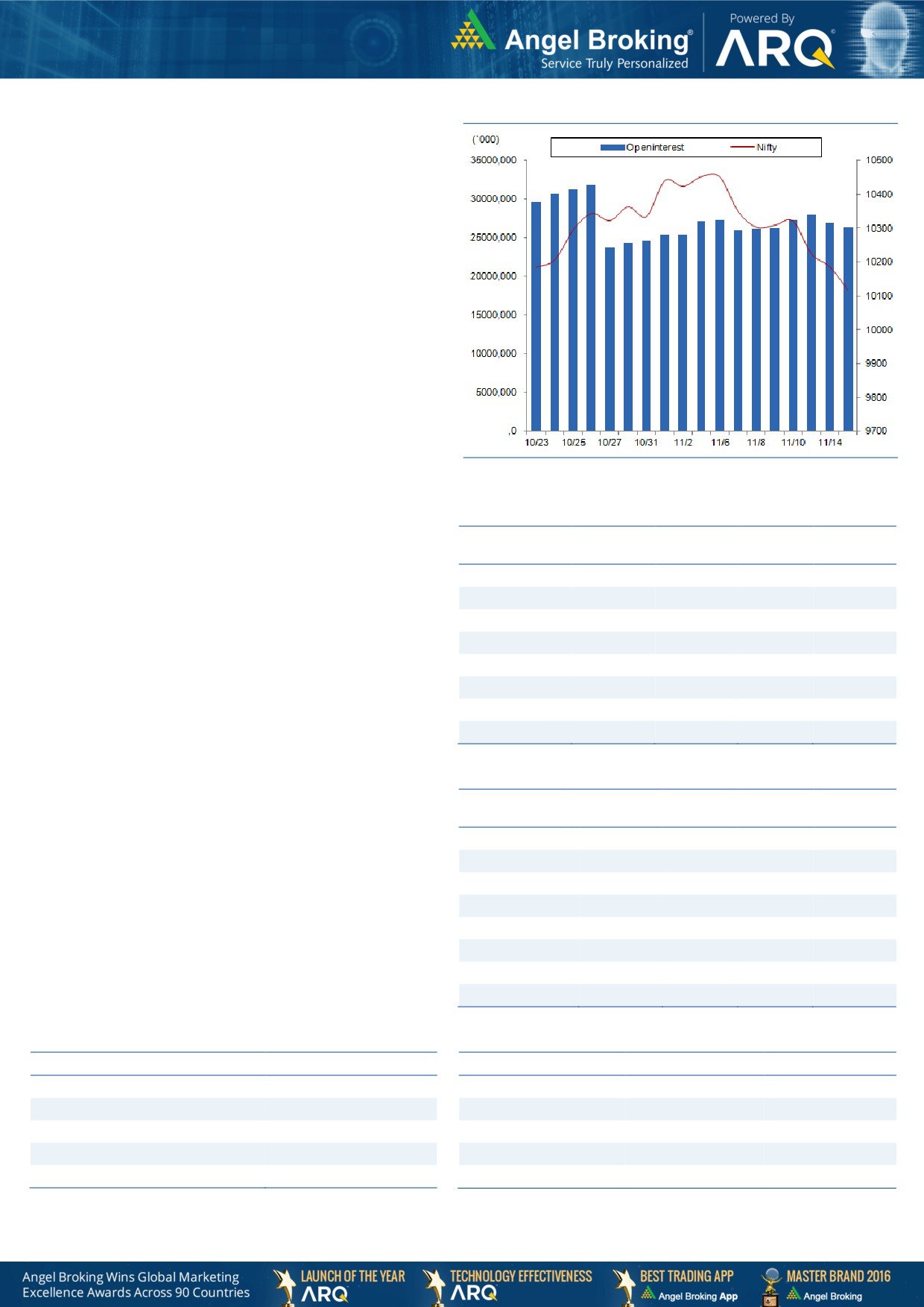

Nifty Bank Outlook - (25219)

Exhibit 2: Nifty Bank Daily Chart

The Nifty Bank index continues its consolidation phase as

expected and traded in a narrow range of about 150 points in

yesterday's session.

In spite of a sell-off in the broader markets, the Nifty Bank

index traded in a range and comparatively outperformed the

benchmark indices. The private sector banks, which constitute

majority of the index weightage, showed relative strength

which prevented the index from any significant correction.

However, broadly the index is in a consolidation phase, much

in line with we have expecting since last few days. Hence, we

continue with our advice to traders to focus on stock specific

moves from the banking space and avoid taking any

directional bet on the index.

Key Levels

Support 1 - 25113

Resistance 1 - 25400

Support 2 - 25050

Resistance 2 - 25450

Technical & Derivatives Report

November 16, 2017

Comments

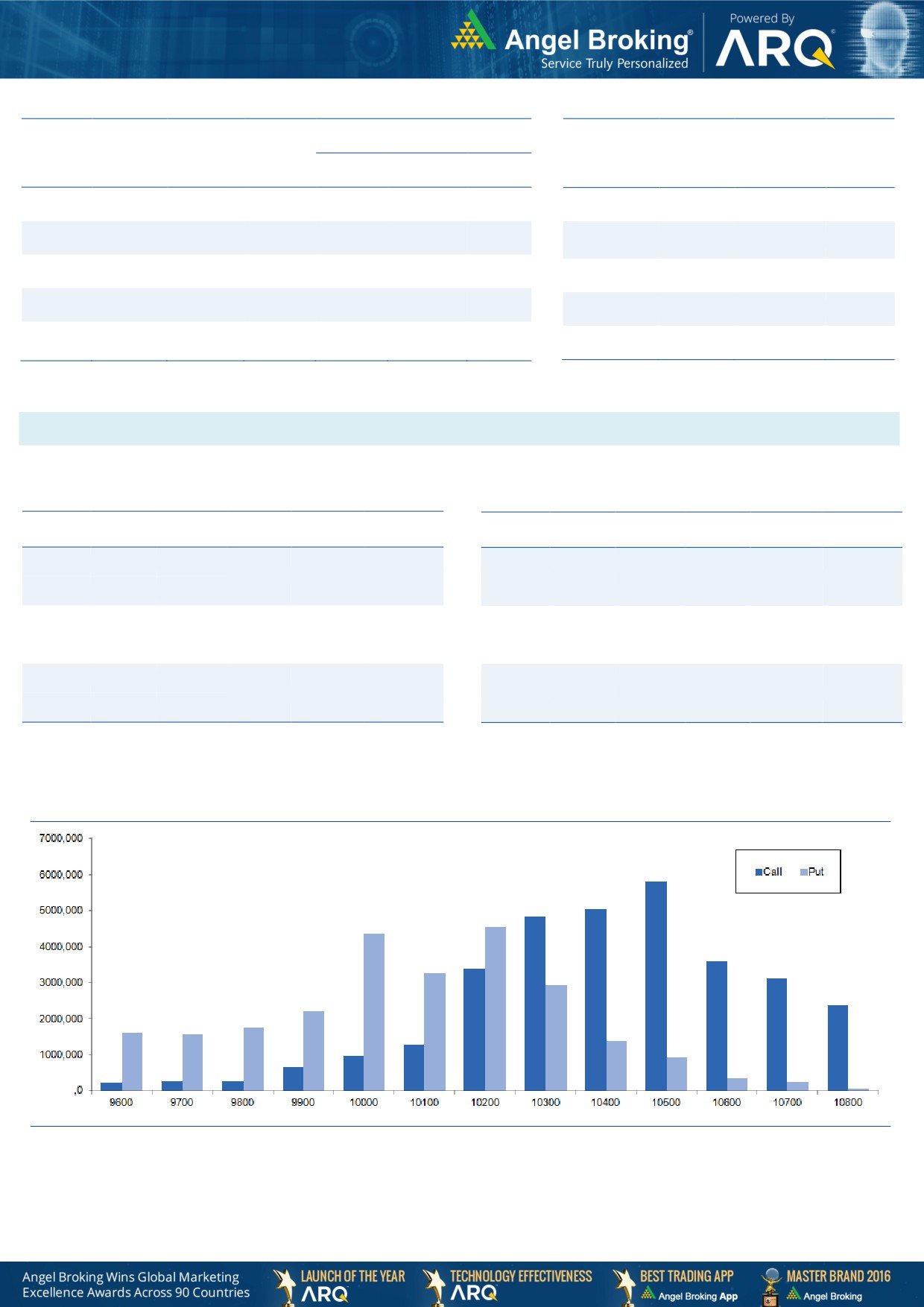

Nifty Vs OI

The Nifty futures open interest has decreased by 2.13%

BankNifty futures open interest has decreased by 1.18%

as market closed at 10118.05 levels.

The Nifty November future closed with a premium of

36.30 points against a premium of 47 points in last

trading session. The December series closed at a

premium of 73.25 points.

The INDIA VIX has increased from 14.16 to 14.26. At the

same time, the PCR-OI of Nifty has decreased from 1.19

to 1.13 level.

Few of the liquid counters where we have seen high cost

of carry are TV18BRDCST, HDIL, IDBI, ALBK and MRPL.

Views

FIIs were net sellers in both cash market segment and

OI Gainers

index futures. They sold equities to the tune of Rs. 381

OI

PRICE

crores. While, they were sellers of Rs. 1325 crores in

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

index futures with some fall in open interest, suggesting

JETAIRWAYS

7833600

16.76

693.40

0.06

blend of long unwinding and fresh short formation in

BALKRISIND

420000

11.35

2162.30

3.74

yesterday's trading session.

ICIL

12393500

10.59

121.30

7.44

In index options front, they sold worth Rs. 821 crores with

BATAINDIA

2497000

10.09

747.00

-5.04

rise in open interest. In call options, fresh build-up was

IGL

5769500

8.37

305.60

-3.09

seen in 10100-10200 strikes. On the other side, we

VGUARD

3099000

7.83

225.05

-2.41

some open interest addition

10100 and

9800 put

RELCAPITAL

14563500

7.72

423.85

-10.44

options; followed by good amount of unwinding in

RECLTD

40368000

7.25

155.45

-3.30

10300 strike. At present, highest open interest remains

intact at 10500 call and 10200 put options.

Yesterday's market extended its loss for the third

OI Losers

OI

PRICE

consecutive session. Since past couple of days, FIIs have

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

been forming good amount of short positions in index

VOLTAS

2564000

-16.43

586.55

-2.18

futures and they also unwound some of their existing

BANKBARODA

51700500

-15.46

175.25

-0.03

longs. At the same time, they also formed long positions

HEXAWARE

2556000

-11.25

336.75

-2.11

in index put options along with writing in call strikes.

CEATLTD

2037700

-9.39

1756.35

2.00

Considering the above data points, we believe market

JUSTDIAL

2949800

-8.18

507.35

-6.44

may witness further pain in near term. Thus, any bounce

KSCL

4524000

-7.26

516.00

-3.08

back shall be an opportunity to buy puts of current series.

RAMCOCEM

628800

-6.21

703.45

1.90

CGPOWER

28212000

-5.43

79.70

-3.04

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

RPOWER

50.88

NIFTY

1.13

0.81

RELINFRA

58.40

BANKNIFTY

0.94

0.67

RNAVAL

55.11

TATAMOTORS

0.33

0.36

FORTIS

46.39

RELIANCE

0.40

0.48

RELCAPITAL

74.69

YESBANK

0.34

0.42

Technical & Derivatives Report

November 16, 2017

FII Statistics for November 15, 2017

Turnover on November 15, 2017

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Value

Change

Contracts

( in Cr. )

(%)

Contracts

(in Cr.)

(%)

INDEX

INDEX

1986.46

3311.04

(1324.58)

335434

26185.28

(2.83)

199417

16944.72

12.22

FUTURES

FUTURES

INDEX

INDEX

64554.02

65375.06

(821.04)

1105069

86509.74

2.75

6348353

589581.29

45.40

OPTIONS

OPTIONS

STOCK

8369.56

8961.57

(592.00)

1018451

69214.74

0.31

STOCK

FUTURES

758016

50945.38

11.98

FUTURES

STOCK

STOCK

7610.13

7710.20

(100.07)

121694

8399.16

1.33

562872

39149.79

18.80

OPTIONS

OPTIONS

Total

82520.18

85357.87

(2837.69)

2580648

190308.92

0.96

TOTAL

7868658

696621.18

39.60

Nifty Spot = 10118.05

Lot Size = 75

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

10100

127.90

Buy

10100

74.30

53.60

46.40

10153.60

28.25

71.75

10071.75

Sell

10200

74.30

Sell

10000

46.05

Buy

10100

127.90

Buy

10100

74.30

88.40

111.60

10188.40

46.75

153.25

10053.25

Sell

10300

39.50

Sell

9900

27.55

Buy

10200

74.30

Buy

10000

46.05

34.80

65.20

10234.80

18.50

81.50

9981.50

Sell

10300

39.50

Sell

9900

27.55

Note: Above mentioned Bullish or Bearish Spreads in Nifty (November Series) are given as an information and not as a recommendation.

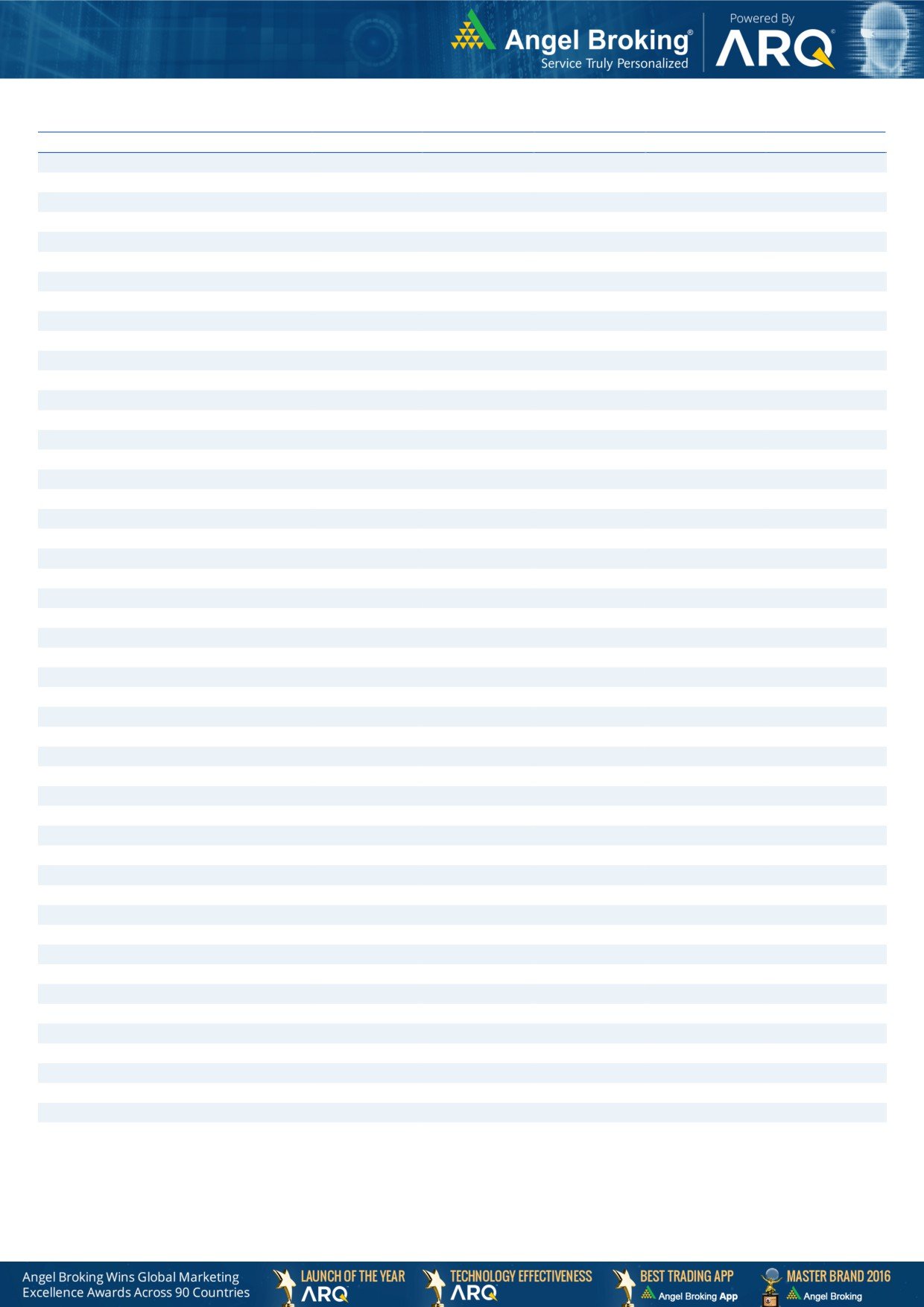

Nifty Put-Call Analysis

Technical & Derivatives Report

November 16, 2017

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ADANIPORTS

398

402

408

413

419

AMBUJACEM

268

272

275

279

282

ASIANPAINT

1,135

1,158

1,174

1,197

1,213

AUROPHARMA

676

686

699

709

722

AXISBANK

529

536

544

550

558

BAJAJ-AUTO

3,159

3,186

3,234

3,261

3,309

BAJFINANCE

1,671

1,693

1,728

1,749

1,785

BPCL

489

497

503

511

517

BHARTIARTL

474

481

490

496

505

INFRATEL

360

369

384

393

408

BOSCHLTD

18,816

19,011

19,355

19,550

19,895

CIPLA

580

587

597

604

615

COALINDIA

268

270

272

274

276

DRREDDY

2,269

2,290

2,313

2,334

2,357

EICHERMOT

29,704

30,094

30,390

30,780

31,076

GAIL

428

439

451

462

474

HCLTECH

826

837

857

868

888

HDFCBANK

1,782

1,791

1,797

1,807

1,813

HDFC

1,631

1,641

1,659

1,669

1,687

HEROMOTOCO

3,604

3,638

3,674

3,707

3,743

HINDALCO

242

247

253

258

265

HINDPETRO

405

409

416

421

427

HINDUNILVR

1,243

1,254

1,270

1,280

1,296

IBULHSGFIN

1,112

1,137

1,173

1,198

1,234

ICICIBANK

309

312

316

319

323

IOC

384

387

391

394

398

INDUSINDBK

1,563

1,580

1,610

1,628

1,658

INFY

941

946

950

955

959

ITC

247

250

254

257

261

KOTAKBANK

991

1,001

1,008

1,018

1,024

LT

1,195

1,202

1,214

1,221

1,232

LUPIN

810

817

826

833

841

M&M

1,395

1,405

1,417

1,427

1,439

MARUTI

8,038

8,083

8,131

8,176

8,224

NTPC

172

173

175

176

178

ONGC

173

175

178

181

184

POWERGRID

203

205

206

208

209

RELIANCE

871

878

884

890

897

SBIN

317

321

326

330

335

SUNPHARMA

490

497

509

516

527

TCS

2,667

2,686

2,721

2,740

2,774

TATAMOTORS

401

405

411

415

422

TATASTEEL

664

671

676

683

688

TECHM

479

488

494

502

508

ULTRACEMCO

4,214

4,260

4,308

4,354

4,402

UPL

698

710

728

740

758

VEDANTA

286

291

299

303

311

WIPRO

291

294

297

299

302

YESBANK

291

296

301

306

311

ZEEL

534

537

540

543

546

Technical & Derivatives Report

November 16, 2017

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager and Investment Adviser with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking

Private Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide

registration number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory

authority for accessing /dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or

co-managed public offering of securities of the c*ompany covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.