www.angelbroking.com

July 02, 2021

Technical & Derivatives Report

Nifty

Bank Out

look

-

(

34684)

Quite similar to the last couple of sessions, the bank nifty started

on a flat note, and an attempt to bounce got sold into. Yesterday

on the weekly expiry we didn't see major traction and after a

gradual decline Bank Nifty ended with a minor loss of 0.25% at

34684.

As mentioned in the previous outlook and as seen in the chart, the

bank index is approaching the key support level of trendline

joining higher bottoms. Hence, we are now placed at a make or

break level and if any bounce has to come then it has to be from

the current levels. Going ahead crucial support is placed around

34525 followed by 34200 whereas resistance is placed around

35000 and 35250 levels. Traders can prefer having a stock-

specific approach from the space however one should avoid

aggressive bets overnight on the weekend.

Key Levels

Support 1 – 34525 Resistance 1 – 35000

Support 2 – 34200 Resistance 2 – 35250

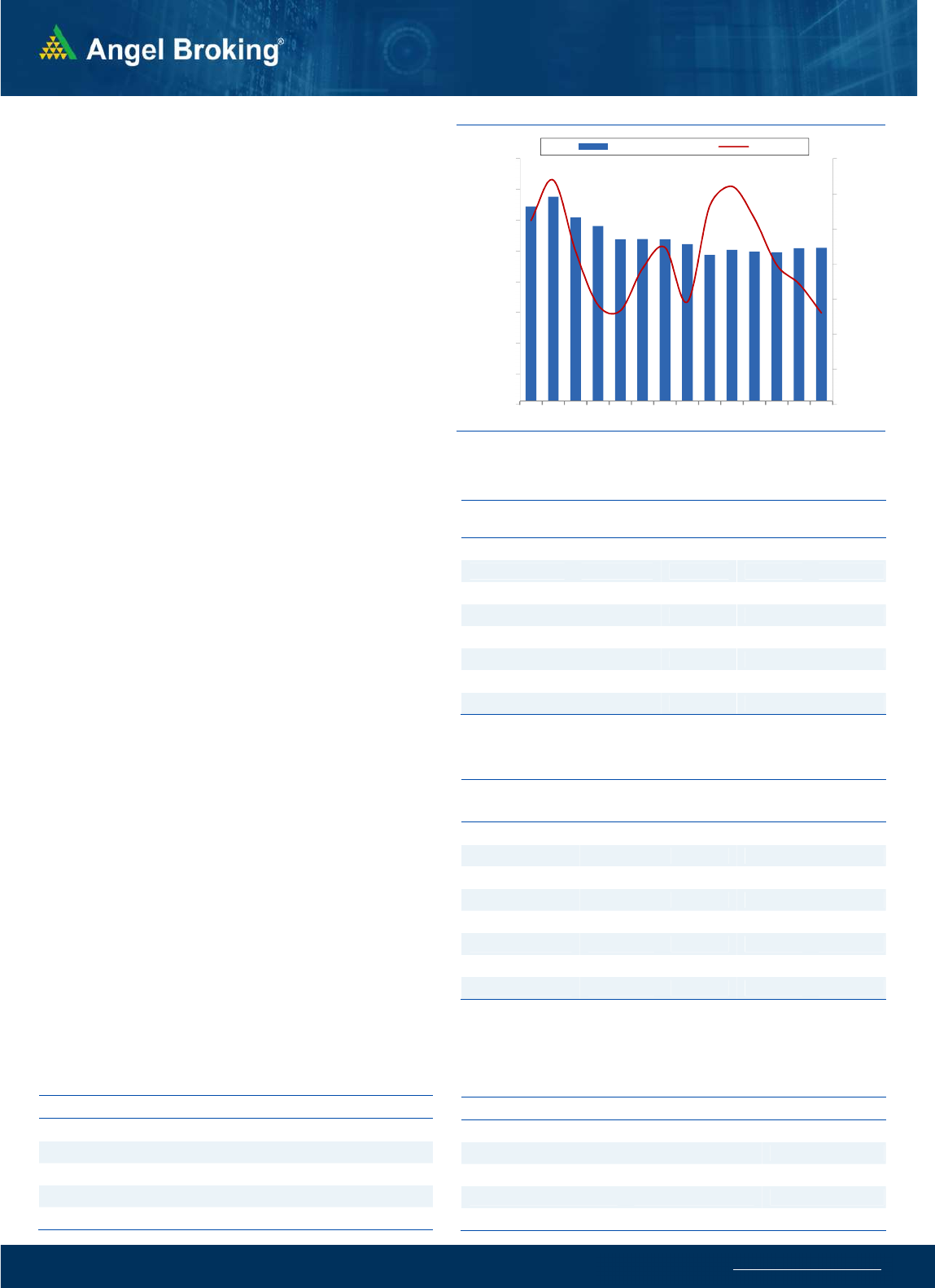

Exhibit 1: Nifty Daily Chart

Exhibit 2: Nifty Bank Daily Chart

Sensex (52319) / Nifty (15680)

For the second straight session, we started the proceedings

marginally higher as indicated by the SGX Nifty. However, the buying

interest is still missing and as a result, markets are finding it extremely

difficult to sustain at higher levels. Barring one attempt of recovery at

the mid-session, the index remained under a bit of pressure

throughout the session. However the damage is not big though and

hence, the weekly expiry ended tad below 15700 with nominal losses.

Throughout this week, the intraday price action was quite identical

where we see index sliding from the opening point and closing

almost at the lowest point of the day. As a momentum trader, one

needs volatility in the market and if not volatility then a good stock

specific action at least. Since last few days, both these important

factors are missing and this consolidation in a slender range is really

frustrating traders now. In such times, it’s better not to trade

aggressively and more importantly, avoiding compulsive trades is the

key here. As far as levels are concerned, Nifty is very close to its crucial

support i.e. 15650. If any recovery has to happen, it’s the best place

for bulls to take the charge. If we do not sustain here, we may see

weakness persisting to test 15550 – 15450 levels. On the higher side,

15750 followed by 15850 are to be seen as immediate hurdles.

Key Levels

Support 1 – 15700 Resistance 1 – 15800

Support 2 – 15650 Resistance 2 – 15900

www.angelbroking.com

Technical & Derivatives Report

July 02, 2021

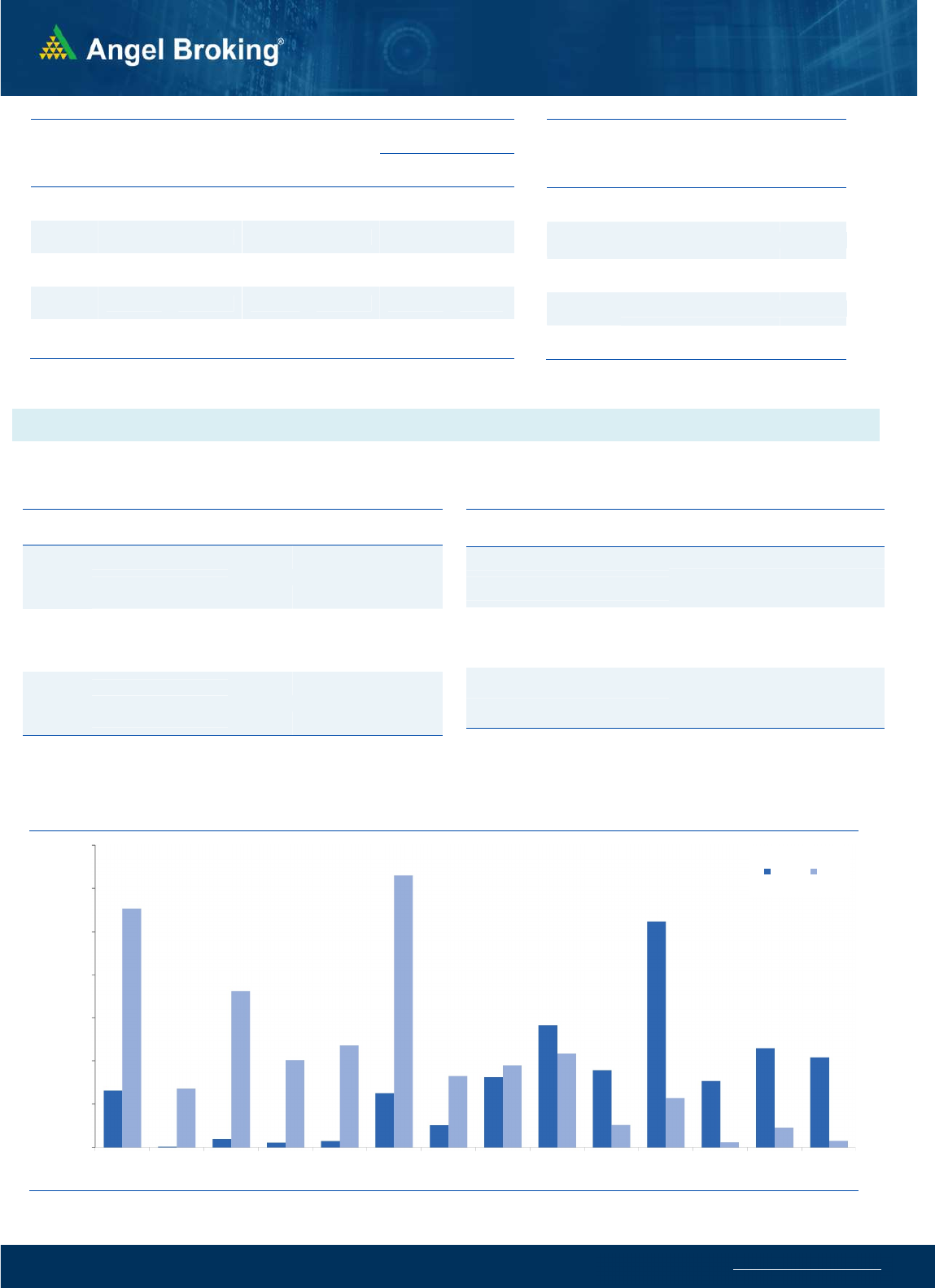

Nifty Vs OI

15550

15600

15650

15700

15750

15800

15850

15900

,0

20,000

40,000

60,000

80,000

100,000

120,000

140,000

160,000

6/14 6/16 6/18 6/22 6/24 6/28 6/30

(`000)

Openinterest Nifty

View

Nifty consolidated within a narrow range on the weekly

expiry day and ended with a loss of about a quarter of a

percent.

FIIs were net sellers in the cash segment to the tune of

Rs. 1245 crores. In index futures front, they sold worth

Rs 294 crores with increase in open interest indicating

short formations in yesterday’s session.

The boredom continues on the index front as the

momentum has been missing since last couple of days.

We witnessed marginal short additions in Bank Nifty

while no major addition was seen in Nifty. FII's were

sellers in the cash segment and added some shorts.

However, the Nifty PCR OI is at 0.89 which is a sign of

oversold market. Nifty is trading around the support zone

of 15650-15600 and hence, we could see a pullback

move in the near term.

C

o

mme

n

t

s

The Nifty futures open interest has increased by 0.37%.

Bank Nifty futures open interest has decreased by 3.80%

as market closed at 15680 levels.

The Nifty July future closed with a premium of 30.60 point

against a premium of 30.65 point in last trading session.

The August series closed at a premium of 78.45 point.

The INDIA VIX decreased from 13.04 to 12.84.

At the same time, the PCR-OI of Nifty decreased from

0.90 to 0.89.

Few of the liquid counters where we have seen high cost

of carry are IDEA, ADANIPORTS, SUNTV, AUROPHARMA,

AND GLENMARK .

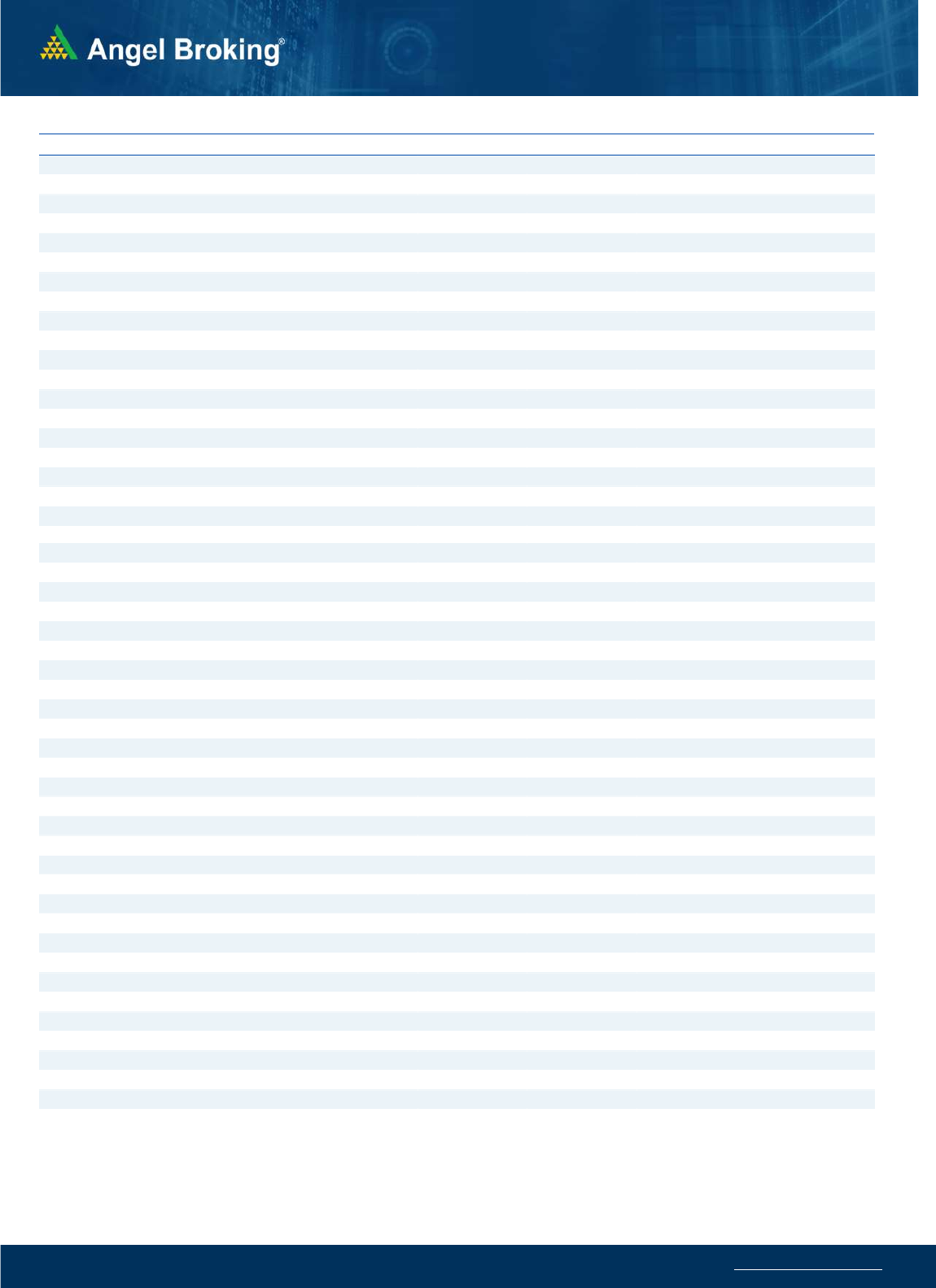

OI Gainers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

CHOLAFIN 10133750 18.49 506.15 -1.42

DABUR 7771250 11.10 589.75 4.10

NAUKRI 1159500 9.48 5317.20 7.96

PFC 46853400 8.36 121.95 -3.81

ESCORTS 5915800 8.06 1200.85 -1.92

BAJAJ-AUTO 1482750 7.50 4204.60 1.50

LALPATHLAB 467500 7.22 3267.30 -0.13

VOLTAS 2928000 7.08 1013.05 -0.88

OI Losers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

COLPAL 2433200 -4.70 1708.20 1.29

BOSCHLTD 125250 -4.28 15188.05 1.03

CIPLA 9694100 -4.20 978.10 1.12

PAGEIND 69150 -4.16 29624.20 0.27

MPHASIS 702650 -4.04 2171.70 1.70

IRCTC 1988025 -3.59 2034.75 0.42

MOTHERSUMI 29683500 -3.57 244.80 1.05

NTPC 48478500 -3.56 117.35 0.30

Put-Call Ratio

SCRIP PCR-OI PCR-VOL

NIFTY 0.89 0.83

BANKNIFTY 0.64 0.85

RELIANCE 0.43 0.37

ICICIBANK 0.53 0.34

INFY 0.61 0.42

Historical Volatility

SCRIP HV

NAUKRI 53.91

DABUR 26.76

IDEA 101.72

PFC 47.10

DRREDDY 34.20

www.angelbroking.com

Technical & Derivatives Report

July 02, 2021

Note: Above mentioned Bullish or Bearish Spreads in Nifty (July Series) are given as an information and not as a recommendation.

Nifty Spot =

15680

FII Statistics for July 01, 2021

Detail Buy

Net Contracts

Open Interest

Sell

Value

(in Cr.)

Change

INDEX

FUTURES

2537.10

2831.20

(294.10) 128877

10374.35

5.93

INDEX

OPTIONS

707930.65

709050.37

(1119.72) 772946

66662.34

(28.64)

STOCK

FUTURES

9871.88

10280.84

(408.96) 1387961

109439.13

0.66

STOCK

OPTIONS

7742.14

7847.14

(105.00) 188321

14727.74

6.79

Total 728081.77

730009.55

(1927.78) 2478105

201203.56

(10.21)

Turnover on July 01, 2021

Instru

ment

No. of

Contracts

Turnover

( in Cr. )

Change

(%)

Index Futures

2,19,779 18213.66 -24.72

Index

Options

8,61,48,293 82,42,710.36

73.18

Stock Futures

5,33,358 42389.60 -11.16

Stock

Options

13,26,104 1,06,431.08 -10.52

Total 8,82,27,534 84,09,744.70

69.88

Bull-Call Spreads

Action Strike Price Risk Reward BEP

Buy 15700 214.00

52.60 47.40 15752.60

Sell 15800 161.40

Buy 15700 214.00

96.50 103.50 15796.50

Sell 15900 117.50

Buy 15800 161.40

43.90 56.10 15843.90

Sell 15900 117.50

Bear-Put Spreads

Action Strike Price Risk Reward BEP

Buy 15700 201.00

40.75 59.25 15659.25

Sell 15600 160.25

Buy 15700 201.00

74.00 126.00 15626.00

Sell 15500 127.00

Buy 15600 160.25

33.25 66.75 15566.75

Sell 15500 127.00

Nifty Put-Call Analysis

,0

500,000

1000,000

1500,000

2000,000

2500,000

3000,000

3500,000

15000 15100 15200 15300 15400 15500 15600 15700 15800 15900 16000 16100 16200 16300

Call Put

www.angelbroking.com

Technical & Derivatives Report

July 02, 2021

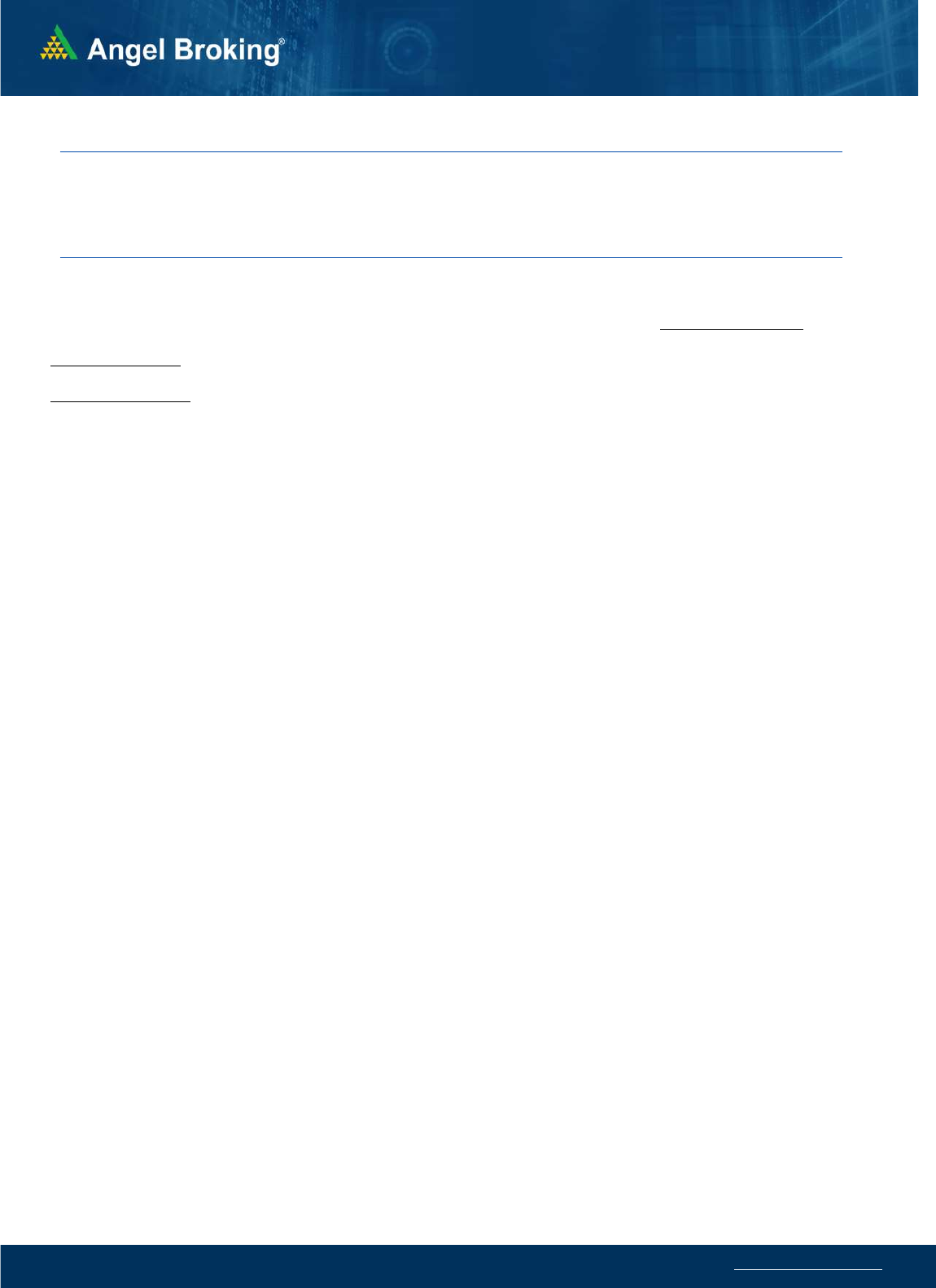

Da

ily

Pivot Level

s for

Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ADANIPORTS

692

698

708

714

723

ASIANPAINT 2,958 2,976

3,003

3,020

3,047

AXISBANK

738

743

752

757

766

BAJAJ-AUTO 4,095 4,114

4,139

4,159

4,183

BAJFINANCE 5,922 5,969

6,047

6,094

6,172

BAJAJFINSV 11,877

11,993

12,181

12,297

12,486

BPCL

464

466

468

471

473

BHARTIARTL

521

523

527

529

533

BRITANNIA 3,600 3,625

3,658

3,682

3,715

CIPLA

952

962

979

990

1,007

COALINDIA

144

145

146

148

149

DIVISLAB 4,321 4,365

4,398

4,442

4,475

DRREDDY 5,368 5,396

5,432

5,460

5,496

EICHERMOT 2,627 2,649

2,687

2,709

2,747

GRASIM 1,481 1,490

1,500

1,509

1,519

HCLTECH

975

979

985

990

996

HDFCBANK 1,485 1,492

1,500

1,507

1,515

HDFCLIFE

678

682

689

693

700

HDFC 2,445 2,460

2,487

2,503

2,530

HEROMOTOCO 2,877 2,890

2,910

2,923

2,943

HINDALCO

366

369

374

377

383

HINDUNILVR 2,438 2,455

2,480

2,497

2,522

ICICIBANK

623

627

63

4

638

645

IOC

106

107

108

109

111

INDUSINDBK 1,003 1,010

1,019

1,025

1,034

INFY 1,562 1,572

1,581

1,591

1,600

ITC

201

202

203

204

205

JSW STEEL

673

678

688

694

704

KOTAKBANK 1,671 1,688

1,716

1,733

1,761

LT 1,479 1,490

1,506

1,51

7

1,534

M&M

767

772

781

786

795

MARUTI 7,398 7,457

7,552

7,611

7,706

NESTLEIND 17,481

17,557

17,651

17,727

17,821

NTPC

115

116

117

118

119

ONGC

115

116

119

120

122

POWERGRID

228

230

234

236

240

RELIANCE 2,077 2,094

2,108

2,125

2,140

SBILIFE

993

1,000

1,006

1,014

1,019

SHREECEM 26,803

27,154

27,802

28,153

28,801

SBIN

414

417

421

423

427

SUNPHARMA

669

672

678

681

687

TCS 3,312 3,329

3,355

3,372

3,399

TATACONSUM

738

746

757

765

776

TATAMOTORS

335

337

341

344

348

TATASTEEL 1,145 1,156

1,173

1,184

1,202

TECHM 1,073 1,084

1,095

1,106

1,116

TITAN 1,711 1,722

1,739

1,749

1,766

ULTRACEMCO 6,681 6,729

6,797

6,845

6,913

UPL

778

785

798

806

819

WIPRO

539

542

545

548

551

www.angelbroking.com

Technical & Derivatives Report

July 02, 2021

*

Research Team Tel: 022 – 39357600 (Extn. 6844) Website: www.angelbroking.com

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager and Investment Adviser with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking

Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration

number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for

accessing /dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed

public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits

and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Technical and Derivatives Team:

Sameet Chavan Chief Analyst - Technical & Derivatives sameet.chavan@angelbroking.com

Ruchit Jain Senior Analyst - Technical & Derivatives ruchit.jain@angelbroking.com

Rajesh Bhosale Technical Analyst rajesh.bhosle@angelbroking.com

Sneha Seth Derivatives Analyst sneha.seth@angelbroking.com