www.angelbroking.com

July 19, 2021

Technical & Derivatives Report

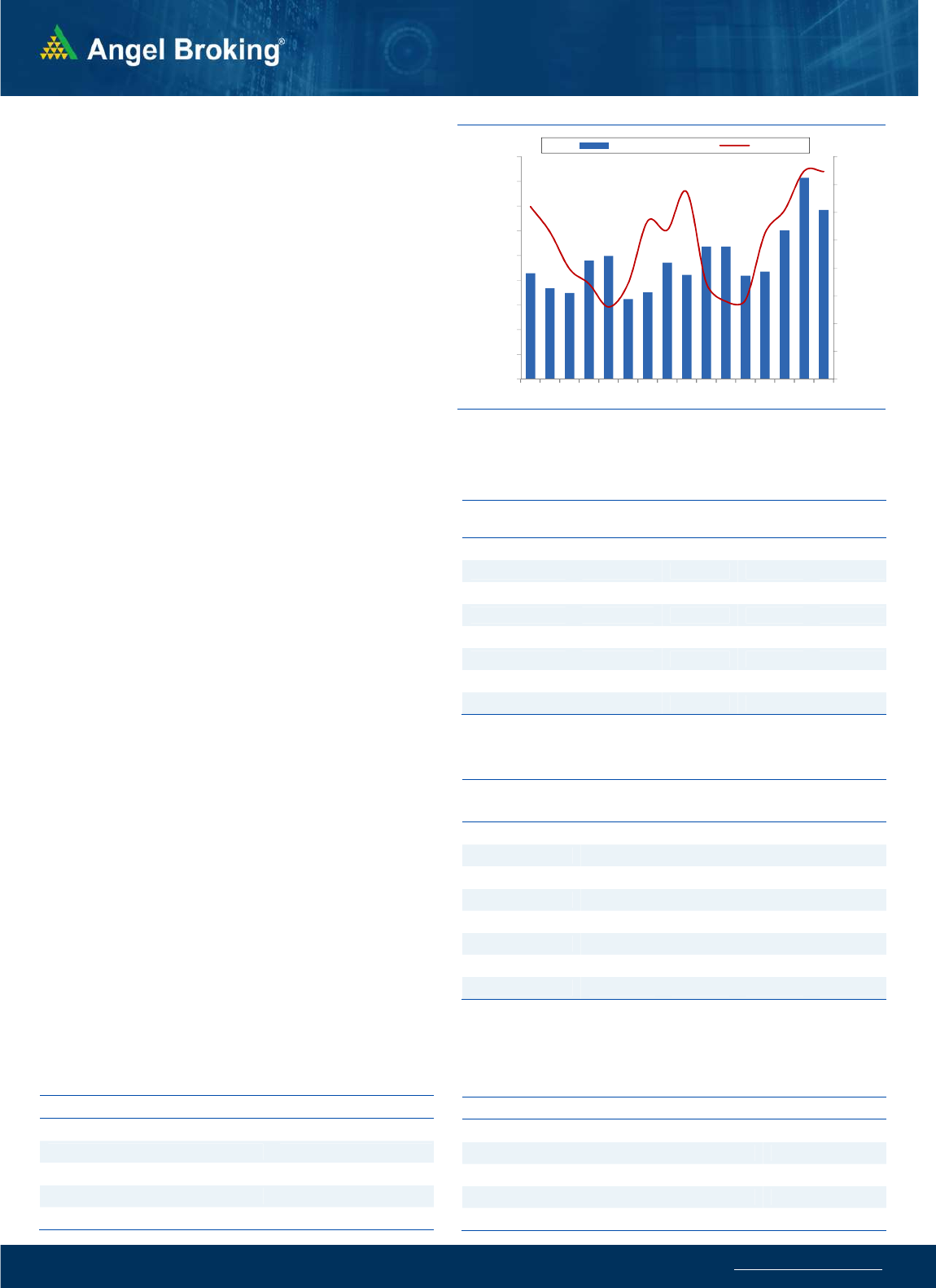

Nifty Bank Outlook

-

(3

5752

)

On Friday, Bank Nifty started on a mild positive note however from

the word go it slipped lower forming an 'Open High' scenario and

after a gradual decline throughout the session ended with a loss of

0.43% tad above 35750.

In spite of a bullish breakout on Thursday above the 35810 levels;

the bank nifty disappointed on Friday with a lack of follow-up

buying. This was due to as Bank Nifty has reached a key

psychological level of 36000. We reiterate with our view that for

the next leg of broader market rally the banking space needs to

participate and the outperformance will only come when the bank

nifty sustains above the 36000 levels. Hence for the next few

sessions, 35900 - 36000 remains a key resistance whereas, on the

flip side, 35600 - 35300 are the immediate support. Traders are

advised to focus on stock-specific trades within this basket as with

the result season they may give outperforming opportunities.

Key Levels

Support 1 – 35600 Resistance 1 – 35900

Support 2 – 35300 Resistance 2 – 36000

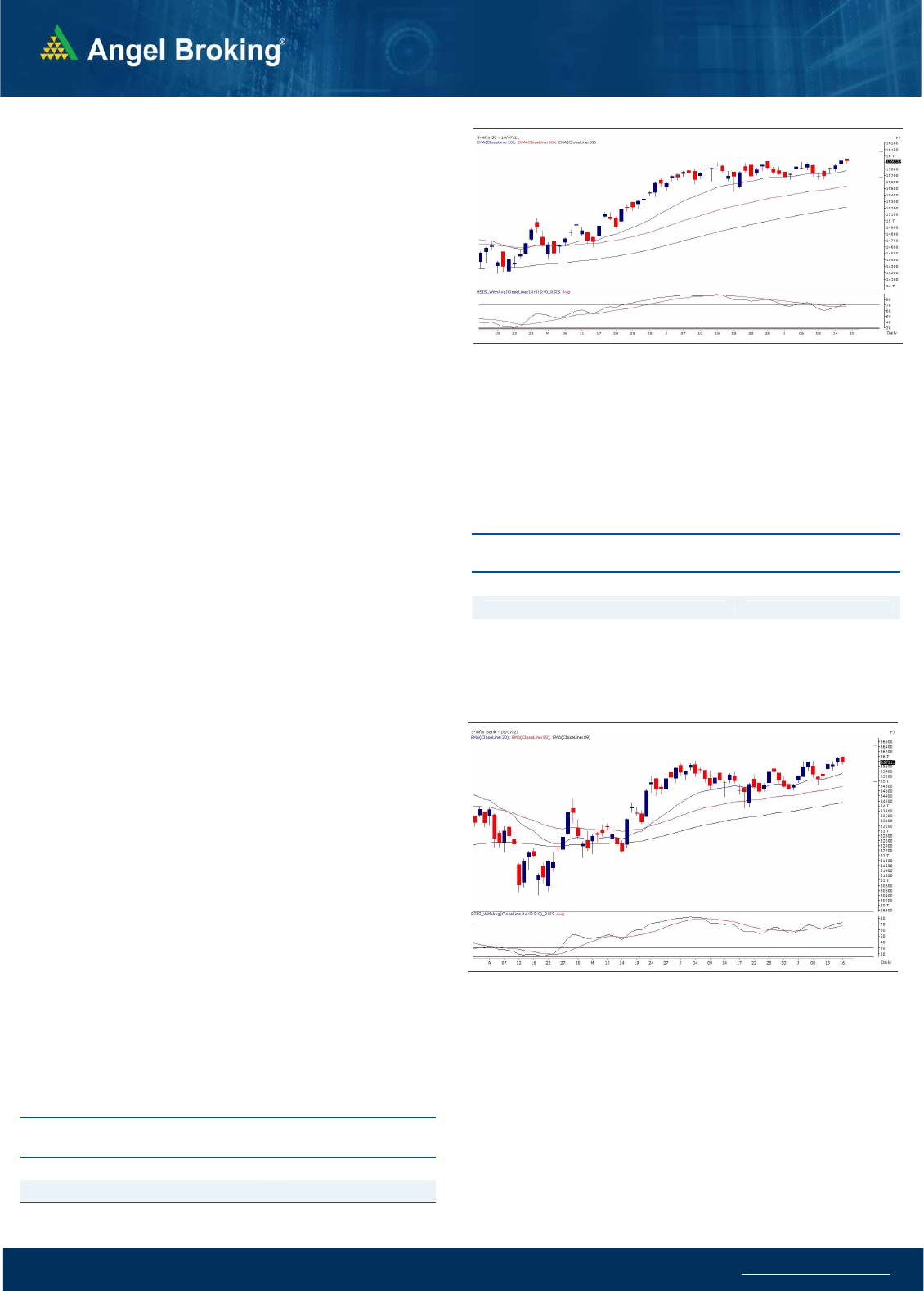

Exhibit 1: Nifty Daily Chart

Exhibit 2: Nifty Bank Daily Chart

Sensex (53140)

/ Nifty (15923)

During the last week, market started on a pleasant note on Monday

owing to slightly cheerful mood across the globe. However on the

same day, all of a sudden market took a nosedive and before anyone

could realize Nifty was retesting 15650 levels. Fortunately 15650

once again acted as a sheet anchor to restrict the sudden

hiccup. During the remaining part of the week, Nifty continued its

slow and steady march to conclude at the highest point. In the

process, it added nearly one and half a percent gains to the previous

weekly close.

In last month or so, market made several attempts to go pass the

level of 15910; but on every occasion, markets struggled at higher

levels. Finally on the weekly expiry day, this sturdy wall was breached

and that too on a closing basis. In fact, although there was no follow

up buying seen, the week concluded at a new high which certainly

bodes well for the bulls. Now, 16000 is merely a formality and if there

is no aberration on the global front, we would see market reaching

the millstone in the first half of this week itself. After this, 16200 is

the next level to watch out for. We reiterate that if this assumption

has to turn into reality, the banking needs to contribute and hence,

all eyes on BANKNIFTY. The moment it traverses the 36000 mark, we

would see NIFTY hastening beyond the magical figure of 16000. On

the flipside, 15800 followed by 15630 are to be seen as key supports.

One needs to keep in mind that any sustainable move below 15630

would apply brakes on the ongoing optimism and we may then see

some corrective moves in the market in the short term. During the

week, the stellar move in IT space lifted the markets higher from the

lower levels. Also, the broader end of the spectrum too did extremely

well. One can certainly continue with a stock centric approach and

keep a tab on all the above mentioned scenarios.

Key Levels

Support 1 – 15900 Resistance 1 – 16000

Support 2 – 15850 Resistance 2 – 16080

www.angelbroking.com

Technical & Derivatives Report

July 19, 2021

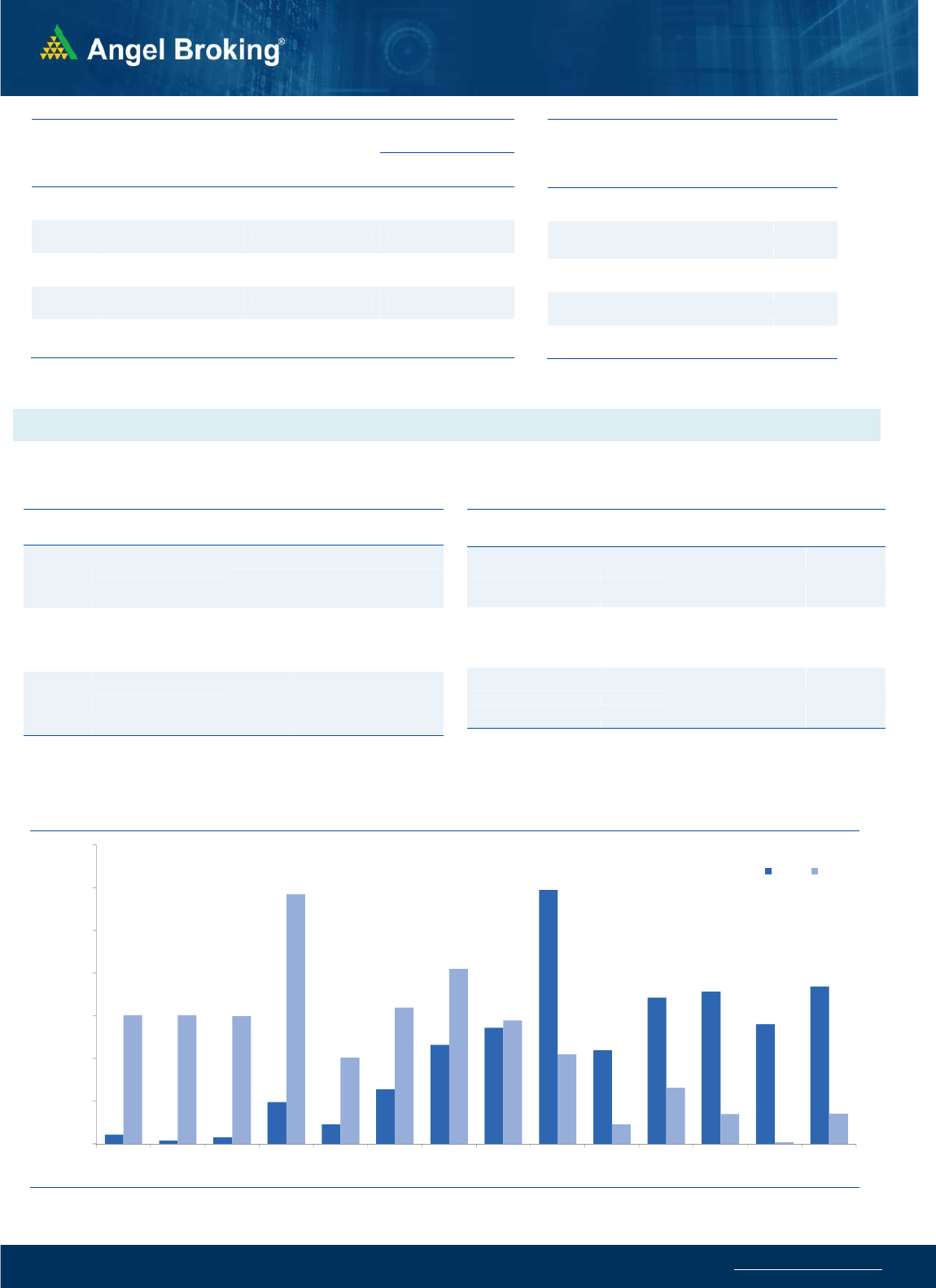

Nifty Vs OI

15550

15600

15650

15700

15750

15800

15850

15900

15950

92,000

94,000

96,000

98,000

100,000

102,000

104,000

106,000

108,000

110,000

6/25 6/29 7/1 7/5 7/7 7/9 7/13 7/15

(`000)

Openinterest Nifty

View

Post some hiccup on Monday, Nifty has slowly inched

higher throughout the week and has ended the week

above 15900.

FIIs were net sellers in the cash segment to the tune of

Rs. 466 crores. In index futures front, they sold worth

Rs 1109 crores with fall in open interest indicating long

unwinding and short formations on Friday.

Nifty saw some long formation towards the end of the

week, while Bank Nifty initially witnessed short covering

and then added some fresh longs as well. FII’s were

sellers in the cash segment, but they covered some of

their shorts and added longs in the index futures

segment. Hence, their ‘Long Short Ratio’ increased to 68

percent from 55 percent last week. This bodes well for

the bulls and hence, should provide impetus to this

week’s upmove. In options segment, 15800 call writers

ran to cover their positions on Tuesday as Nifty surpassed

that hurdle, and now put writing was seen due to which

15800 is seen as immediate support. Traders are advised

to continue to trade with a positive bias for this week and

review the situation if the market breaks 15800. On the

higher side, 16000 and 16200-16300 are the probable

targets to watch out for.

Comments

The Nifty futures open interest has decreased by 2.38%.

Bank Nifty futures open interest has increased by 4.64%

as market closed at 15923.40 levels.

The Nifty July future closed with a premium of 12.6 point

against a premium of 13.1 point in last trading session.

The August series closed at a premium of 54.65 point.

The INDIA VIX decreased from 12.27 to 11.70. At the

same time, the PCR-OI of Nifty decreased from 1.29 to

1.24.

Few of the liquid counters where we have seen high cost

of carry are IDEA, SAIL, NAVINFLUOR, INDUSTOWER,

AND IDFCFIRSTB.

OI Gainers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

IRCTC 2257125 34.78 2426.65 7.02

ALKEM 682200 33.82 3351.10 0.73

MCDOWELL-N 14922500 33.68 667.15 2.78

INDUSTOWER 18158000 33.46 240.90 2.98

NAM-INDIA 3216000 24.77 418.60 5.51

HDFCAMC 986200 23.03 3094.25 -0.07

COROMANDEL 1247500 19.38 863.25 -1.65

HAVELLS 6634000 19.34 1077.65 3.76

OI Losers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

LTI 740850 -10.70 4288.55 -3.08

LTTS 737400 -8.69 3396.85 -1.57

NMDC 76326400 -7.49 178.70 2.57

GODREJPROP 2308800 -6.77 1577.80 1.35

PFC 38657000 -5.57 127.55 1.39

GRANULES 12348850 -5.50 381.55 3.29

BHEL 111531000 -5.27 66.25 2.07

TORNTPHARM 758750 -5.16 2990.65 -0.29

Put-Call Ratio

SCRIP PCR-OI PCR-VOL

NIFTY 1.24 0.99

BANKNIFTY 0.80 0.96

RELIANCE 0.44 0.36

ICICIBANK 0.65 0.62

INFY 0.46 0.42

Historical Volatility

SCRIP HV

IRCTC 46.72

NAM-INDIA 52.79

UBL 38.72

GLENMARK 49.81

DIVISLAB 35.19

www.angelbroking.com

Technical & Derivatives Report

July 19, 2021

Note: Above mentioned Bullish or Bearish Spreads in Nifty (July Series) are given as an information and not as a recommendation.

Nifty Spot = 15923.40

FII Statistics for July 16, 2021

Detail Buy

Net Contracts

Open Interest

Sell

Value

(in Cr.)

Change

INDEX

FUTURES

2043.49

3152.66

(1109.17) 144238

11864.60

0.63

INDEX

OPTIONS

237468.66

236546.17

922.49

1092749

94042.61

26.34

STOCK

FUTURES

12201.82

11700.93

500.89

1411071

113197.33

(0.00)

STOCK

OPTIONS

17591.78

17671.77

(79.99) 299037

24482.69

1.19

Total 269305.75

269071.53

234.22

2947095

243587.23

8.55

Turnover on July 16, 2021

Instru

ment

No. of

Contracts

Turnover

( in Cr. )

Change

(%)

Index

Futures

1,85,618 15768.05 -13.43

Index

Options

2,57,50,180 25,37,319.68

-71.99

Stock

Futures

6,94,140 55707.29 8.66

Stock

Options

26,46,642 2,17,627.38 14.43

Total 2,92,76,580 28,26,422.40

-69.67

Bull-Call Spreads

Action Strike Price Risk Reward BEP

Buy 15900 143.05

52.20 47.80 15952.20

Sell 16000 90.85

Buy 15900 143.05

90.75 109.25 15990.75

Sell 16100 52.30

Buy 16000 90.85

38.55 61.45 16038.55

Sell 16100 52.30

Bear-Put Spreads

Action Strike Price Risk Reward BEP

Buy 15900 107.60

33.60 66.40 15866.40

Sell 15800 74.00

Buy 15900 107.60

57.55 142.45 15842.45

Sell 15700 50.05

Buy 15800 74.00

23.95 76.05 15776.05

Sell 15700 50.05

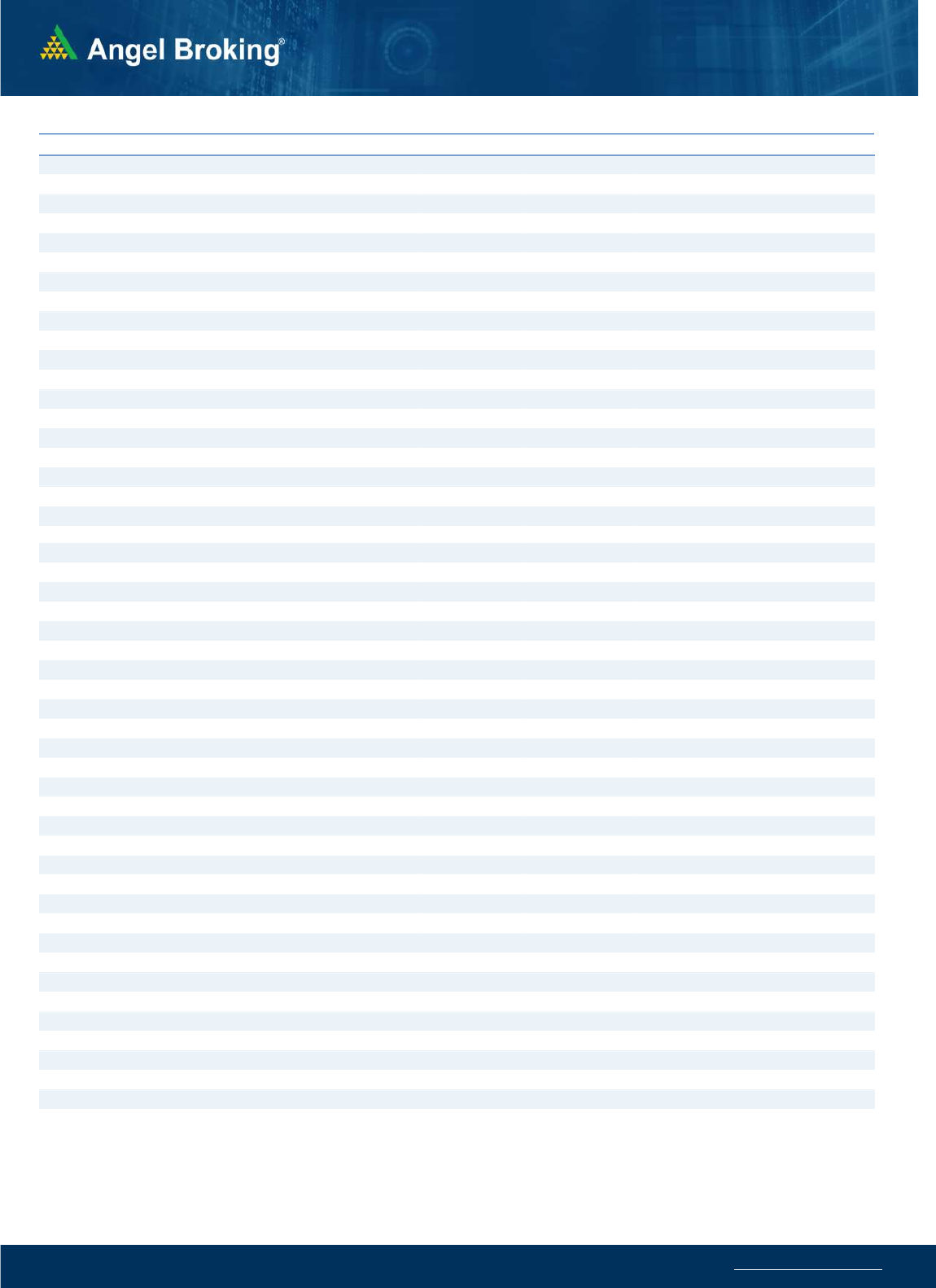

Nifty Put-Call Analysis

,0

500,000

1000,000

1500,000

2000,000

2500,000

3000,000

3500,000

15200 15300 15400 15500 15600 15700 15800 15900 16000 16100 16200 16300 16400 16500

Call Put

www.angelbroking.com

Technical & Derivatives Report

July 19, 2021

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ADANIPORTS

674

681

692

699

710

ASIANPAINT 2,946 2,968

2,987

3,009

3,028

AXISBANK

762

766

771

776

781

BAJAJ-AUTO 3,904 3,918

3,939

3,953

3,975

BAJFINANCE 6,045 6,085

6,138

6,178

6,230

BAJAJFINSV 12,533

12,639

12,832

12,939

13,131

BPCL

443

446

448

451

454

BHARTIARTL

519

530

537

548

554

BRITANNIA 3,415 3,428

3,450

3,463

3,486

CIPLA

964

971

980

987

997

COALINDIA

144

145

146

147

149

DIVISLAB 4,565 4,661

4,717

4,813

4,869

DRREDDY 5,347 5,377

5,413

5,443

5,480

EICHERMOT 2,569 2,593

2,632

2,656

2,696

GRASIM 1,535 1,554

1,567

1,585

1,598

HCLTECH

967

986

1,017

1,036

1,068

HDFCBANK 1,513 1,517

1,524

1,529

1,535

HDFCLIFE

688

693

697

703

707

HDFC 2,516 2,526

2,542

2,553

2,569

HEROMOTOCO 2,869 2,887

2,898

2,916

2,926

HINDALCO

397

401

404

408

410

HINDUNILVR 2,394 2,406

2,418

2,430

2,442

ICICIBANK

652

656

662

666

672

IOC

104

105

106

107

108

INDUSINDBK 1,031 1,038

1,048

1,055

1,065

INFY 1,535 1,545

1,560

1,570

1,585

ITC

206

207

208

209

211

JSW STEEL

697

701

704

707

710

KOTAKBANK 1,729 1,739

1,751

1,761

1,773

LT 1,585 1,602

1,612

1,629

1,640

M&M

773

776

780

784

788

MARUTI 7,243 7,273

7,303

7,333

7,363

NESTLEIND 17,459

17,556

17,636

17,733

17,813

NTPC

117

118

119

121

122

ONGC

115

116

117

118

118

POWERGRID

228

231

234

237

240

RELIANCE 2,078 2,095

2,105

2,122

2,132

SBILIFE 1,041 1,046

1,052

1,056

1,062

SHREECEM 27,699

27,897

28,199

28,397

28,699

SBIN

425

427

430

433

435

SUNPHARMA

676

682

689

695

702

TCS 3,174 3,185

3,202

3,212

3,230

TATACONSUM

753

758

766

772

780

TATAMOTORS

307

309

312

314

317

TATASTEEL 1,251 1,265

1,273

1,287

1,295

TECHM 1,066 1,085

1,102

1,120

1,137

TITAN 1,677 1,686

1,698

1,707

1,719

ULTRACEMCO 7,115 7,225

7,292

7,402

7,470

UPL

819

828

840

850

862

WIPRO

557

568

578

589

599

www.angelbroking.com

Technical & Derivatives Report

July 19, 2021

*

Research Team Tel: 022 – 39357600 (Extn. 6844) Website: www.angelbroking.com

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager and Investment Adviser with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking

Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration

number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for

accessing /dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed

public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits

and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Technical and Derivatives Team:

Sameet Chavan Chief Analyst - Technical & Derivatives sameet.chavan@angelbroking.com

Ruchit Jain Senior Analyst - Technical & Derivatives ruchit.jain@angelbroking.com

Rajesh Bhosale Technical Analyst rajesh.bhosle@angelbroking.com

Sneha Seth Derivatives Analyst sneha.seth@angelbroking.com