July 20, 2022

www.angelone.in

Technical & Derivatives Report

OOOOOOOO

Nifty Bank Outlook

-

(35720)

Bank Nifty started on a negative note however from the word go it

started moving higher and in no time it crossed Monday's high and

remained buoyant throughout the session. Eventually, Bank Nifty

continued its outperformance as it ended with gains of around a

percent at 35720.

On the daily chart, the bank index has closed above the recent swing

high formed recently during the start of July month and by doing so it

continues to move in a structural 'Higher Top Higher Bottom'

formation. In addition, we are witnessing a bullish crossover between

20 and 50EMA that is technically considered a strong setup for the

bulls in the short term. With these said signals and the way individual

counters from this basket were buzzing yesterday we remain

optimistic about the bank index and expect it to continue to

outperform. In such a scenario, traders are repeatedly advised to use

any dip as a buying opportunity. As far levels are concerned,

immediate support is seen at 35500 - 35350 whereas resistance is seen

at 35950 - 36100 levels.

Key Levels

Support 1 – 35500 Resistance 1 – 35950

Support 2 – 35350 Resistance 2 – 36100

Exhibit 1: Nifty Daily

Chart

Exhibit 2: Nifty Bank Daily Chart

Sensex (54768) / Nifty (16341)

The buoyant move continued for the consecutive session in the week,

wherein the benchmark index witnessed strong traction since the

opening bell. The broad-based buying has uplifted the overall market

sentiments, which certainly portrays the urge of the bulls of D-Street

while favorable conditions. The Nifty50 index finally concluded the day

at higher grounds with gains of 0.38 percent, a tad below the 16350

level.

Technically, the index has maintained its positive stature while

marching upwards in the rising wedge on the daily chart. And also, the

strong bullish candle on the daily chart construes to be an encouraging

sign for the bulls, as such participation is seen after a long while. On the

level front, the 16200 level is expected to provide a cushion to any

minor decline from the ongoing up move, while the unfilled gap of

16067-16142 is likely to provide a strong demand zone for the index.

On the contrary, the 16380-16430 zone is expected to act as immediate

resistance, above which the next leg of the rally gets unfolded.

There have been contributions across the board, wherein the

significant benefactors that boosted the bullish sentiments were

from the Banking and Auto space. Also, the broader end of the

spectrum did extremely well, which we believe should continue in

the coming session as well. Ideally, we expect the index to

consolidate a bit now, and hence, the pragmatic approach would be

to identify apt themes in order to find better trading opportunities.

Key Levels

Support 1 – 16200 Resistance 1 – 16380

Support 2 – 16140 Resistance 2 – 16430

www.angelone.in

Technical & Derivatives Report

July 20, 2022

View

The upmove extends for the third straight session to

reclaim 16300 with an authority. However, the banking

index was the major contributor which surge more

than a percent yesterday.

FIIs were net buyers in the cash market segment to

the tune of Rs. 974 crores. Simultaneously, in Index

futures, they bought worth Rs. 310 crores with a rise in

open interest, indicating addition of fresh bullish bets.

Yesterday’s upmove was supported by fresh longs for

both Nifty as well as BankNifty. Stronger too turned

net buyers not only in equities but also in index futures

segment for last two trading sessions, this is certainly

an encouraging sign for Bulls. In Nifty options front, we

saw addition of fresh positions in 16550 and 16600 call

strikes along with unwinding in 16100-16250 strikes. On

the opposite side, massive build-up was seen in 16200-

16300 puts. This clearly suggest the base has now

shifted higher to 16100-16200. Considering the above

development, we expect continuation of northward

journey going ahead and hence, any declines below

16200 shall be an opportunity add fresh longs in

system. For now, traders can focus on individual

space which has better trade set-up.

Comments

The Nifty futures open interest has increased by 5.29%.

and BANK Nifty futures open interest has increased by

1.69% as the market closed at 16340.55.

The Nifty July future closed with a premium of 6.40 point

against a premium of 21.75 point in the last trading

session. The Aug series closed at a premium of 21.15

point.

The INDIA VIX increased from 17.16 to 17.20. At the same

time, the PCR-OI of Nifty has decreased from 1.36 to 1.35.

Few of the liquid counters where we have seen high

cost of carry are BHARTIARTL, BHEL, IDEA,

INDUSTOWER and CHAMBLFERT.

Historical Volatility

SCRIP HV

ESCORTS 42.26

FEDERALBNK 45.66

POLYCAB 42.95

OBEROIRLTY 51.61

RBLBANK 74.13

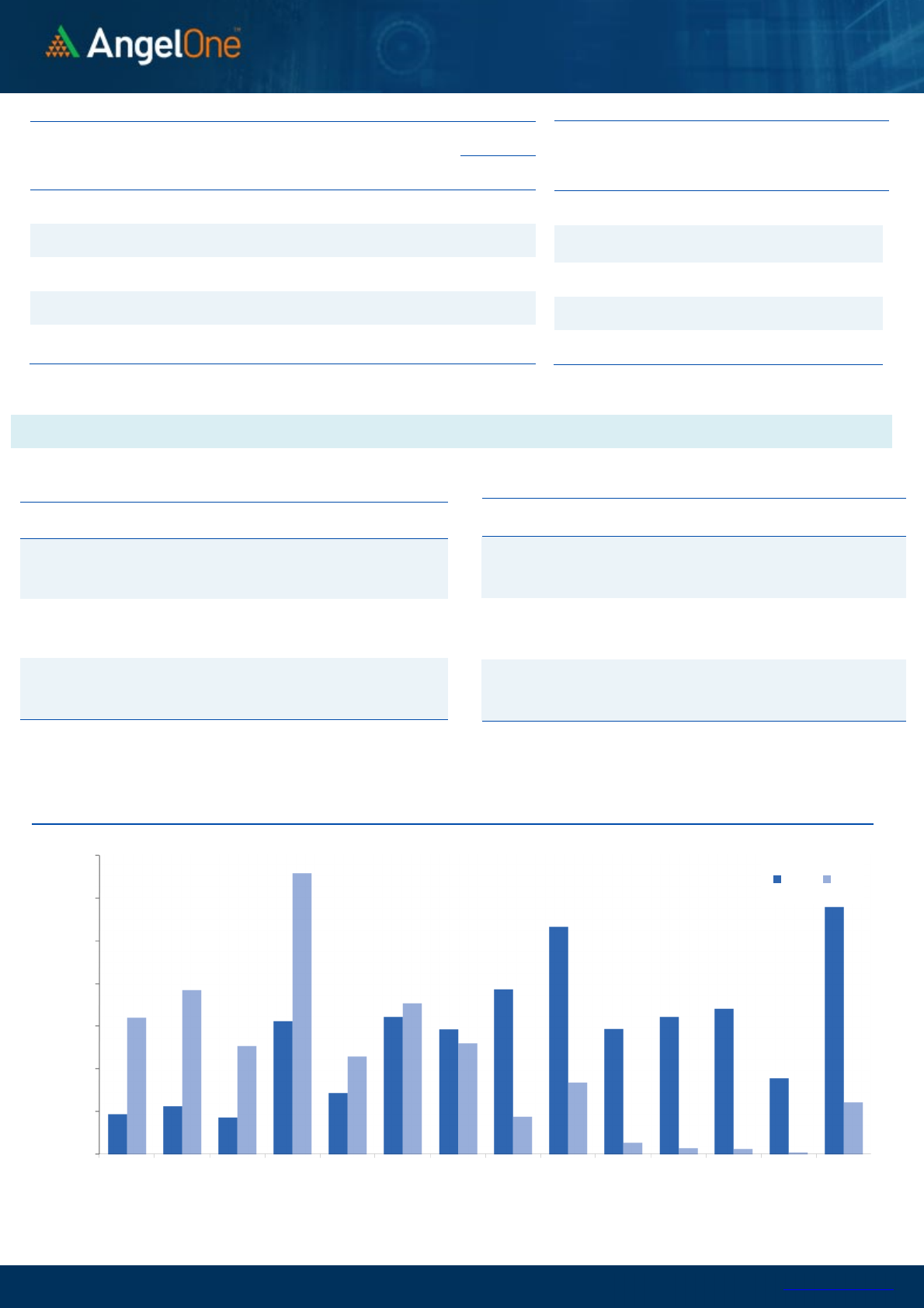

Nifty Vs OI

15000

15200

15400

15600

15800

16000

16200

16400

6,000

8,000

10,000

12,000

14,000

16,000

18,000

6-30 7-4 7-7 7-11 7-13 7-15 7-19

Openinterest Nifty

OI Gainers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

COFORGE 1007700 22.21 3411.60 -2.24

GAIL 29060400 15.27 140.25 -2.54

POLYCAB 1438500 11.95 2250.75 4.54

CUB 11220000 10.16 158.00 2.72

AUBANK 8112000 9.41 566.20 0.69

RAMCOCEM 5977200 7.67 668.90 1.53

BANKBARODA 118193400 6.57 112.70 4.24

RBLBANK 52735000 6.29 91.40 6.20

OI Losers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

ABBOTINDIA 39280 -8.99 19825.50 -0.58

RECLTD 30834000 -6.61 126.00 1.77

ESCORTS 2095500 -6.55 1755.40 5.08

BHARTIARTL 53431800 -4.99 672.90 0.94

CROMPTON 3675000 -4.71 395.20 0.91

BAJAJFINSV 1201900 -4.68 12444.80 1.41

LTTS 1489000 -4.65 3189.10 0.73

INTELLECT 1065750 -4.50 671.90 0.07

Put-Call Ratio

SCRIP PCR (OI) PCR (VOL)

NIFTY 1.35 0.87

BANKNIFTY 1.41 0.86

RELIANCE 0.50 0.45

ICICIBANK 0.88 0.46

INFY 0.62 0.64

www.angelone.in

Technical & Derivatives Report

July 20, 2022

Note: Above mentioned Bullish or Bearish Spreads in Nifty (July Series) are given as an information and not as a recommendation.

Nifty Spot = 16

340.55

FII Statistics for

July 1

9

, 2022

Detail Buy

Contracts

Open

Interest

Value

(in Cr.)

Sell

Net

CHANGE

INDEX

FUTURES

3053.32 2743.75 309.57

149758 12589.42 3.81

INDEX

OPTIONS

855086.84 855550.48 (463.64) 1551739 131031.76 11.45

STOCK

FUTURES

10918.77 11733.73 (814.96) 2262916 146572.66 0.38

STOCK

OPTIONS

8718.87 8645.32 73.55

163023 10607.19 4.37

Total

877777.80

878673.28

(895.48) 4127436

300801.03

4.57

Turnover

on

July 1

9

, 2022

Instrument

No. of

Contracts

Turnov

er

( in Cr. )

Change

(%)

Index Futures

388328 32925.77 16.04

Index Options

120803293 10237940.97 56.31

Stock Futures

929799 60174.82 -0.24

Stock Options

3597740 242729.22 -3.21

Total

35,97,740 242729.22 53.48

Bull

-

Call Spreads

Action Strike Price Risk Reward BEP

Buy

16300 183.80

52.80

47.20

16352.80

Sell

16400 131.00

Buy

16300 183.80

96.45

103.55

16396.45

Sell

16500 87.35

Buy

16400 131.00

43.65 56.35 16443.65

Sell 16500 87.35

Bear

-

Put Spreads

Action Strike Price Risk Reward BEP

Buy

16300 139.60

37.15

62.85

16262.85

Sell

16200 102.45

Buy

16300 139.60

63.90

136.10

16236.10

Sell

16100 75.70

Buy

16200 102.45

26.75 73.25 16173.25

Sell

16100 75.70

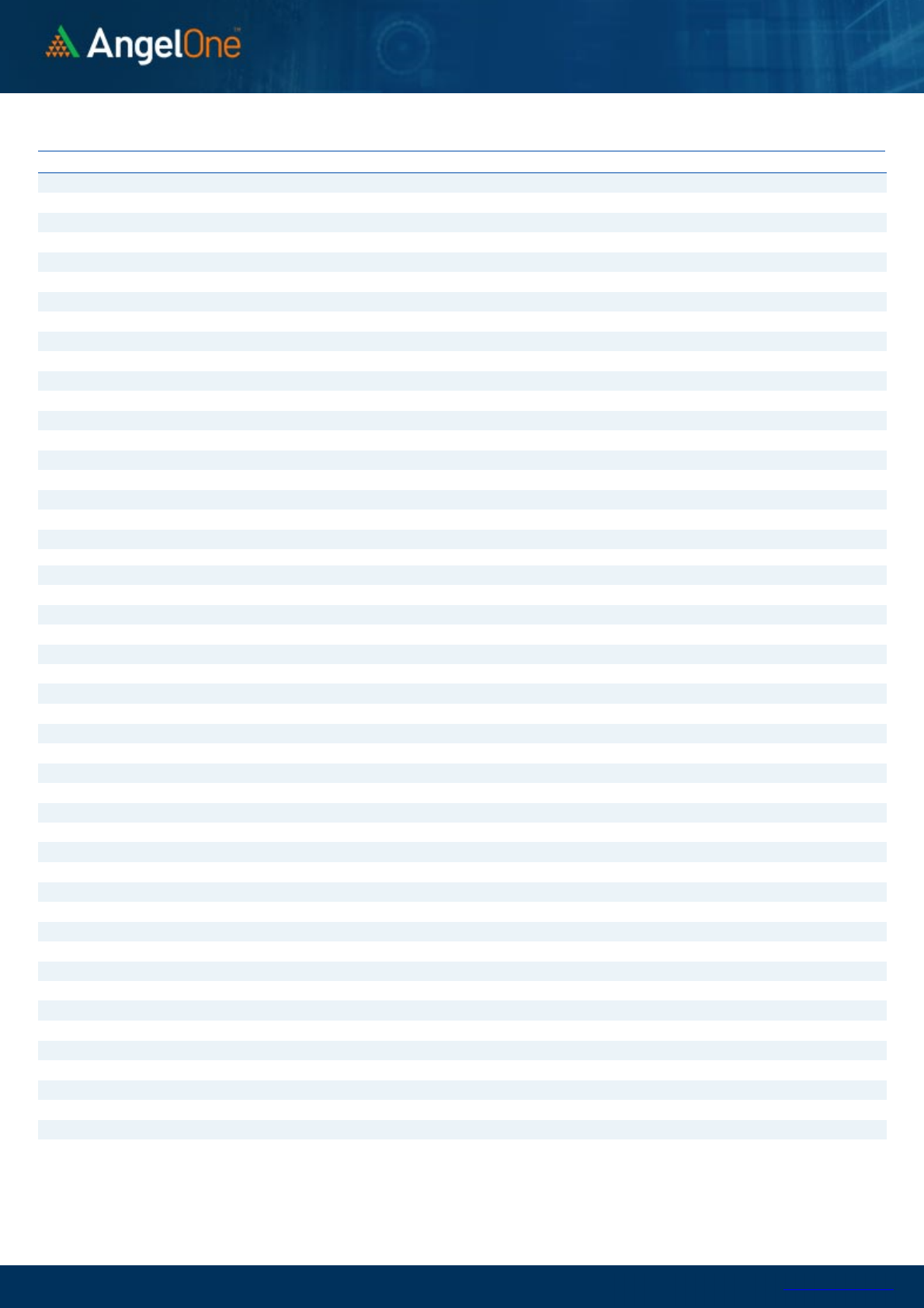

Nifty Put

-

Call Analysis

,0

500,000

1000,000

1500,000

2000,000

2500,000

3000,000

3500,000

15700 15800 15900 16000 16100 16200 16300 16400 16500 16600 16700 16800 16900 17000

Call Put

www.angelone.in

Technical & Derivatives Report

July 20, 2022

`

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ADANIPORTS 727 738

745 756 763

APOLLOHOSP 3,883 3,951

3,992 4,061 4,102

ASIANPAINT 2,962 2,991

3,007 3,035 3,052

AXISBANK 669 685

694 710 720

BAJAJ-AUTO 3,931 3,967

4,001 4,037 4,071

BAJFINANCE 5,959 6,013

6,055 6,109 6,151

BAJAJFINSV 11,959 12,202

12,336 12,579 12,713

BPCL 310 313

316 319 321

BHARTIARTL 657 665

671 679 685

BRITANNIA 3,721 3,754

3,776 3,809 3,830

CIPLA 945 953

963 971 982

COALINDIA 192 195

197 201 203

DIVISLAB 3,714 3,734

3,750 3,769 3,786

DRREDDY 4,398 4,423

4,460 4,486 4,523

EICHERMOT 2,987 3,032

3,061 3,106 3,135

GRASIM 1,407 1,425

1,435 1,453 1,463

HCLTECH 878 884

891 896 903

HDFCBANK 1,326 1,337

1,348 1,359 1,369

HDFCLIFE 529 532

539 542 548

HDFC 2,179 2,198

2,211 2,230 2,242

HEROMOTOCO 2,747 2,774

2,811 2,838 2,874

HINDALCO 359 364

368 372 376

HINDUNILVR 2,503 2,535

2,555 2,588 2,607

ICICIBANK 762 771

777 786 791

INDUSINDBK 828 848

860 880 892

INFY 1,464 1,474

1,480 1,491 1,497

ITC 291 293

294 296 297

JSW STEEL 572 578

584 591 596

KOTAKBANK 1,814 1,825

1,838 1,849 1,862

LT 1,705 1,718

1,726 1,739 1,747

M&M 1,150 1,168

1,179 1,197 1,207

MARUTI 8,596 8,656

8,727 8,787 8,859

NESTLEIND 17,996 18,187

18,418 18,609 18,840

NTPC 148 150

150 152 152

ONGC 120 124

129 133 137

POWERGRID 208 209

210 211 212

RELIANCE 2,381 2,409

2,428 2,456 2,475

SBILIFE 1,140 1,155

1,170 1,185 1,201

SHREECEM 19,768 19,918

20,053 20,203 20,337

SBIN 484 491

495 502 505

SUNPHARMA 862 869

880 887 898

TCS 3,012 3,043

3,061 3,092 3,110

TATACONSUM

779 783

788 792 797

TATAMOTORS 441 445

448 452 456

TATASTEEL 893 906

914 927 935

TECHM 983 995

1,003 1,015 1,023

TITAN 2,201 2,221

2,237 2,257 2,273

ULTRACEMCO 5,942 6,014

6,055 6,127 6,168

UPL 673 678

683 689 694

WIPRO 398 402

405 409 411

www.angelone.in

Technical & Derivatives Report

July 20, 2022

*

Technical and Derivatives Team:

Sameet Chavan

Chief Analyst

–

Technical & Derivatives

sameet.chavan@angelone.in

Sneha Seth Senior Analyst – Technical & Derivatives sneha.seth@angelone.in

Rajesh Bhosale Technical Analyst rajesh.bhosle@angelone.in

Osho Krishan Senior Analyst – Technical & Derivatives osho.krishan@angelone.in

Research Team Tel: 022 – 39357600 (Extn. 6844) Website: www.angelone.in

For Technical Queries E-mail: technicalresearch-cso@angelone.in

For Derivatives Queries E-mail: derivatives.desk@angelone.in

DISCLAIMER

Angel One Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel One

Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration

number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for

accessing /dealing in securities Market.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Angel or its associates or research analyst or his relative may have actual/beneficial ownership of 1% or more in the securities of

the subject company at the end of the month immediately preceding the date of publication of the research report. Neither Angel or

its associates nor Research Analysts or his relative has any material conflict of interest at the time of publication of research report.

Angel or its associates might have received any compensation from the companies mentioned in the report during the period

preceding twelve months from the date of this report for services in respect of managing or co-managing public offerings, corporate

finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction

in the normal course of business. Angel or its associates did not receive any compensation or other benefits from the companies

mentioned in the report or third party in connection with the research report. Neither Angel nor its research analyst entity has been

engaged in market making activity for the subject company.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate

the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel One Limited or any of its affiliates/ group companies shall not be in any way responsible

for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel One

Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make

any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel

One Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel One Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information. Angel or its associates or Research Analyst or his relative might have financial interest

in the subject company. Research analyst has not served as an officer, director or employee of the subject company.