Aug 24, 2022

www.angelone.in

Technical & Derivatives Report

OOOOOOOO

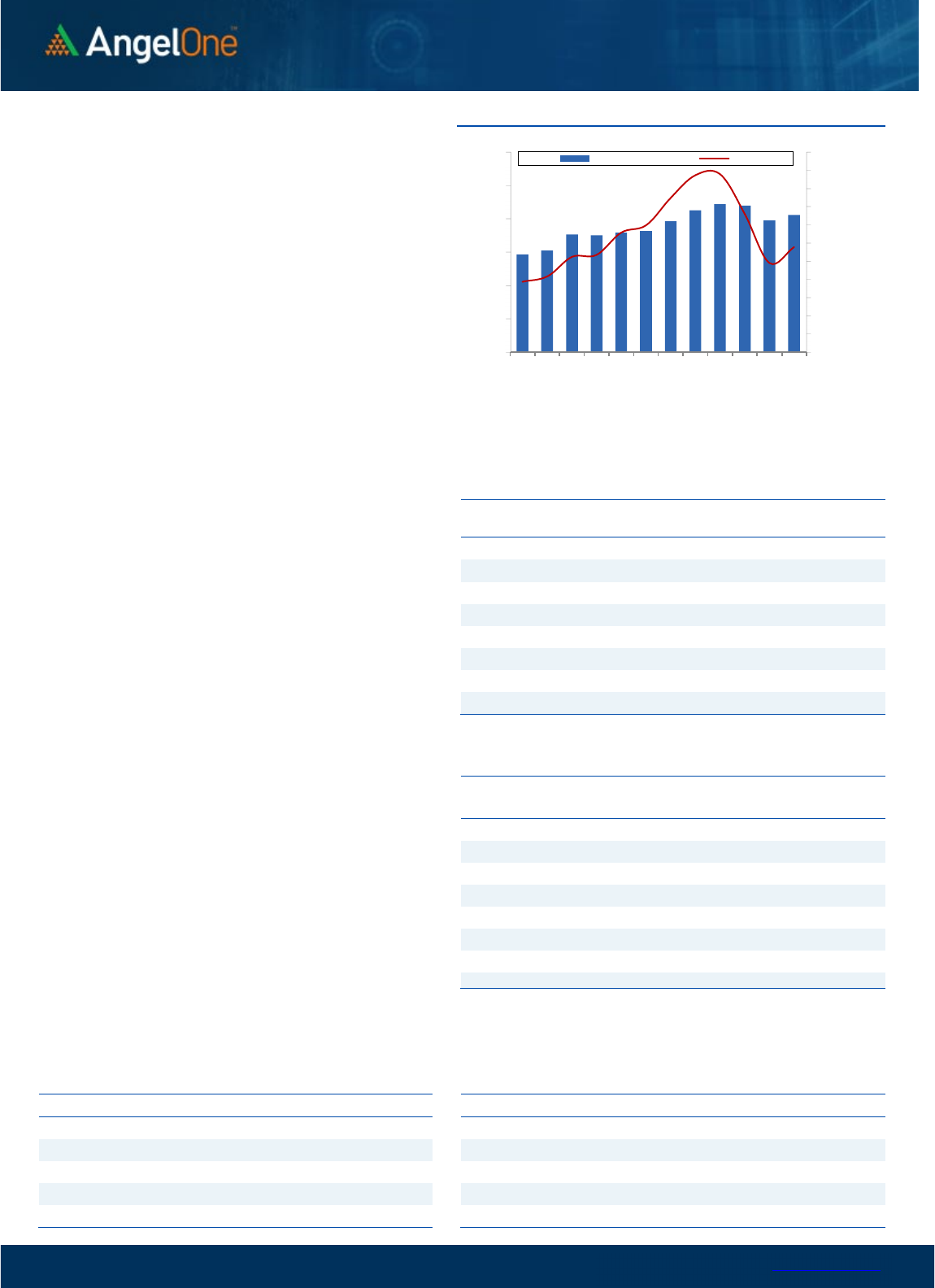

Nifty Bank Outlook (38698)

Similar to the previous session, Bank Nifty started with a huge gap

down opening however right from the start there was buying

momentum that not only erased the morning lost ground but entered

well into positive territory. The action was however not done yet as

we witnessed wild swings on both sides after that and with bulls

having the upper hand the bank index eventually ended the volatile

session with gains of a percent tad below 38700 levels.

In our yesterday's outlook, we had clearly stated the last two session's

weaknesses as just a price correction and that the undertone remains

bullish. This point was clearly validated as twice there was strong

buying seen yesterday at the lower levels. Now we are witnessing a

strong bullish candle on the daily chart that is seen on the key support

of 20EMA and hence we sense that any dips in the near term are likely

to get bought and yesterday's low around 38000 to act as sacrosanct

support. On the higher side, immediate resistance is seen around

39070 and 39300 levels. Even though the momentum is back with the

bulls, one should avoid getting complacent and need to be very

selective as global markets remain highly volatile.

Key Levels

Support 1 – 38150 Resistance 1 – 39070

Support 2 – 38000 Resistance 2 – 39300

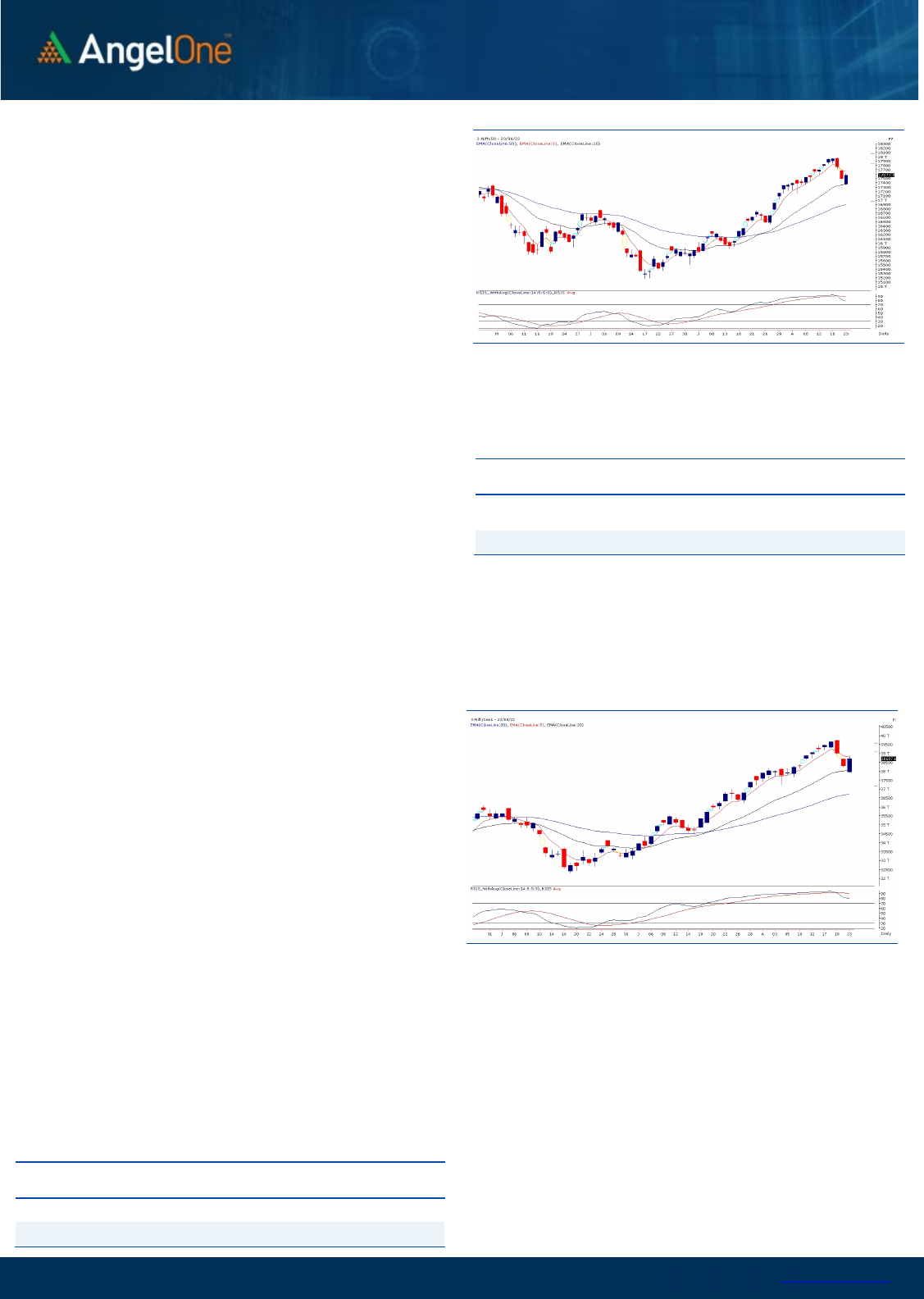

Exhibit 1: Nifty

Daily

Chart

Exhibit 2: Nifty Bank Daily Chart

Sensex (59031) / Nifty (17557)

Monday night, US markets had one more round of selling which

dampened the overall sentiments of traders across the globe. Tracking

these cues, our markets too started off lower to hasten towards the key

support of 17350. This being the ’20-day EMA’ level, the correction

halted in the opening hour which was then followed by a sharp

recovery to not only erase all losses but also entered the positive

terrain. The similar sort of swings on either sides repeated during the

latter half as well. Eventually, the action packed session eventually

ended with half a percent gains tad above the 17550 mark.

The Nifty has completed a price correction of 650 points in merely three

sessions i.e. nearly 3.50% from the Friday’s high of 17992.20. In our

previous commentary, we had mentioned about the support zone

around 17400 – 17350. Since it coincided with the key moving average

(20-EMA), the oversold market attracted some buying at lower levels.

With the help of RIL and banking space who became the real

protagonists, the benchmark index Nifty managed to close almost at

day’s high. Although, the rebound was very much on expected lines,

one should avoid getting carried away with this. We are still not out of

the woods yet till the time few important levels are taken out in the

upward direction. As of now, 17650 – 17710 is to be seen as immediate

resistance zone and momentum traders should ideally look to lighten

up longs around it. On the flipside, 17525 – 17450 are to be seen as

immediate supports.

The coming session can slightly be a tricky one, because if we

rebound first towards the mentioned intraday hurdles, the index is

likely to land up in corridor of uncertainty. Hence, it’s better to

follow one step at a time for couple of trading sessions.

Key Levels

Support 1 – 17525 Resistance 1 – 17650

Support 2 – 17450 Resistance 2 – 17710

www.angelone.in

Technical & Derivatives Report

Aug 24, 2022

View

Our market started the day on a sluggish note

tracking the weak global cues, wherein the

benchmark index tested the 20-DEMA. However, a

modest recovery was seen from the lows, and the

action-packed session eventually ended with half a

percent gains tad above the 17550 level.

FIIs were net buyers in the cash market segment to

the tune of Rs. 563 crores. Simultaneously, in Index

futures, they sold worth Rs. 110 crores with an increase

in open interest, indicating some short formation.

In the F&O space, we have seen mixed positions in both

the indices, with short covering in the Bank Nifty and

long formation in Nifty. On the options front, the

primary concentration of OI is seen at the 17500 put

strike, which is likely to act as an immediate support

zone. On the contrary, OI concentration could be seen

at 17700-17800 call strikes, which is likely to act as a

primary hurdle. Considering the recent price action, it

is advisable to keep a close tab on the mentioned

levels along with the global developments. Also, ahead

of the contract expiry, some volatility could be seen;

hence one should avoid aggressive overnight bets in

the indices.

Comments

The Nifty futures open interest has increased by

2.43%. and Bank Nifty futures open interest has

decreased by 0.89% as the market closed at 17577.50.

The Nifty Aug future closed with a premium of 8.05

point against a premium of 1.55 point in the last

trading session. The Sep series closed at a premium

of 88.05 point.

The INDIA VIX increased from 19.03 to 19.05. At the

same time, the PCR-OI of Nifty has increased from

0.79 to 0.98.

Few of the liquid counters where we have seen high

cost of carry are NMDC, IDFCFRSTB, COROMANDEL,

M&M and CUB.

Historical

Volatility

SCRIP HV

IDEA 83.50

IBULHSGFIN 74.87

RBLBANK 71.71

ZEEL 65.22

HINDCOPPER 64.94

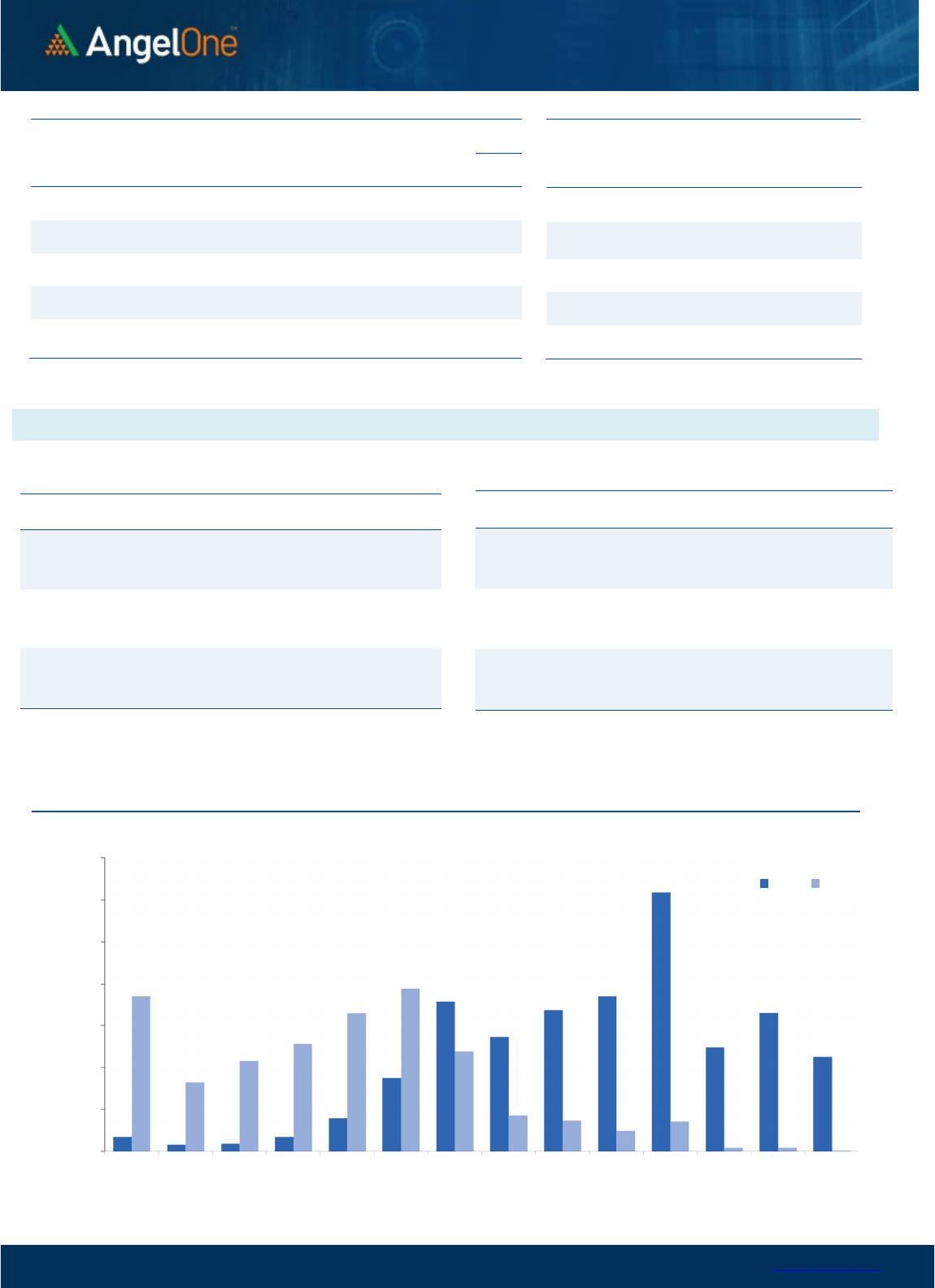

Nifty Vs OI

17000

17100

17200

17300

17400

17500

17600

17700

17800

17900

18000

18100

6,000

8,000

10,000

12,000

14,000

16,000

18,000

8/4 8/8 8/11 8/16 8/18 8/22

Openinterest Nifty

OI Gainers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

CUB 7985000 28.89 178.90 3.78

ATUL 149700 26.49 9239.20 3.35

DIXON 844375 15.16 4049.55 0.41

DELTACORP 18002100 15.12 209.35 3.52

BEL 27455000 11.89 298.45 3.20

INDIACEM 12678800 11.79 206.80 3.43

UBL 1271600 11.04 1622.70 -1.23

IDFC 130480000 10.86 61.25 3.11

OI Losers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

SYNGENE 2512000 -16.32 595.55 2.41

VOLTAS 3525000 -15.86 994.50 1.97

TATACHEM 5852000 -15.82 1101.25 1.48

POLYCAB 882300 -11.84 2399.70 2.13

INDUSTOWER 21394800 -11.83 199.10 2.09

IPCALAB 1614600 -10.94 922.65 2.13

ASHOKLEY 46060000 -9.42 146.65 3.24

GUJGASLTD 5283750 -9.29 488.50 2.03

Put-Call Ratio

SCRIP PCR (OI) PCR (VOL)

NIFTY 0.98 0.90

BANKNIFTY 0.88 0.91

RELIANCE 0.56 0.55

ICICIBANK 0.82 0.60

INFY 0.43 0.63

www.angelone.in

Technical & Derivatives Report

Aug 24, 2022

Note: Above mentioned Bullish or Bearish Spreads in Nifty (Aug Series) are given as an information and not as a recommendation.

Nifty Spot =

17,

5

5

7

.

5

0

FII Statistics for

August

2

3

, 2022

Detail Buy

Contracts

Open

Interest

Value

(in Cr.)

Sell

Net

CHANGE

INDEX

FUTURES

5566.14 5676.59 (110.45) 175985 15935.55 0.50

INDEX

OPTIONS

900094.14 894025.84 6068.30

1667374 150473.68

9.26

STOCK

FUTURES

55409.10 55041.84 367.26

2159891 150034.98

(0.17)

STOCK

OPTIONS

11108.74 10924.14 184.60

162796 11562.20

(8.06)

Total 972178.12

965668.41

6509.71

4166046

328006.41

3.07

Turnover on

August

2

3

, 2022

Instrument

No. of

Contracts

Turnover

( in Cr. )

Change

(%)

Index

Futures

623745 56729.98 33.73

Index Options

149467779

13574265.72 56.77

Stock

Futures

2372753 165967.25 7.57

Stock Options

4928592 379334.77 -0.19

Total

49,28,592

379334.77 53.50

Bull-Call Spreads

Action Strike Price Risk Reward BEP

Buy

17500 131.70

53.80

46.20

17553.80

Sell

17600 77.90

Buy

17500 131.70

91.50

108.50

17591.50

Sell

17700 40.20

Buy

17600 77.90

37.70 62.30 17637.70

Sell 17700 40.20

Bear

-

Put Spreads

Action Strike Price Risk Reward BEP

Buy 17500 50.20

24.95

75.05

17475.05

Sell

17400 25.25

Buy 17500 50.20

36.35

163.65

17463.65

Sell 17300 13.85

Buy

17400 25.25

11.40 88.60 17388.60

Sell 17300 13.85

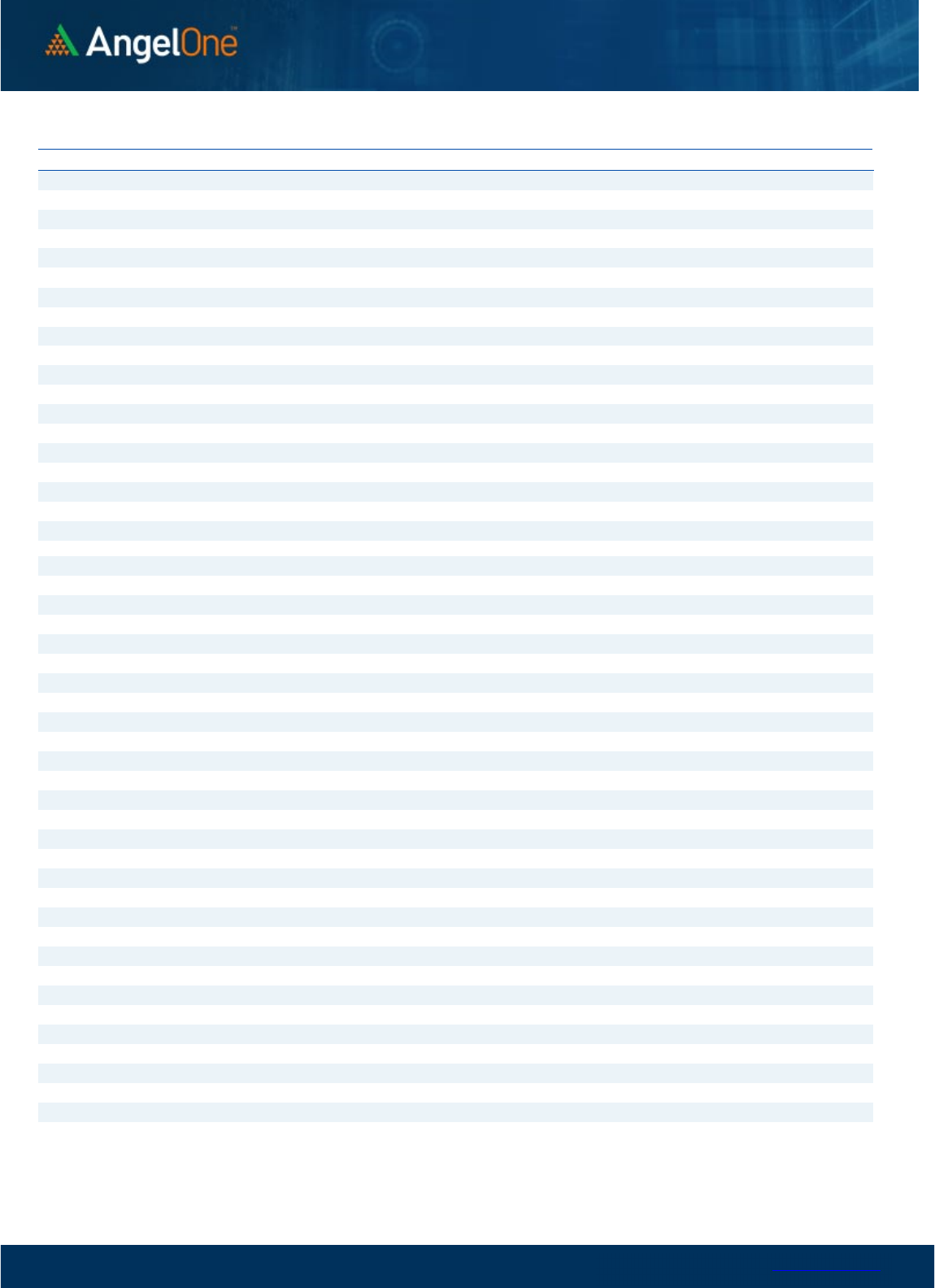

Nifty Put

-

Call Analysis

,0

2000,000

4000,000

6000,000

8000,000

10000,000

12000,000

14000,000

17000 17100 17200 17300 17400 17500 17600 17700 17800 17900 18000 18100 18200 18300

Call Put

www.angelone.in

Technical & Derivatives Report

Aug 24, 2022

`

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1 R2

ADANIPORTS 781 807

832

858

883

APOLLOHOSP 3,945 4,008

4,051

4,114

4,156

ASIANPAINT 3,285 3,321

3,352 3,388

3,420

AXISBANK 727 737

744

754

761

BAJAJ-AUTO 3,994 4,029

4,051

4,086

4,108

BAJFINANCE

6,969

7,088

7,169

7,288

7,369

BAJAJFINSV 15,317 15,810

16,165

16,659

17,014

BPCL 329 331

333

336

337

BHARTIARTL 714 726

734

746

754

BRITANNIA

3,607

3,643

3,674 3,710

3,741

CIPLA 996 1,018

1,033

1,055

1,069

COALINDIA 214 218

221

226

228

DIVISLAB

3,491

3,512

3,550 3,571 3,609

DRREDDY 4,112 4,168

4,202 4,259 4,292

EICHERMOT 3,286 3,375

3,428 3,517

3,569

GRASIM

1,523

1,559

1,583

1,620

1,644

HCLTECH

934

940

946

952

958

HDFCBANK

1,439

1,452

1,464

1,478

1,490

HDFCLIFE

554

560

566

571

577

HDFC

2,375

2,398

2,420 2,442

2,464

HEROMOTOCO

2,736

2,770

2,790

2,824

2,844

HINDALCO

407

417

425

435

442

HINDUNILVR 2,558 2,575

2,603

2,620

2,647

ICICIBANK

833

848

858

874

883

INDUSINDBK 1,017 1,044

1,061 1,089

1,106

INFY

1,522

1,532

1,543

1,554

1,565

ITC

311

313

315

317

319

JSW STEEL

630

641

648

660

666

KOTAKBANK

1,799

1,828

1,848

1,877

1,897

LT

1,839

1,858

1,885

1,904

1,931

M&M 1,197 1,235

1,256

1,294

1,315

MARUTI 8,488 8,604

8,681

8,797

8,874

NESTLEIND

19,084

19,355

19,522

19,793

19,960

NTPC 154 156

158

160

161

ONGC

129

131

133

135

137

POWERGRID 222 225

227

230

232

RELIANCE

2,569

2,608

2,630

2,670

2,692

SBILIFE

1,258

1,269

1,281

1,291

1,303

SHREECEM

20,501

20,814

21,055

21,367

21,608

SBIN

502

512

518 528

534

SUNPHARMA

865

877

884

896

904

TCS

3,227

3,256

3,299

3,328

3,371

TATACONSUM

778

794

803

818

827

TATAMOTORS

442

451

457

466 471

TATASTEEL 102 105

106

109

111

TECHM

1,038

1,052

1,061 1,075

1,084

TITAN

2,359

2,419

2,461

2,521

2,563

ULTRACEMCO

6,319

6,407

6,494 6,582

6,668

UPL

728

744

753

769

778

WIPRO

407

412

415 420

424

www.angelone.in

Technical & Derivatives Report

Aug 24, 2022

*

Technical and Derivatives Team:

Sameet Chavan Chief Analyst – Technical & Derivatives sameet.chavan@angelone.in

Sneha Seth Senior Analyst – Technical & Derivatives sneha.seth@angelone.in

Rajesh Bhosale Technical Analyst rajesh.bhosle@angelone.in

Osho Krishan Senior Analyst – Technical & Derivatives osho.krishan@angelone.in

Research Team Tel: 022 – 39357600 (Extn. 6844) Website: www.angelone.in

For Technical Queries E-mail: technicalresearch-cso@angelone.in

For Derivatives Queries E-mail: derivatives.desk@angelone.in

DISCLAIMER

Angel One Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel One

Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration

number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for

accessing /dealing in securities Market.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Angel or its associates or research analyst or his relative may have actual/beneficial ownership of 1% or more in the securities of

the subject company at the end of the month immediately preceding the date of publication of the research report. Neither Angel or

its associates nor Research Analysts or his relative has any material conflict of interest at the time of publication of research report.

Angel or its associates might have received any compensation from the companies mentioned in the report during the period

preceding twelve months from the date of this report for services in respect of managing or co-managing public offerings, corporate

finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction

in the normal course of business. Angel or its associates did not receive any compensation or other benefits from the companies

mentioned in the report or third party in connection with the research report. Neither Angel nor its research analyst entity has been

engaged in market making activity for the subject company.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate

the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel One Limited or any of its affiliates/ group companies shall not be in any way responsible

for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel One

Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make

any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel

One Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel One Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information. Angel or its associates or Research Analyst or his relative might have financial interest

in the subject company. Research analyst has not served as an officer, director or employee of the subject company.