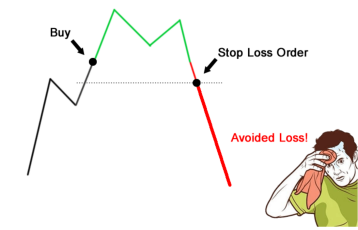

In trading, it is always a fear in the mind “What if I lose all my capital”.

But do you know you can easily limit your losses? So how do you keep losses in control?

I will demonstrate to you the technique by which you can keep your losses in control.

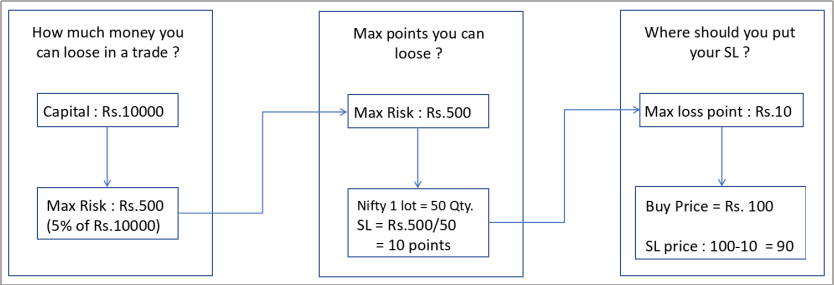

Step 1: Set a fixed percentage of your trading capital as a maximum loss on any trade, we recommend keeping it at 5%.

Suppose your capital is Rs.10000, So your maximum risk in single trade should be :

Rs. 10000 * 5% = Rs. 500/-

Step 2: Calculate the Max points you can lose.

So to do that, divide Max risk by your quantity.

For eg. If you are trading in 1lot (50 Qty) of Nifty

Then, Max loss points = Rs.500/50 = 10 points.

Step 3: Calculate your SL level.

So your Max loss points are 10 points.

So If your Buying price is Rs.100,

Place your stop loss at 10 point below i.e. Rs.100- 10 = Rs. 90

So your SL level will be Rs. 90

So, suppose your SL gets hit and you have entered at 100. SL hit at 90. Your loss would be Rs. 10*50 = Rs.500.

So this is how you can restrict your loss in your plan.

Some important quotes on Stop loss:

“Never trade without a stop-loss. Doing this is like rock-climbing without a harness.”

“A stop-loss is meant to protect you. From yourself.”

“Whenever you enter a trade, you must know the point at which you are willing to say, ’I was wrong about this trade’ and get out. This is your stop-loss point.”

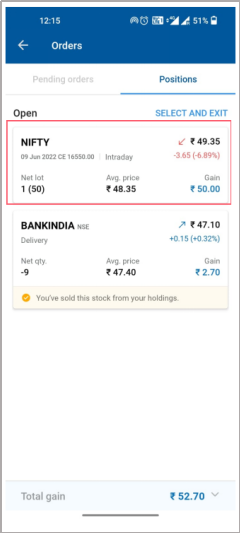

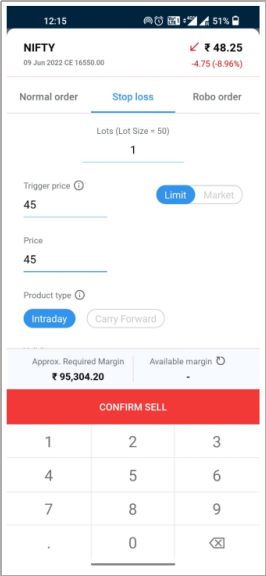

How to place Stop-loss in Angel?

Go to Order Page

There you will find your Positions

From there, you can click on the position in which you want to place SL.

Once you click on any position, you will get a sleeve up to where you will find the Exit, Buy More, Stop loss, Convert button

Click on the Stop-loss button.

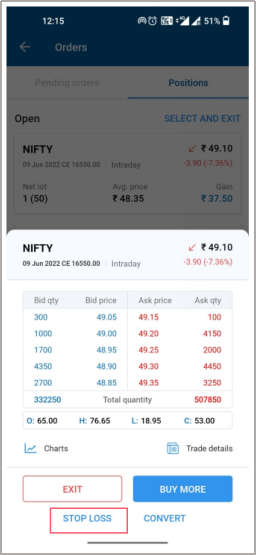

Once you click on Stop-loss button, you will get a SL order page. There you can put Qty (at which you want to place SL).

Trigger price: The price at which your order should trigger.

Price: The price at which your Order should execute

If you select Market, your price will get executed at Market price.

Click on Sell >> Confirm Sell, your SL will be placed.

Trading Style that works:

- l Book Profit and loss quickly

- l Be fast identifying a trend and whether the trend is continuing or has reversed

- l Don’t hold onto a trade that has not panned out. Live to trade another day.

Try Insta Trade

The easiest Options Trading platform! Get Charts, Watchlist, Positions & live P&L in single screen

Next Article – How to Be A Profitable Trader

Previous Article – When To Enter A Trade