All you need to know, for trading in Options

Now, as you know the importance of trading in Options in my previous blog ‘Why you should trade in Options?’. The next natural step is to know the basics of Options trading which will act as a foundation stone for your Options trading journey.

Just relax, and take the time to think ‘what is the first thing you need to figure out before taking an Option trade’?

Thinking….?

Now, you must be having some questions in your mind, some technical jargon, some blurred concepts, words you have noticed while watching some video, reading some article, etc. about Options.

In this blog, I will try to cover all the important foundation concepts which will clear all your doubts about Option.

‘Option trade’ in a nutshell

Again, you are on your trading screen, watching the Nifty chart which is trading at 16500.

There can be two possible outcomes in the Nifty chart.

- At some point either, the Nifty may go up or It may go down.

- If you expect the Nifty to go up, just Buy Call Option

- If you expect the Nifty to go down, just Buy the Put Option

- In the cash market,

- If you are bullish You BUY,

- If you are bearish You SELL.

- But in Options, you have to trade with Call & Put.

- If you are bullish BUY CALL,

- If you are bearish BUY PUT.

Let's say, you need to buy a Call or Put option. Once u decide to put a trade, you will notice there are several Nifty Call and Put options available. Each of them is denoted by what's called a 'strike price'. So let's understand what is this, trust me it's nothing complicated.

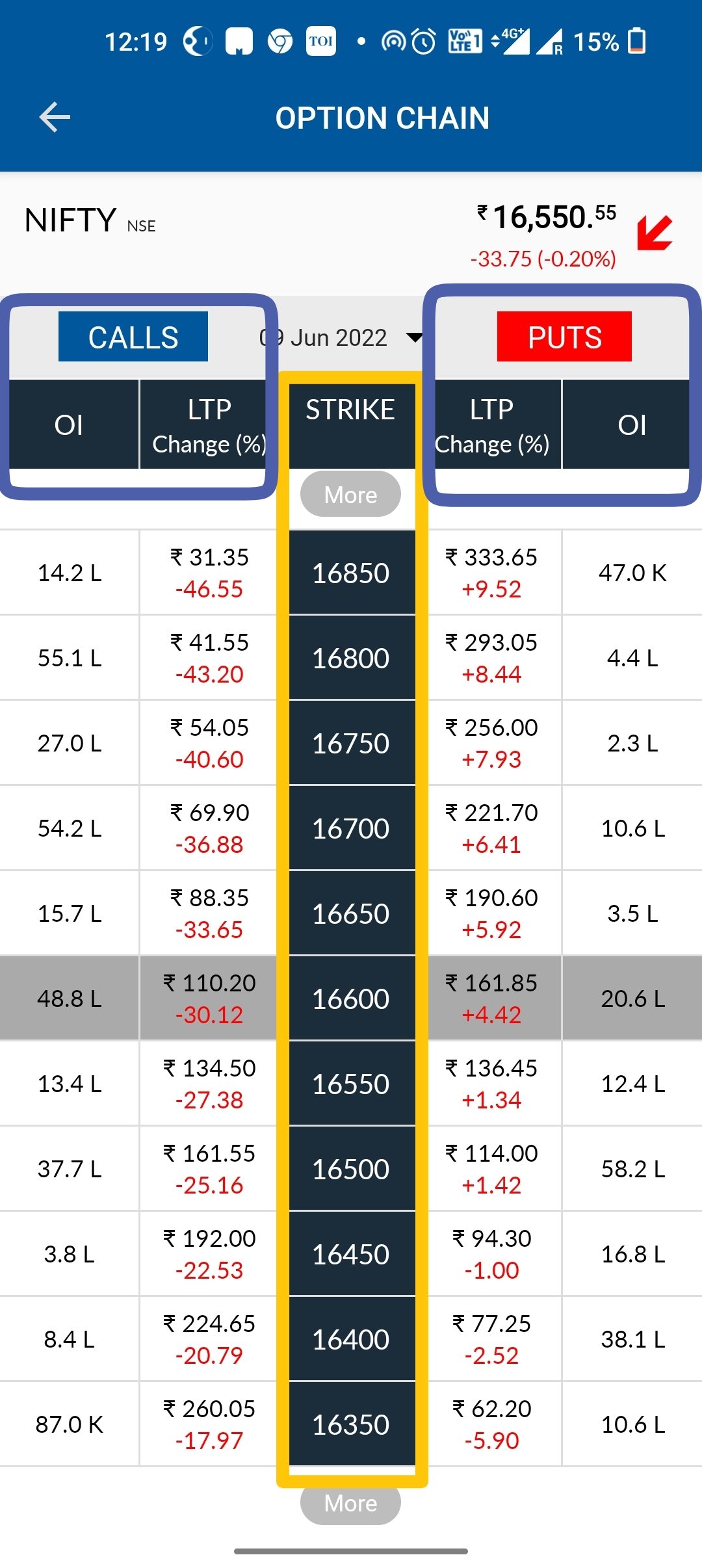

You must have heard about the Option chains.

It must look very complex, but it's very simple and useful.

In this, you will see different strikes (bordered with Orange color) 16600,16650,16700, and so on. In Nifty, strikes are available after every 50-round number.

Each strike has its own Call Option price & Put Option price.

So, on the left, you can see Prices for the Call Option, on the right you can see prices for the put Option.

So the big question is - Which strike should you trade?

You can trade in any strike as each strike has its Call price & Put price.

Now, let's do a dummy trade with some simple maths:

In the above Option chain, if you can notice Nifty is trading at 16553, so the closest strike to 16553 is 16600 (which is also highlighted in Grey color).

So, for example, you are Bullish on Nifty

So which Option you should buy? i.e. Call Option.

Now, you decided to Buy Call Option, now next step comes to choose a strike, so suppose we choose 16600 strike which is most preferable.

So the 16600 strike’s Call Option is trading at Rs.110.60.

| Option | Strike | Buy Price | Qty | Capital Req. (Price*Qty) |

| Call | 16600 | 110.6 | 1Lot (50 Qty) | Rs.5530 |

Now if the Nifty moves 100pts. Up the option price of 16600 strike will become approx. Rs.160, and you sell it.

| Option | Strike | Buy Price | Sell Price | Profit | Capital Req. | Return on Capital |

| Call | 16600 | 110.6 | 160 | (160-110.6)*50 Rs. 2470 | Rs.5530 | 45% |

But suppose you don’t have Rs.5530 margin in your account.

You can trade lower price strikes also, which are known as ‘Out of the Money’ strikes (OTM).

Suppose, in the above Option chain you choose 16800 strike for trading, whose Call option is trading at Rs. 42 (rounded off).

| Option | Strike | BuyPrice | Qty | Capital Req. (Price*Qty) |

| Call | 16800 | 42 | 1Lot (50 Qty) | 2100 |

If Nifty moves 100pts up, your 16800 strike’s Call option price will become approx 60, and you sell it.

| Option | Strike | Buy Price | Sell Price | Profit | Capital Req. | Return on Capital |

| Call | 16800 | 42 | 60 | (60-42)*50

Rs. 900 |

Rs.2100 | 43% |

So this is how you can play around strikes.

- ATM (closest to spot price): Most preferred

- OTM (low priced strikes): Trade when you have low capital

- ITM (high priced strikes): It’s recommended to avoid trading in them as they require high capital and movement is very fast in them which may hit your Stop losses.

I know it's become somewhat complex, Now it's time for a Pro tip:

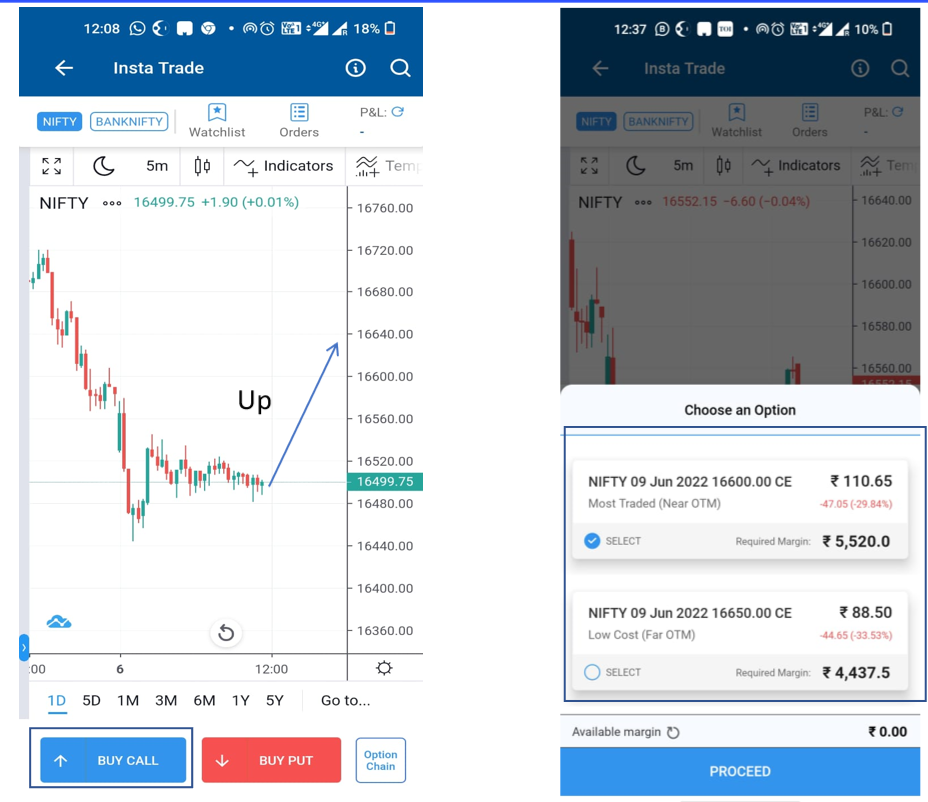

- In the Angel One app, if you visit Insta trade (on the Discover page).

- There you will get the chart to analyse and Buy Call/ Buy Put

- Buttons to trade instantly.

- Once you click on Buy Call or Buy Put, you will get two-strike suggestions, you don’t have to go to the Option chain to choose strike, you can directly choose strike from here.

- Here, you will get two strikes:

1. ATM strike - Most traded

2. Near OTM strike - Low Cost

Just select any one of them and proceed to place your order.

Try Insta Trade

The easiest Options Trading platform! Get Charts, Watchlist, Positions & live P&L in single screen

Also Read More about Options Trading Basics - Part 2