No matter how much you invest and in what instruments, there comes a time when you want to withdraw funds from your trading account. This process of transferring funds to a registered bank account is known as Funds Payout. In this article, we answer some of the key questions that users may have related to withdrawing funds from their Angel One account.

When will the funds be credited to my account once I have placed a funds payout request?

In Angel One, funds payout requests are processed twice a day for the convenience of traders. We will process your funds payout request as per the timeline given below.

| Days | Payout Request Time | Funds Credited By (approx) |

| Monday to Friday | 12:00 am – 07:00 am | 11:30 am, Same Day |

| 07:00 am – 05:30 pm | 11:30 pm, Same Day | |

| 05:30 pm – 12:00 am | 11:30 am, Next Working Day |

Suppose you have ₹1000 in your withdrawable balance on Monday.

- If you place a withdrawal request of ₹500 on Monday 11 am (i.e. between 7:00 am to 5:30 pm), your request will be processed at 5:30 pm, and you will receive credit by 11:30 pm.

- If you place a withdrawal request on Monday at 6 pm (i.e. between 5:30 pm today and 7:00 am of the next working day), your request will be processed at 7:00 am on Tuesday, and you will receive funds in your account by 11:30 am on Tuesday.

Please Note:

- Angel One will process payout requests only on settlement days. After you place a request, funds will be credited according to the payout cycles as above.

- Any request received after the cut-off time/day will be processed on the next settlement/working day.

- Payout requests and credits will not be processed on Saturday, Sunday, and on NSE Clearing Holidays (Maharashtra Bank Holidays).

Why is my withdrawable balance zero or not matching my trading account balance? You have unsettled balances in your account. It can happen because of the following reasons:

- For delivery sell transactions: You can withdraw the amount on T+1 day (Next working day).

For example – You have a ₹1000 delivery sell transaction on Monday. You can withdraw these on Tuesday. So on Monday, you will see withdrawable balance as zero and unsettled balance as ₹1000..

- Funds received from exiting F&O positions can be withdrawn on T +1 day (next working day).

For example – You have a ₹1000 F&O sell transaction on Monday. You can withdraw these on Tuesday. So on Monday, you will see the withdrawable balance as zero and the unsettled balance as ₹1000.

- Funds that you have added during the day can be withdrawn on the following day.

For example, if you added ₹1000 on Monday, you will still be able to see the withdrawable balance as Zero on Monday. Say you add ₹500 on Tuesday. Your withdrawable balance will be ₹1000 (which you had added earlier that day. The ₹500 of today will not be visible in your withdrawable balance).

I added funds to my account today, but I am not able to withdraw them today. Why?

Funds added cannot be withdrawn on the same day. They can be withdrawn only on T+1 day (the next working day) onwards. For example, if you added ₹10,000 on 22-Nov-22, then you can withdraw it only on 23-Nov-22. Please Note: If you have added funds through Net Banking/Payment Aggregator, you can place a withdrawal request only after the funds are settled through the banking channel.

I have placed the withdrawal request, but my trading balance has not been reduced why?

Kindly check if the next payout cycle has started yet. If not, the withdrawal request will be processed only once the payout cycle has started. Overall, the withdrawal process also takes the minimum processing time. Until the payout cycle starts, you can still trade assets using the entire available balance, even if you have placed a withdrawal request. For example, you have ₹1000 in your account and have placed a withdrawal request for the entire amount. But the amount has not been withdrawn yet, while the stock market has already opened. At this point, say you buy a stock worth ₹200 – so ₹200 is used up while ₹800 remains. Therefore, when the withdrawal happens, only ₹800 will be withdrawn. The remaining ₹200 withdrawal will be executed once the account again has ₹200 or more.

Why have I received only a partial amount against my funds payout request?

You have received partial funds against your withdrawal because of either of the following reasons:

- Margin requirements

- Initiated new trade

- Accrual charges

For example: Assume you have ₹1000 as a withdrawable balance at the beginning of the day i.e. 9:00 am. And you have placed a funds payout request of ₹1000. After placing the request, you entered into an intraday trade and suffered a loss of Rs. 100 (including Brokerage, Taxes, and other statutory charges), leaving your clear ledger balance to be ₹900. Hence, when your withdrawal request is processed, you will receive ₹900 in your account and not ₹1000. In this case, the loss of ₹100 due to the intraday transaction modified the amount you received. Similarly, if there is any change in the margin requirements or any accrual charges that need payment, you will receive only a partial amount.

Why is my funds payout request rejected?

Your withdrawal request can be rejected for the following reasons:

- You have entered a new trade

- The margin requirement has changed

- Inadequate balance in your account

I have sold the shares from my Demat account. When can I transfer the funds to my bank account?

As per the settlement cycle, you can place funds withdrawal requests on the following days. For delivery sell transactions and F&O transactions, funds payout requests can be placed on T+1 day (Next working day).

I have made a BTST (Buy Today, Sell Tomorrow) trade. When can I place a funds payout request?

In BTST transactions, withdrawal requests can be placed on T+1 day (The next working day) after the selling transaction is executed.

I have 2 bank accounts. I want to receive funds from my secondary bank account. What should I do?

While withdrawing, Angel One gives you the option to select a bank account in which you want to receive the funds. The amount will get credited to the bank account you have chosen.

I have placed multiple withdrawal requests. Why was only one request processed at a time?

If you place multiple withdrawal requests with different bank accounts within the payout cycle, the system will process only one bank’s withdrawal request at a time. The other withdrawal requests will remain pending until the next payout processing cycle. For example:

- If you place a withdrawal request on Monday at 11:00 am for Bank A and at 12:00 pm for Bank B (i.e., between 07:00 am and 05:30 pm), only one of the payout requests (i.e., either Bank A or Bank B) will be processed at 05:30 pm and credited to your account by 11:30 pm.

- The payout request of Bank B will be processed in the next payout cycle (i.e., on Tuesday at 7:00 am) and credited to your account by 11:30 am on Tuesday.

Before you leave, let us go over the entire funds payout process.

Withdrawal of Funds from Your Angel One Account

With Angel One, you can easily place a funds payout (withdrawal) request on our platform and receive it directly in the bank account linked to your trading account. The benefits of using an Angel One trading account are:

- You can attach multiple bank accounts with the correct bank details.

- No restriction as to receiving funds only in your primary bank account. You can receive money in your selected bank account.

Before making funds withdrawal requests, you must check the “Withdrawable Balance” in your account. You should also know that the “Withdrawable Balance” may be less than the “Funds” available as a portion may be withheld against

- Margin requirements

- Brokerage charges

- Other statutory charges, etc.

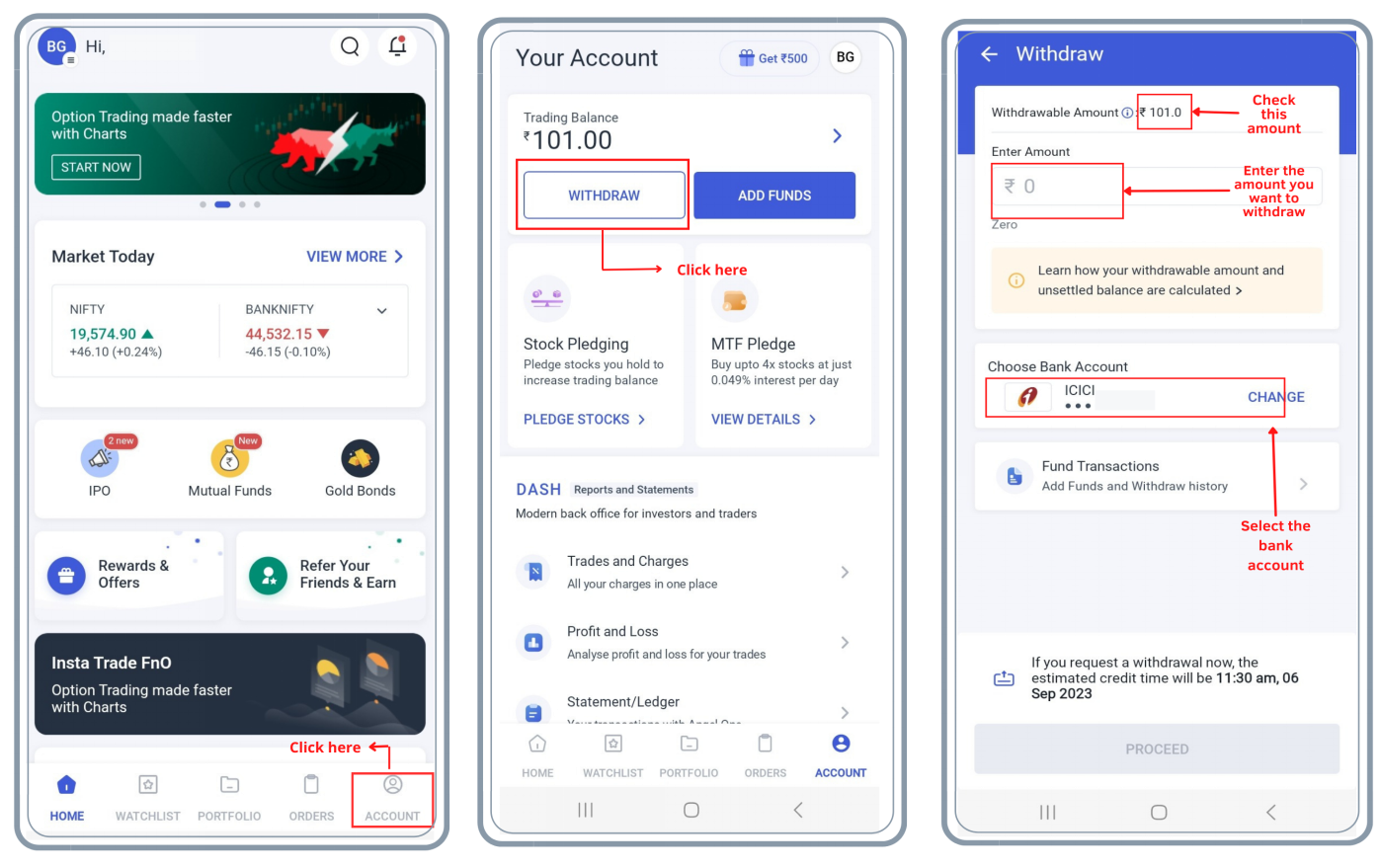

The funds payout process with Angel One is entirely digital and straightforward. Follow the below steps to withdraw funds.

- Go to the ‘Account’ section after logging in

- Click the ‘Withdraw’ button

- Enter the amount you want to withdraw from the withdrawable balance and click the bank to which you want the money to be withdrawn.

- Click ‘Proceed’ to submit the request

Figure 1: Process of withdrawal of funds

Figure 1: Process of withdrawal of funds

When can I place a withdrawal request in case of sell transactions?

As per the settlement cycle, you can place a funds payout request on the below-mentioned days.

- For delivery sell transactions, a payout request can be placed on the T+1 day (next working day).

- For F&O transactions, fund payout requests can be placed on T+1 day (next working day).

For example, you have sold equity shares of ABC Limited on Monday. In that case, your funds will be released on T+1 day (The next working day), i.e. Tuesday, assuming that there are no trading holidays between Monday and Tuesday. So, you will be able to place the funds payout request on Tuesday.

What are the different types of balances that you should look at?

Withdrawable balance – The total available balance in your account that can be withdrawn from your bank account is the withdrawable balance. The withdrawable amount can differ from the total trading balance shown in your trading account. Unsettled balance - If a user earns a profit today and tries to withdraw the amount today, even though the amount from all the transactions has not been settled yet, then this amount is counted as an unsettled balance. Total balance – The total balance can be found by adding the withdrawable balance and the unsettled balance – it is the total amount that the user is entitled to at that point in time.

Update your bank account details

IFSC codes and account numbers have been changed for several banks due to the recent mergers. For example, the Oriental Bank of Commerce & United Bank of India merged with the Punjab National Bank and more. So, if your bank has recently merged or amalgamated, then please make sure that your account number and IFSC code are updated on our app. The old IFSC code will not be valid for any of the online transactions. For some of the users account numbers might have been changed too. So, to continue enjoying hassle-free pay-ins/payouts with Angel One, you need to ensure that your bank details, like IFSC code, account number, etc., are correct. You can do so online by visiting the profile section of our app. Check the below table to know if your bank is on the list of merged banks.

| Merged Banks | Acquired by |

| Andhra Bank | Union Bank of India |

| Corporation Bank | |

| Oriental Bank of Commerce | Punjab National Bank |

| United Bank of India | |

| Allahabad Bank | Indian Bank |

| Syndicate Bank | Canara Bank |

| Vijaya Bank | Bank of Baroda |

| Dena Bank | |

| State Bank of Bikaner and Jaipur | State Bank of India |

| State Bank of Hyderabad | |

| State Bank of Mysore | |

| State Bank of Patiala | |

| State Bank of Travancore | |

| Bharatiya Mahila Bank |

How can I check the status of my withdrawal request?

You can easily check the status and other details of your requests for withdrawals as well as other transactions. To do so, visit the “ACCOUNT” section of the app, go to the section named “VIEW FUNDS TRANSACTION DETAILS”, and then view the “Funds Withdrawn”. Under the Funds Withdrawn section, you can click on any of your withdrawal requests and view its details, such as the status of the request and the expected credit time of the requested amount in your bank account.

Figure 2: Transaction details (left) and section individual withdrawal details section (right)

Can I cancel my withdrawal request?

Yes, if the payout cycle has not started yet, you can cancel your withdrawal request. For example, if you made a withdrawal request at 6:30 am on a Monday morning, you can easily cancel it at 6:50 am because the payout cycle does not start until 7:00 am on Mondays. You can check from the above table when Angel One's payout cycles are effective. For non-traded users, the processing of the request for funds withdrawal starts within a few minutes of the placement of the request. However, you can still cancel the request if you can send your request for cancellation within that time window.

Regarding your funds payout rejection and limit updation?

AOL shall endeavour to give the payout rejection effect in ledger within T+1 Working day. Kindly know that trading limits or withdrawable balances in such a case will reflect within T+2 working days only after the payout rejection information is shared by the bank.

Conclusion

Transferring funds from your trading account to your bank account is hassle-free and convenient with Angel One. However, to avoid rejection, check the withdrawable balance and adhere to the timeline above before placing a withdrawal request. Click on the embedded links to withdraw funds instantly through our app or web platform. If you have any further problems, check out our