The IPO boom of 2021 shed a spotlight on the anchor investors when the share prices of a few of the newly listed companies hit a low after the expiry of the lock-in period for anchor investors. With the new SEBI guidelines for anchor investors from 1-Apr-22, it is time for you to know who are anchor investors? What role do they play in an IPO? What are the new SEBI guidelines for them? Read along to find the answers to all the questions.

Key Takeaways

- Anchor investors are marquee entities like Mutual Funds and Pension Funds who commit at least ₹10 crore.

- The participation of angel investors serves as a "quality seal," signaling to the market that the IPO is a sound investment.

- They absorb up to 60% of the institutional quota, and this massive upfront commitment helps stabilize the stock price during the listing phase.

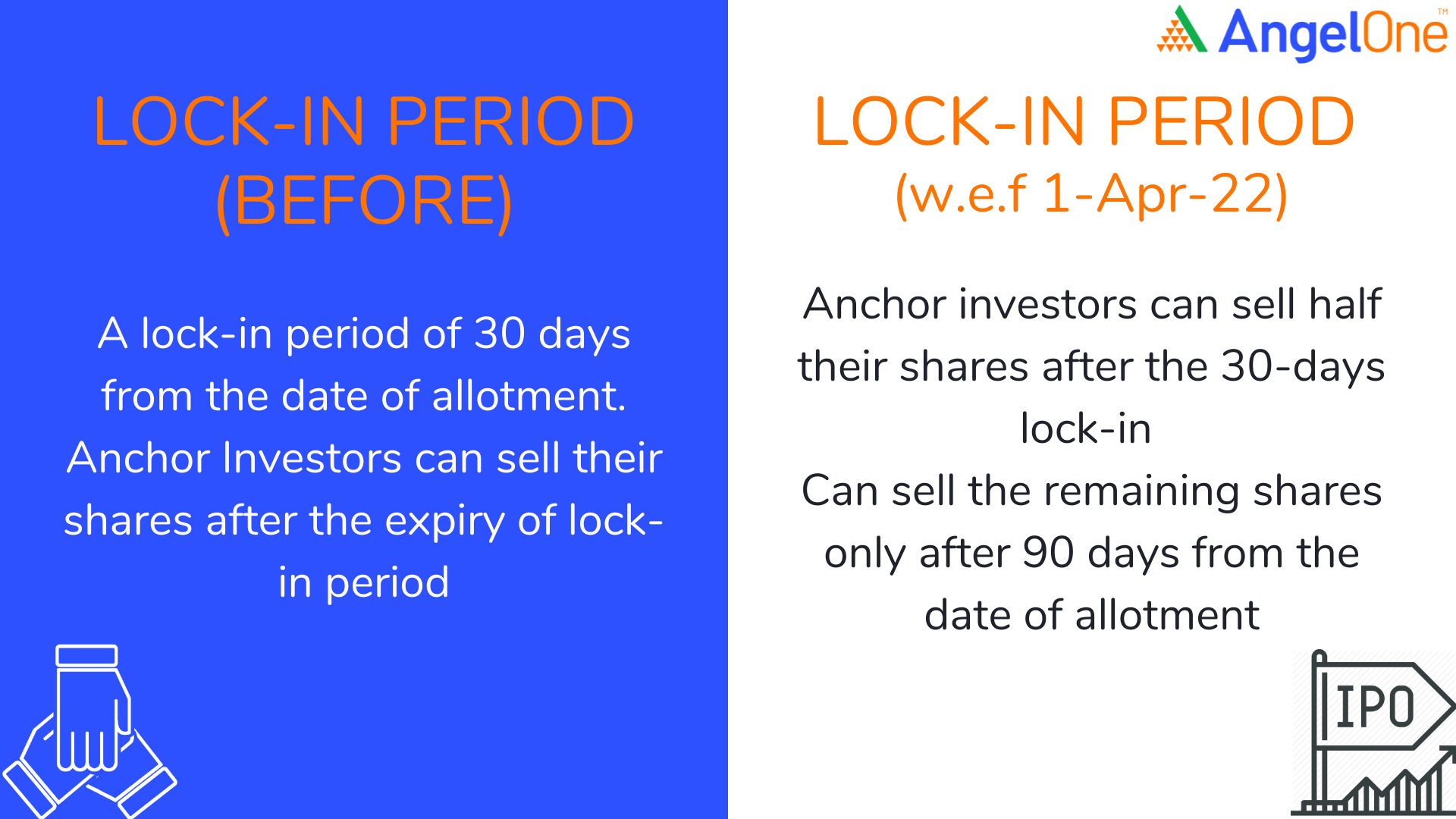

- Investor exits were staggered by SEBI's revised norms, thereby reducing sharp price movements from the initial listing period.

Who are anchor investors?

Anchor investors are the qualified institutional buyers who are offered shares in an IPO just before the IPO opens for the subscription. As the name suggests, they are supposed to ‘anchor’ the issue by agreeing to subscribe to shares at a fixed price to increase retail investors’ confidence in the demand for the shares offered. They act as a bridge between the issuing company and the public.

Purpose And Role of Anchor Investors in IPOs

Anchor investors critical stabilising factor when companies are going into the market. Anchor investors strengthen market sentiment by buying early at the fixed anchor price, signalling credibility in the company’s valuation. Their show of trust and financial strength helps the issuer set a fair issue price and generates steady demand for the IPO.

Things to know about Anchor Investors

- Anchor investors were introduced to financial markets in 2009 by SEBI

- Each anchor investor has to invest a minimum of₹10 crores for the issue.

- Anchor investors are allowed up to 60% of the issues’ portion available for Qualified Institutional Bidders (QIB).

- They have to buy the shares at a price fixed by the company.

- The allotment price for anchor investors will be within the price band.

- If the price fixed during the book-building process is more than the price at which the allocation is done to anchor investors, they need to pay the price difference.

- If the book building price is less than the price at which the allocation is done to anchor investors, they will not get back the price difference.

- The company allots the shares at a fixed price to the anchor investors only a day before the IPO.

- There can be a minimum of 15 anchor investors if the offer is less than ₹250 crores. If the offer size is more than ₹250 crores, the number of anchor investors can be increased to 25.

Lock-in period for Anchor Investors

Anchor investors in India have a lock-in period from the date of IPO allotment during which they can’t sell their shares. The lock-in period for anchor investors is as follows:  source: SEBI Keeping the shares locked in prevents the volatility in the share prices soon after listing. However, the prices of a few shares witnessed a record low immediately after the expiry of the lock-in period of 30 days in the year 2021 due to the exit of anchor investors, creating a panic among the retail investors. Thus, SEBI introduced a new norm where anchor investors can only sell half of their shares after 30 days and the remaining shares can be sold only after 90 days.

source: SEBI Keeping the shares locked in prevents the volatility in the share prices soon after listing. However, the prices of a few shares witnessed a record low immediately after the expiry of the lock-in period of 30 days in the year 2021 due to the exit of anchor investors, creating a panic among the retail investors. Thus, SEBI introduced a new norm where anchor investors can only sell half of their shares after 30 days and the remaining shares can be sold only after 90 days.

There is no doubt about the role of anchor investors in instilling confidence about an IPO among general investors. But it is also to be borne in mind that all investors have their own rationale, horizon, and expectations from their own investments which hold true for anchor investors as well. Hence as a common investor, you may use the anchor investment only as a guiding star for investment consideration, but the final decision has to be based on your own risk appetite, return expectations, and time frame. Disclaimer: "This blog is exclusively for educational purposes and does not provide any advice/tips on Investment or recommend buying and selling any stock" and "Angel One Ltd. is just acting as the distributor of the IPO".

Types of Investors in an IPO: Who CUnderstanding QIBs, NIIs, and RIIs

To understand anchor roles, one must first understand what type of investors in IPO are. Three main types of investors determine the level of demand and price for an IPO.

-

Qualified Institutional Buyers (QIBs).

Large financial institutions (such as mutual funds, insurance companies and pension funds) are typically considered QIBs and are relied upon for their expertise. Anchor investors are part of this group.

-

Non-Institutional Investors (NIIs)

Often high-net-worth individuals, NIIs invest sizeable amounts but operate without institutional advantages.

-

Retail Individual Investors (RIIs)

Every day, investors who apply with smaller amounts receive a reserved quota in most issues, completing the mix of types of investors in IPO structures.

Benefits of Anchor Investors in IPOs

Stronger Market Credibility: When respected institutions take a stand as an anchor investor, their presence is usually noticed by the market. Their early backings are almost equivalent to a public vote of confidence, which gives the impression that the firm has been vetted and displays real potential, not mere hype.

Clearer Pricing & Reduced Volatility: Their participation helps the issuer arrive on a practical and defensible price range. This tends to hold the stock steadier on listing day and not subject the stock to wild swings that are often feared by new investors.

Early Demand Boost: Often, these initial promises act as a spark to attract more attention from retail buyers who are more comfortable following experienced players.

Reassurance for Retail Participants: Most first-time investors look to anchor investors as a gauging point. Seeing serious institutional money already committed gives them confidence that the offer is not a blind gamble.

How Anchor Investors Impact the IPO Subscription

Guiding the Initial Price Setting: In the early stages of the IPO Process, anchor investors often help shape what becomes the reference price for the issue. Their valuation input acts as a practical benchmark for QIBs, NIIs, and retail buyers that reduces the chances of dramatic price swings once the stock hits the market.

Boosting Market Confidence: Their presence sends a clear signal that the offering has already earned trust from serious institutions. This tends to make the IPO more appealing to everyday investors who might otherwise hesitate.

Driving Higher Subscription Levels: Because anchor investors create early traction, the issue often gains momentum quickly, sometimes leading to oversubscription when the sentiment is upbeat.

Stabilizing Prices After Listing: With the mandatory 30-day lock-in, their continued holding adds a layer of stability during the volatile opening phase of the IPO Process, limiting sharp, sudden price movements.

Who Can Become an Anchor Investor?

Mutual Funds: These fund houses pool money from lakhs of investors and often step in early because they can quickly evaluate whether an issue matches their strategy.

Pension Funds: Long-horizon investors that look for steady, dependable opportunities, making them natural candidates to act as anchor investors in IPO when a company shows solid fundamentals.

Banks: Banks with investment or treasury arms frequently participate, relying on in-house research teams and direct market insight.

Insurance Companies: Large insurers diversify into promising sectors and use IPOs to balance long-term portfolios.

Anchor Capital and Pricing: How Anchor Investors Influence the IPO Price

Anchor investors in IPO can also pre-commit large sums of money prior to the issue going live, thus enabling the underwriters to refine the price range, sample actual interest in the shares, and prevent over-valuations.

Their orders create an effective reference point pushing final pricing to levels serious, long-term institutional investors feel comfortable with in live trading.

How Do Companies Select Anchor Investor in India

Screening: The issuer and its bankers quietly filter through a list of seasoned institutions, checking how they’ve handled past offerings and whether their expertise fits the sector.

Allocation Invitation: Only a few are approached, typically those whose participation can add weight to the offer because of their proposed investment size and market standing.

Independent Assessment:Anchor investors pore over the prospectus, drill into the numbers, and decide whether the story behind the issue holds up.

Anchor Allotment: If they move ahead, their shares are allotted at the agreed price a day before the public bids open, giving the issue a steadier launchpad.

Conclusion

A well-structured IPO depends heavily on the early participation of strong institutional backers, and their involvement shapes everything from pricing to investor sentiment. Their capital provides stability when the issue enters the market, and the staggered lock-in norms introduced by SEBI have further strengthened that stability by limiting abrupt exits.

While anchor investors in IPO offer useful signals about demand and valuation, retail investors should treat their participation as just one indicator rather than a guarantee of returns.