Robo orders are types of intraday orders that are automated to minimise and manage risk based on pre-defined order entry, target and stop-loss levels. They assist traders in making their trades in a systematic way without constantly monitoring the markets. By automating exits and reducing losses to a minimum, robo orders assist in disciplined trading, reducing the ability to make such decisions based on emotions, and enhancing the consistency of trading in fast-moving intraday market situations.

Key Takeaways

-

Robo order is used only for intraday trading positions.

-

The robot orders are 3-leg intraday orders with entry, target, and stop loss legs.

-

All open robo order positions are squared off automatically at around 3:10 pm if no exits are triggered.

-

Trailing stop-loss moves in fixed LTP jumps and in a favourable direction only.

What is a Robo Order?

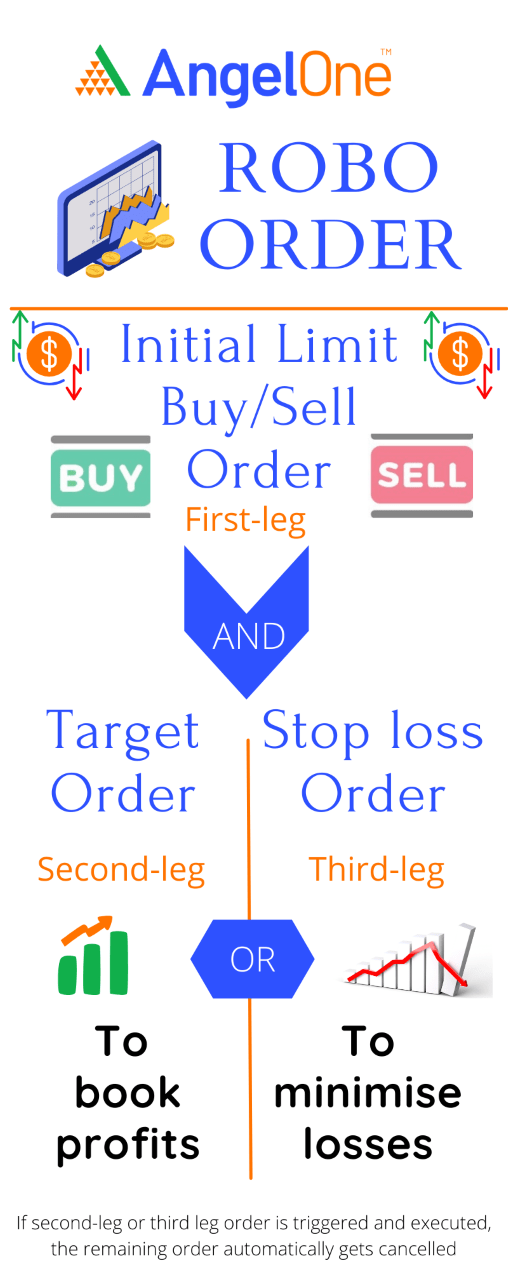

A Robo order is a multi-leg order used in intraday trading that allows you to place two more orders along with your initial order. Among the other two orders, one of the orders is to set returns at the specified price and the other is to minimise losses at a trigger price.

Important features of Robo Order

- Robo order can only be placed in Intraday trading

- It is a 3-leg order that includes an initial Buy/Sell Limit Order followed by a Target order and a Stop loss order

- Saves your time as you need not keep a tab on market movements all time. Just place your orders and get back to your work.

- Effective in minimising losses with Trailing stop loss feature

How do Robo Orders work?

Robo order works as follows:

| Case 1: | Case2: |

| If the initial order is a Buy order, then both the Target and Stop-loss orders should be Sell orders. | If the initial order is a Sell order, then both the Target and Stop-loss orders should be Buy orders. |

|

For instance, if you are buying the shares of Company XYZ at ₹ 1000, and want to place a Robo order, let us assume you’ve placed,

Once the initial limit order is filled and any of the 2 following orders is triggered and executed, the remaining order will automatically get cancelled. In the above case,

|

For instance, if you are selling the shares of Company XYZ at ₹ 1000, and want to place a Robo order, let us assume you’ve placed,

Once the initial Limit order is filled and any of the 2 following orders is triggered and executed, the remaining order will automatically get cancelled. In the above case,

|

| Note: If your first-leg order is executed and neither the second-leg nor the third-leg order gets executed your position will get auto-squared off at 3:10 pm. | |

Note: If your first-leg order is executed and neither the second-leg nor the third-leg order gets executed, your position will get auto-squared off at 3:10 pm. However, this can vary across brokers and segments.

Also Read: What is Limit Order?

How Robo Orders Help With Risk Management

Intraday trading needs strict control of risk because of the speed of price movements. Robo orders (also called automated orders) can help to control the risk by executing predefined rules without manual intervention. They are in favour of disciplined trading where you limit your losses, lock in profits, or reduce your level of emotional decisions.

-

Setting Precise Stop-Loss Orders

Robo orders give traders the ability to set specific stop-loss orders in advance. Once the price reaches the trigger level, the order runs automatically, which helps limit losses in case of a sudden move in the market and not getting caught in delayed reactions.

-

Automating Levels of Take-Profit

Robo orders allow predefined levels of profit. If the price reaches the set level, the order will be executed automatically, and gains would be made without having to monitor the market constantly.

-

Maintaining Consistent Risk-Reward Ratios

Traders can predefine ratios such as 1:2 or 1:3. Robo orders are used to execute trades strictly according to such rules to allow consistency in the trading and avoid deviation from planned risk parameters.

-

Reducing Human Error

Manual trading is susceptible to human biases, lack of energy and delays. Robo orders are based on algorithm-based instructions, which reduces errors while performing the execution and ensures that the trade is executed as per the instructions.

-

Adapting to Market Conditions

The good robo orders can have a trailing stop loss in them. These dynamically adjust the level of a stop loss as prices move favourably to help protect profits and manage the downside risk.

-

Supporting Diversified Strategies

Robo orders let us execute multiple trades simultaneously. This distribution of exposure ensures the risks of concentration are reduced, and better risk management is achieved in volatile intraday markets.

Trailing Stop loss in Robo Orders

The Robo Order comes with a unique feature of trailing stop loss, where you can trail your losses to minimise the losses and generate the possible returns out of every trade by setting a LTP Jump Price. Case 1:For example, if you are buying a scrip ‘X’ at a limit price of ₹ 100 with a Stop loss Sell order placed at ₹ 90 and target price at ₹ 110, and if you have set a LTP jump price of ₹ 2, then for every ₹ 2 rise in Last Traded Price (LTP), Stop loss Sell order trigger price will jump by ₹ 2.

- In the above case, if LTP becomes ₹ 102, the trigger price for Stop loss sell order will jump to ₹ 92 and so on.

- However, the stop loss remains unchanged if the LTP goes down in this case. The Stop loss trigger price remains at ₹ 90 if the LTP falls below ₹ 100.

Case 2:For example, if you are selling a scrip ‘X’ at a limit price of ₹ 100 with Stop loss Buy order placed at ₹ 105 and target price at ₹ 90, and if you have set a LTP jump price of ₹ 2, then for every ₹ 2 fall in LTP, stop loss Buy order trigger price will fall by ₹ 2.

- In the above case, if LTP becomes ₹ 98, the trigger price for Stop loss Buy order will fall to ₹ 103 and so on.

- However, the stop loss remains unchanged if the price goes up in this case. The Stop loss trigger price remains at ₹ 105 if the LTP rises above ₹ 100.

Robo orders give you all the convenience you are looking for in Intraday trading. Now that you know how to place Robo orders, relax and enjoy your Intraday trading journey. Happy trading!!

Common Pitfalls to Avoid With Robo Orders

Robo orders make order execution easy, but should not be considered a completely hands-off option. Overdependence with no monitoring might result in less than optimal results. Traders periodically need to check the order conditions so that they can match the trading conditions.

Poor Robo orders can be made in the markets with high volatility or low liquidity. In the case of sudden and sharp price movements or in case of a flash crash, stop loss or target orders may not be able to be executed at anticipated prices due to slippage. Liquidity conditions being ignored with unrealistic stop-loss levels can increase risk. Periodical evaluation and conservative parameter setting are a must.

Conclusion

Robo orders are useful for helping intraday traders implement disciplined risk management, such as triggering stop-losses, profit targets and execution rules automatically. They minimise emotional influences and procrastination of execution and promote uniform trading strategies. However, in order to be effective, the use must be realistic, and there must be regular monitoring and an understanding of market conditions to avoid unintended risks.