PAN issued by the Income Tax Department is a centralised system to store tax-related information about individuals or corporations. As the data is stored against a single number, the PAN card number is unique for all.

In India, all individuals and non-individual entities require a PAN card to participate in and avail of financial services. However, you must check the eligibility criteria before applying for a PAN to ensure the application isn't rejected. This article discusses PAN card eligibility, age, and documents required for applying for a PAN card.

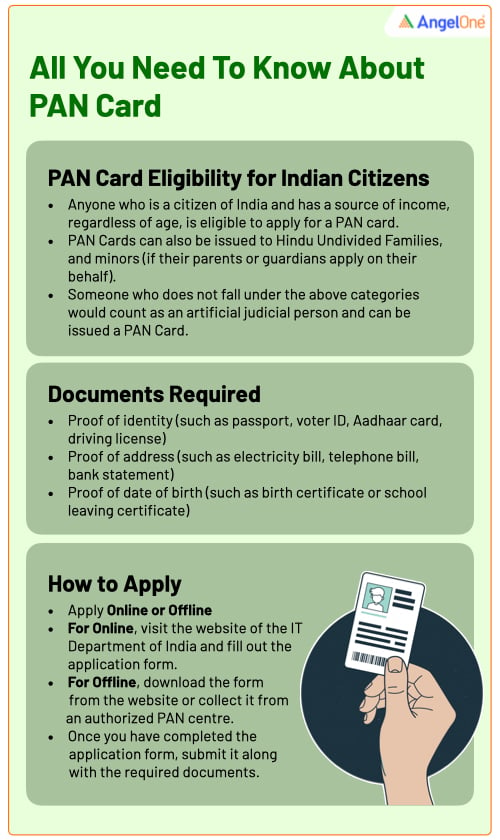

PAN Card Eligibility for Indian Citizens

According to the Government of India, the following individuals and entities need PAN cards to participate in financial activities.

Individuals: Indian citizens can apply for a PAN card by submitting essential documents, such as identity proof, proof of date of birth, and address proof.

Hindu Undivided Family (HUF): A PAN card can be issued in the name of the head of the HUF. By presenting documents like proof of identity, date of birth, and address proof, a HUF can apply for a PAN card. Additionally, they must also provide their father's name, names and addresses of coparceners, and an affidavit mentioning all the details.

Minor: Minors can't apply for a PAN card. However, the parents of the minor child can apply on behalf of the child. PAN cards for minors are mandatory if they are a nominee for a property or their parents want to make investments for them.

A person with a mental disability: A representative of a mentally challenged individual can apply for a PAN card on their behalf.

Artificial Juridical Person: If an assessee doesn't fall under any of these categories, it is considered an artificial juridical person. These individuals can apply for PAN cards by submitting their government registration certificate.

Here is a list of documents required to apply for a PAN card.

Identity proof: The approved list of identity proof documents includes:

- Passport or Person of Indian origin (PIO) card

- Taxpayer Identification Number (TIN) or Citizen Identification Number (CIN)

- Attestation from the country’s consulate or an authorised official of an overseas scheduled Indian bank branch

Address proof: The following documents can be submitted as address proof:

- Passport/Overseas Citizen Of India (OCI)/Persons of Indian Origin(PIO)

- Ministry of External Affairs or Embassy-approved TIN or CIN

- Bank account statement

- Non-Resident External (NRE) Account Statement

- Certificate of Registration

- Residential Certificate

Pan card age limit:

- The minimum age for a PAN card is 18 years

- Parents of a minor can also apply on behalf of the child

- There is no upper limit to applying for PAN

Eligibility Criteria for Indian Companies

Indian companies, trusts, partnership firms, limited liability partnerships, etc. can also apply for PAN cards. Here is a list of entities that are eligible to obtain a PAN.

Companies: Indian companies registered with the state Registrar of Companies can also obtain PAN cards by producing the necessary documents and certificates from the state registration office.

Local Authorities: Local authorities, including local governments, can also get PAN cards.

Limited Liability Partnership (LLP): LLP firms can apply for PAN cards. They must provide the certificate issued by the Registrar of LLPs.

Partnership firms: Indian partnership firms must submit their registration copy issued by the Registrar of Firms or a copy of their partnership deed to apply for PAN cards.

Trusts: Trusts that are responsible for paying income tax can also obtain PAN cards from the government. They need to submit a Certificate and Deed of registration number issued by the charity commissioner.

Association of Persons: Associations need to submit their registration certificate while applying for a PAN card.

PAN Card Eligibility for Foreign Citizens

Foreign citizens who want to conduct financial transactions in India must also apply for PAN cards. They need to fill out Form 49AA and submit all necessary documents to complete the process.

Foreign candidates must satisfy the following eligibility criteria:

Proof of Identity

- Passport, Person of Indian Origin, or Overseas Citizen of India certificate

- Taxpayer Identification Number or Citizen Identification Number

- Attention from the country’s consulate or by an authorised official of an overseas scheduled Indian bank branch

Proof of residence

- Passport/OCI/PIO

- TIN and CIN issued and attended by The Ministry of External Affairs or the Indian Embassy

- Bank account statement

- Non-Resident External Account Statement

- Certificate/Permit of residency issued to foreign individuals by police authorities

- Registration certificate containing Indian address issued by the Foreigner’s Registration Office

- Copy of visa grant or letter of appointment

- Letter issued by Indian employer as proof of address

Who Does Not Need a Pan Card?

Indian individuals, companies, foreign individuals, and foreign companies need to obtain a PAN card if they intend to participate in financial activities. However, there are certain categories of people exempt from the mandatory PAN card requirements.

- Minors who are not receiving any income and are not liable to pay income tax

- Non-Resident Indians don't need PAN cards for specific transactions

- Individuals whose income is below the income tax threshold. They can produce Form 16 instead of PAN cards for investing in mutual funds.

Final Words

A PAN card is a mandatory document necessary for tracking cash inflow and outflow as well as tax compliance. Equipped with the knowledge of PAN card eligibility and the PAN card age limit, you can now apply for your PAN card.