The cost of living has shot up due to rising inflation. In a world where inflation has resulted in individuals fretting even over short-term financial goals, the retirement planning process can prove daunting. The question lingers in the mind constantly - Will I accumulate enough funds to enjoy a stress-free retirement?

The first step in retirement planning would be to estimate the retirement corpus. This will help materialise your goals by assigning your dreams a numerical value. The retirement corpus is calculated by considering various factors such as current age, current savings, investment horizon, retirement age, expected rate of return, etc.

Before understanding the calculation, let us know the meaning of retirement corpus:

What Is Retirement Corpus?

Retirement corpus can be defined as the sum of money required to be accumulated by an individual to financially support themselves throughout the retirement period. It is important to have a retirement corpus as it helps to maintain the desired standard of living after you stop working.

How To Calculate Retirement Corpus?

The following steps illustrate the process of calculating retirement corpus:

Step 1: The List the Assumptions

Assumptions are to be made for the following aspects:

| Aspects | Figures (examples) |

| Current Age | 35 |

| Expected Retirement Age | 62 |

| No. of years left till retirement | 27 |

| Life expectancy | 80 |

| No. of years after retirement | 18 |

| Expected rate of return

(during accumulation) |

15% |

| Expected rate of return

(after retirement) |

9% |

| Inflation rate | 6% |

| Inflation-adjusted return** | 2.83% |

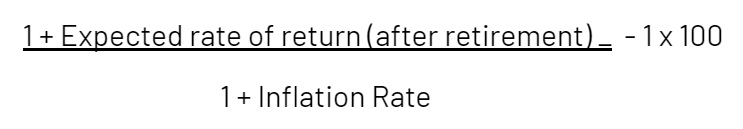

** Formula for inflation-adjusted return:

You can write down these assumptions either on a sheet of paper or digitally on an Excel sheet. Once these assumptions are made, we go to the next step:

Step 2: Estimation of Expenses After Retirement

To maintain your standard of living after retirement, an estimation of expenses is required. To calculate this, we apply the rates of inflation to the present expenses required to maintain the basic lifestyle.

For example, your current monthly expenditure amounts to ₹50,000 per month. This annually sums up to ₹6,00,000. Assuming that the current rate of inflation is 6%, you can estimate the annual expenses after retirement using the Future Value formula in the Excel sheet.

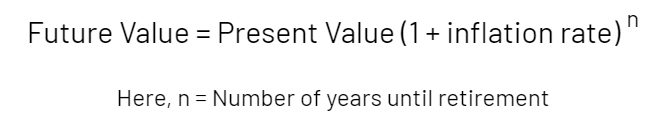

The formula for calculating the future value is as follows:

Thus for calculating the inflation-adjusted annual expenses at retirement (x),

X = 600,000(1+0.06)27

X = ₹34,46,094

The inflation-adjusted annual expenses at retirement amount to ₹34.46 lakh.

| Figures ( in ₹) | |

| Current annual expense (₹) | ₹6,00,000 |

| Inflation rate | 6% |

| Inflation-adjusted annual expenses at retirement | ₹34.46 lakh |

Step 3: Calculation of Retirement Corpus

After estimating various values and figures, we can finally calculate the amount required to create the retirement corpus. The sum we arrive at in this step should be used as a benchmark for creating a strong retirement corpus that can take care of your financial needs after retirement.

To calculate the final amount, we calculate the present value of total expenses for the number of years after retirement. For this, you may use the present value formula in your Excel sheet.

Present Value = Future Value / (1 + r)^n

Here,

Present Value = (required retirement corpus)

Future Value = (future annual expenses after retirement)

r = Inflation-adjusted return rate (expressed as a decimal)

n = Number of years after retirement

Thus, the retirement corpus (y) can be calculated as follows:

y = 34.46 / (1+0.0283)18

y = ₹20,16,835.50

The retirement corpus amounts to approximately ₹20.17 lakh.

| Figures (in ₹) | |

| Expense at retirement (FV) | ₹34.46 lakh |

| No of years after retirement | 18 |

| Inflation-adjusted return | 2.83% |

| Retirement corpus amount required | ₹20.17 lakh |

Step 4: Calculating the Monthly Contribution

After finding out the total amount of the target corpus, we define the monthly contributions that are required to build it. On your Excel sheet, you can apply the PMT formula to find out the contribution amount.

To calculate the amount, divide the interest rate during the accumulation period (15%) by 12 and multiply the number of years to retire (27) by 12 to calculate the required monthly investment amount.

Using the PMT formula, PMT = r x PV / (1-(1+r)-n)

Here,

PMT = Monthly payment (investment)

PV = Present Value (initial investment, which is 0)

r = Monthly interest rate

n = Total number of payments (months)

Using the above formula for figures used in the example, we derive the monthly contribution; we derive that the monthly payment required at 15% of the expected rate during accumulation is ₹2,952.33 per month.

| Figures (in ₹) | |

| No of years to retirement | 27 |

| Rate of return during accumulation | 15% |

| Corpus needed on retirement | ₹20.17 lakh |

| Monthly required contribution | ₹2,952.33 |

Hacking the Calculation

Now that you know the calculation of retirement corpus, you can experiment by changing the figures of various aspects affecting the sum. However, we understand that calculating the corpus can be a tedious task, whether done manually or using the Excel sheet formulas. Extra effort is required to experiment by changing the variables.

Angel One’s retirement calculator has automated this calculation for you. In this calculator, you can easily calculate the corpus amount within minutes or even seconds! Every variable can be changed with your fingertips. This flexibility can allow you to explore various paths towards your corpus amount - different rates, different expected retirement ages, etc. Moreover, opening a Demat account with Angel One also enables you to invest in a range of market securities. Start investing for your retirement today!