The Dividend Discount Model (DDM) is one of the oldest and most conservative methods of valuing stocks. DDM is one of the basic applications of financial theory taught in any introductory finance class. According to the Dividend Discount Model, the stock is worth its price if that price exceeds the net present value of its estimated current and future dividends.

This model requires a lot of assumptions about the company’s dividend payments, growth patterns, and even the direction of future interest rates. In DDM, the net present value of future dividends is used to value stocks. The value of a stock is the sum of all of its future cash flows expected to be generated by the firm, discounted by an appropriate risk-adjusted rate. Dividends can be used to measure the cash flows returned to shareholders.

DDM Formula

Dividend Discount Model = Intrinsic Value = Sum of Present Value of Dividends + Present Value of Stock Sale Price.

In the Dividend Discount Model, the price is the stock’s intrinsic value.

The formula for DDM is:

P = D1/(r-g), where

P = Stock Price

D1 = The value of next year's dividend.

r = Constant cost of equity capital.

g = Constant growth rate in perpetuity.

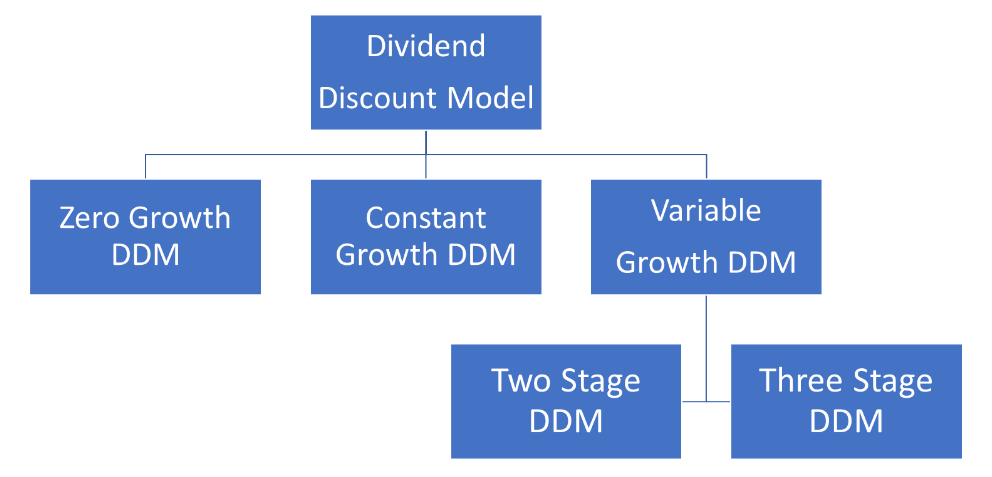

DDM Variations

Now let us try to understand the different variations of the Dividend Discount Model that are present based on their complexity.

1. Zero-Growth Dividend Discount Model

In this model, it is assumed that all dividends paid by the stock remain the same forever.

2. Constant Growth Dividend Discount Model

In this model, it is assumed that all dividends grow at a fixed percentage and are consistent. The dividend growth is believed to be constant.

3. Variable-Growth Rate DDM Model

In this model, it is assumed that the dividend growth may be divided into two or three phases, where the first one will be a fast initial phase followed by a slow transformation phase, and eventually ending with a lower rate for the infinite period.

Zero-Growth Dividend Discount Model:

According to the zero-growth model, the stock price would be equal to the annual dividends by the required rate of return as it assumes that there is no growth in dividends, i.e., the dividend always stays the same.

Intrinsic Value of Stock = Annual Dividends / Rate of Return.

Constant Growth Dividend Discount Model

It is a popular and straightforward method of the Dividend Discount Model developed by Myron J. Gordon of the Massachusetts Institute of Technology, the University of Rochester, and the University of Toronto, who published it along with Eli Shapiro in 1956 and is popularly called the Gordon Growth Model.

The model assumes that dividends grow every year by a specific percentage, and with the help of this method, one can provide a valuation of companies that give out dividends. That said, this model can assist in valuing more mature companies as opposed to rapidly growing ones, as the former would have steadily increasing dividends.

It is important to note that the constant-growth Dividend Discount Model assumes that the growth rate in dividends is constant; however, the actual dividend payout increases each year. With the help of the constant growth Dividend Discount Model, an investor can arrive at the present value of an infinite stream of dividends.

Variable-Growth Rate DDM Model

In comparison to the other two Dividend Discount Models, the variable-growth rate Dividend Discount Model is much closer to reality. This model helps in solving the problems related to fluctuating dividends and assumes that the company will experience different growth phases. A user of this model can assume that the growth rates vary each year and that variable growth rates can take different forms. That said, the most popular form is the one where three different rates of growth are assumed:

- An initial high rate of growth.

- A transition to slower growth.

- A steady rate of growth that is sustainable.

The constant growth rate model continues with each passing growth phase, which is calculated under this method by using different growth rates for the different phases. Here, the cumulative present values of each stage are used to arrive at the intrinsic value of the stock.

Two Stage DDM

This model helps in determining the value of equity in a business in the form of a dual growth stage. Initially, there is a period of faster growth, followed by a period of stable growth.

Three Stage DDM

The equity value of a business is laid out in a three-phased growth stage, where the initial one will be a fast phase, followed by a slow transition phase, and the one with a lower rate for a finite period.

Shortcomings of the DDM

There are a few drawbacks to the Dividend Discount Model. We’ll discuss them in detail here.

1. Dividend Payouts Necessity:

One of the first and foremost drawbacks of DDM is that it cannot be applied to evaluate stocks that don’t pay dividends, despite the capital gains that would be realised from investing in the stock. The DDM makes the flawless, faultless assumption that the return on investment (ROI) it provides through dividends is the only value of a stock. The DDM model only works when the dividends are expected to rise at a constant rate in the future, which makes it useless when it comes to assessing a wide number of companies. It is instrumental for usage with only relatively mature companies that have a dividend payment history and misses out on high-growth companies.

2. Too Many Assumptions:

The Dividend Discount Model is full of too many assumptions regarding dividends, as discussed in this article, including but not limited to assumptions regarding growth rates, interest rates, and tax rates; all these factors are beyond the investor’s control. Such a drawback reduces the reliability of the DDM model.

3. Buyback Ignorance:

Another drawback of the DDM is that it doesn't consider the effects of the buyback of stocks. A difference in stock valuation occurs when a company buys its shares back from shareholders. The DDM model is too conservative and doesn’t account for stock buybacks, especially in certain countries where the tax structure makes it more advantageous to do share buybacks than dividends.

Learn Free Stock Market Course Online at Smart Money with Angel One.