Portfolio performance actually defines how smartly you have invested your hard-earned money.

What is a portfolio?

Before we dive deeper into how to read your portfolio, let’s understand what a portfolio is. A portfolio gives you comprehensive, detailed information about all your holdings as well as positions, from equities to bonds.

However, manually monitoring your portfolio can be a hassle. With Angel One’s Portfolio feature, you can conveniently view and track your trades for various investment products/segments in real time.

Below are a few reasons why knowing how to read your portfolio is important.

- Helps you verify whether all your trades are correctly debited/credited

- Keeps tab on scrip-wise gains and losses

- Cumulates your gains and losses for each investment products

- Helps in making investment decisions

Various investment products for which you can see your portfolio on the Angel One app are as follows:

- Equity

- Mutual Funds

- Gold Bonds

- Bonds

- Advisory*

How to view your portfolio?

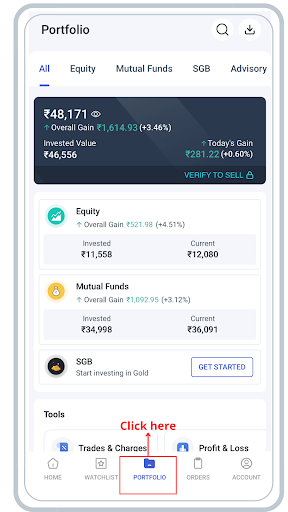

Follow the below steps to view your portfolio:

- Log in on the Angel One app

- Go to the ‘Portfolio’ section

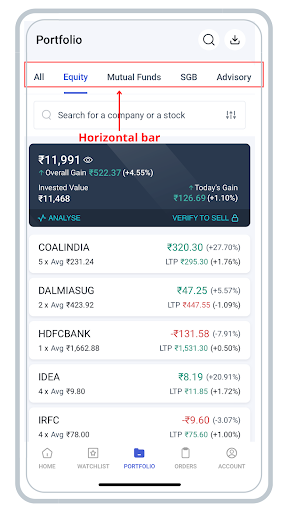

- From the horizontal bar at the top, select the segment for which you want to view the portfolio

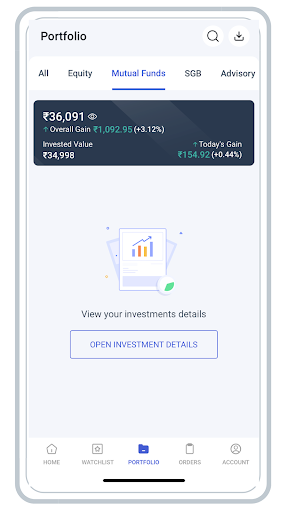

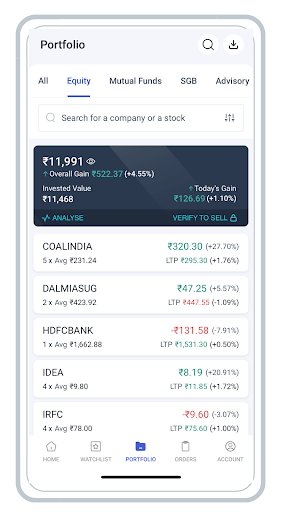

Below are the screenshots of the portfolio section on the Angel One app for Equity and Mutual Funds segments.

Disclaimer: The securities quotes are exemplary and are not recommendatory. Also, note that if you have invested in bonds, you can see them under the SGB tab.

You can now check your Super Portfolio at Angel One

We have now made it easier for you to keep track of your combined investment details through Super Portfolio. So, now you don’t have to open multiple tabs to track your investments in different asset classes. Read ‘Unveiling the Super Portfolio’ to learn more about its benefits.

Explained: Key terms mentioned in your portfolio

Now that you know why reading your portfolio is important, let us explain the meaning of key terms that will give you a better understanding of it.

- Gain/Loss

You can see two types of gain/loss in your portfolio: one is overall gain/loss for all your investments under one product and day’s gain/loss.

2. Invested Value

The amount you have invested in a particular asset, scrip, or product.

3. Current Value

The current market value of your invested amount.

4. Symbol

Symbol of the scrip.

5. Quantity

The number of units you have traded of a particular scrip.

6. Returns

Under the ‘Mutual Funds’ tab, you can see Absolute Returns and XIRR for each scheme. Absolute returns mean the amount you earn from your investment, and XIRR showcases the annualized rate of return of your investment, considering the specific dates and amounts of your purchases and withdrawals.

7. Average Price

It is the average or mean price of the security bought or sold.

8. LTP (Last Traded Price)

It is the price at which the last trade was executed.

Other features that you can take advantage of in the portfolio section of the Angel One app.

- Offers you a ‘Sort By’ feature that lets you sort your investment transactions by Symbol, Average Price, Unrealized Gain/Loss, etc.

- You can see the profit and loss report for each investment product

- For the equity segment, it gives you an ‘Increase Margin’ feature as well that allows you to take collateral margin

Conclusion

The super portfolio contains all the relevant details about your holdings and positions with Angel One under one umbrella. It includes transactions from all segments, from equity to bonds to currency. Investing is not only about parking money in various investment products, it’s also about keeping an eye on your portfolio. This is because it helps compute the profit/loss for individual investment transactions and a whole segment. Angel One has made it easier for you to access and view your portfolio with its user-friendly app. Click here to view your portfolio.

*Advisory - This includes all the investments that you have made through Investment Advisory by Angel One and other third parties.