In the world of finance and investments, understanding the fundamental concepts is crucial. Two terms that often come up in discussions about stocks and companies are "market cap" and "equity." These terms play a significant role in assessing a company's financial health and performance.

In this article, we'll explore what market cap and equity are, how they differ, and why they are essential for investors.

What is Market Capitalisation?

Market cap, or market capitalisation, refers to the cumulative value of all stock shares of a company. It is determined by multiplying the total number of outstanding shares by the current price of a stock.

Here’s the formula used to calculate it:

Market Cap = Stock Price x Total Outstanding Shares

Market capitalisation is a rather important aspect, as it helps investors comprehend the relative size of one business versus another. It provides an estimate of a company's total worth based on the current market price of its outstanding shares. In simple terms, the market cap is the product of the company's stock price and the total number of shares available in the market.

For example, if Company A has 10,00,000 outstanding shares and the current market price of each share is ₹100, then the market cap of Company A would be:

Market Cap = ₹100 x 10,00,000 = ₹10,00,00,000

Market Cap Categories

Market cap is used to categorise companies into different groups based on their size. Based on the market cap, companies are classified into three essential categories:

- Large Cap Companies: SEBI's guidelines classify companies listed on stock exchanges, categorising the top 100 as large-cap companies. Large cap companies typically boast a robust track record and substantial market capitalisation. They frequently find their place in prominent market indices like NIFTY and SENSEX due to their significant market influence.

- Mid-Cap Companies: Companies ranked from 101 to 250 in market capitalisation are considered mid-cap companies. While mid-cap companies exhibit a moderate to strong market presence, their inclusion in broad market indices may vary.

- Small Cap Companies: Companies ranked 251st and beyond in terms of market capitalisation as small-cap companies. These often comprise startups or businesses in developmental stages and typically lack an extensive track record. These companies tend to have limited market presence, resulting in their exclusion from broad market indices.

It's important to note that the market cap is a dynamic figure that changes with the stock's price and the number of outstanding shares. As a result, a company's classification into one of these categories may change over time as its stock price fluctuates.

Equity

Equity, also known as shareholders' equity or simply "equity," refers to the ownership interest of shareholders in a company. It represents the residual interest in the assets of a company after deducting its liabilities. In other words, it's the value that remains for shareholders if the company's assets were to be liquidated and its debts paid off.

Formula: Equity = Total Assets - Total Liabilities

In a company's balance sheet, equity is typically represented as follows:

Equity = Share Capital + Reserves and Surplus

- Share capital: This represents the value of the company's shares issued to shareholders.

- Reserves and Surplus: This includes retained earnings, which are the profits the company has earned and retained over the years, and any other surplus amounts, like share premiums.

Equity plays a vital role in determining the financial stability and health of a company. It is a key factor in assessing the company's solvency, as a higher equity base indicates a lower level of financial risk.

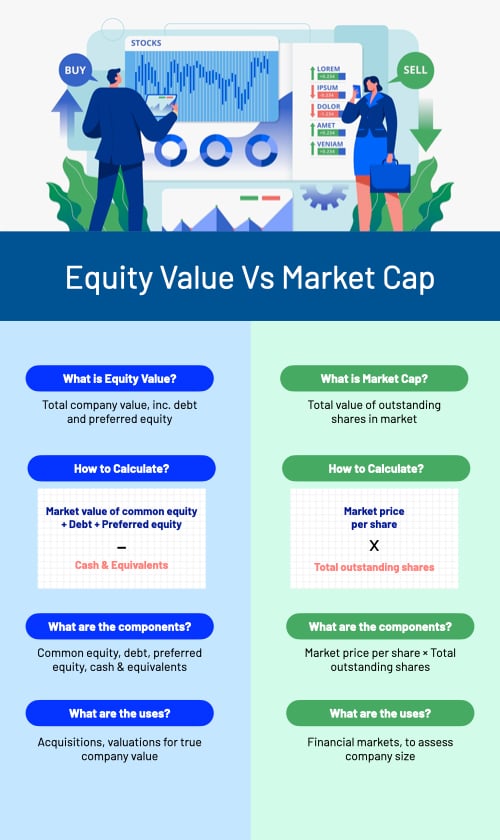

Equity Value vs Market Cap

The value of market capitalisation is almost always greater than the value of equity because investors weigh in factors such as the projected future profits from the growth and expansion of a business. To see whether there is a co-relation it may be useful to make a historical comparison between market capitalisation value and equity value.

It is possible to find both market capitalisation and equity by looking at the annual report of a business. At the time of the report, the report displays the number of outstanding shares, which can then be multiplied by the current share price in order to achieve the market capitalisation figure. The balance of the company sheet will show the equity.

To gain a better understanding of the distinction between market cap and equity, let's break down the key differences between these two financial metrics:

| Aspect | Market Cap | Equity |

|---|---|---|

| Definition | Total market value of a company's shares | Ownership interests of shareholders |

| Formula | Market Cap = Stock Price x Total Outstanding Shares | Equity = Total Assets - Total Liabilities |

| Metrics for Valuation | Measures a company's size in the market | Reflects a company's financial position |

| Stock Price Impact | Influenced by stock price and shares | Stable over time, reflecting earnings |

| Company Classification | Used to categorise companies by size | Not used for categorisation |

| Market Sentiment | Prone to market sentiment and volatility | Less influenced by short-term sentiment |

| Investor Perspective | Quick reference for size and growth | Indicates financial stability and equity |

Capital Market vs Equity Market

The capital market is an umbrella for a wide variety of tradable assets, including equity markets, as well as other venues for trading various financial instruments. The equity market allows investors and financial institutions to trade securities, either publicly or privately.

Stocks are financial instruments representing the partial ownership of the company. Companies make heavy use of these documents as a way of raising money. Primary and secondary markets that deal between banks underwriting stocks and public investors that trade stocks are part of the equity market itself.

Conclusion

Market cap and equity are essential metrics that play distinct roles in assessing a company's financial position and market value. Market Cap provides a quick reference for investors to categorise companies by size, whereas Equity offers insights into a company's financial health and the value available to shareholders.

Understanding the differences between these two metrics is crucial for investors, as it helps them make informed investment decisions. By leveraging both market cap and equity, you can gain a more holistic perspective on your investments. Now that you’re one step closer to your investing journey, Open your demat account today with Angel One and explore the market cap and equity value of various companies.

Learn Free Stock Market Course Online at Smart Money with Angel One.