(Some terms we've used frequently in this article:

- T = Trading Day

- T+n days = Trading day + 'n' number of days, excluding trading holidays)

Whether you're new to investing or a seasoned trader - Settlement Cycle/Period - is a term you will come across often. Over the years, SEBI has updated the settlement cycle period a few times to match world standards. In this brief article, let's look at the latest revision and how it impacts you as an investor.

What is a settlement cycle/ period?

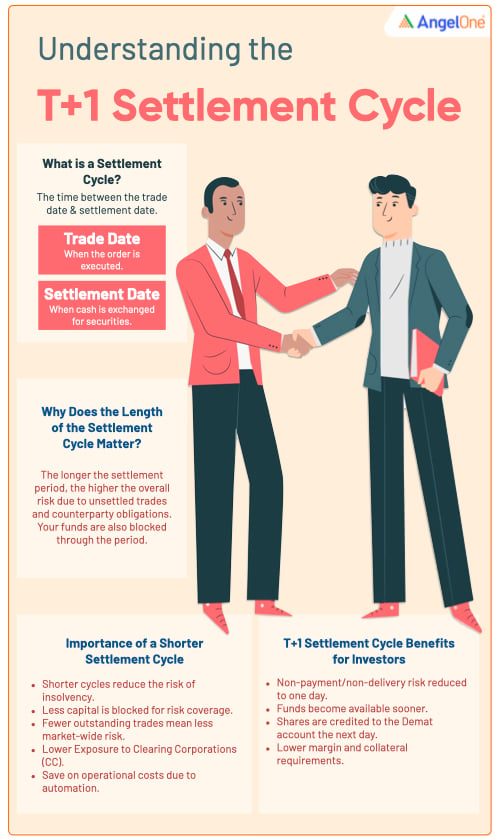

The settlement cycle refers to the period within which the settlement of trades takes place. It is the time between the trade date (the date on which the order is executed in the market) and the settlement date (the date when participants exchange cash for securities or shares)

For more on the Settlement Period, read this.

Now, why exactly is the length of the settlement cycle so important?

The settlement cycle is directly proportional to the overall risk in the system, which depends upon the number of unsettled trades at a point in time. The outstanding trades always increase the risk of the counterparty not fulfilling obligations or declaring insolvency/bankruptcy before settlement. Hence, the longer the settlement period, the greater the risk.

Here's a little background on the revisions that SEBI has been bringing with regards to the settlement cycle period:

2002: Reduced the settlement cycle from T+5 days to T+3 days

2003: Further shortened the cycle to T+2 days.

2021: SEBI permitted stock exchanges to switch to the T+1 settlement cycle.

Feb 2022: Market Infrastructure Institutions (Stock Exchanges, Clearing Corporations, and Depositories) decided to implement the T+1 settlement cycle in a phased manner from February 25, 2022 (Refer to the circular here).

Let's take a look at the impact of this shortened settlement cycle.

For the market, a T+1 Cycle has its advantages. The 2008 financial crisis exposed the risks of longer settlement cycles. SEBI found that reducing the settlement cycle to T+1 days may help streamline the risk management system in the Indian stock market in the following ways:

- Narrower the settlement cycle, slimmer is the time window for a counterparty insolvency/bankruptcy to impact a trade settlement.

- The capital blocked in the system to cover the risk of trades will get reduced with the reduction in the number of outstanding unsettled transactions at any point in time.

- Systemic Risk (the risk inherent to the entire market rather than an individual sector or the security) depends on the number of outstanding trades. The higher the magnitude of open trades, the greater is the concentration of risk. Thus, in this era of increasing trade volumes, a shortened settlement cycle will help in reducing systemic risk.

- A shortened settlement cycle of T+1 also reduces the number of outstanding unsettled trades at any instant of time, reducing the exposure to Clearing Corporations (CC) by 50%

- The risk associated with the value of an open position is proportional to the time to settlement. A 2-day Value at Risk(VaR) is 1.414 times of day 1 VaR.

- Saving in operational costs as many processes move from manual to automation mode.

How will the T+1 settlement cycle benefit you as an investor?

The T+1 settlement cycle is one of SEBI's regulatory measures to protect investors. Here's why this is good news for you:

- With the T+1 cycle, the risk of non-payment of funds or non-delivery of shares by the broker reduces to a day

- The shorter settlement cycle allows investors to utilise their funds more efficiently.

- With the T+1 cycle, the shares get credited to the Demat account the next day, enabling investors to trade shares sooner if they want to protect their profits

- The early settlement cycle would also reduce margin requirements and collateral requirements of investors

The T+1 settlement period benefits all the stakeholders in the stock market by minimising the risks, increasing liquidity, and protecting investors. Let's hope that the T+1 settlement system will become an efficient market mechanism in its full-scale implementation.