Have you received an unwanted phone call or an SMS saying that investors are buying shares of a particular company and you should also buy them as the prices will go up from here? If yes, then you should be cautious of such misleading messages and don’t act on them. Traders, investors, or the general public receive these kinds of messages inducing them to trade or invest in these stocks. Market regulators have noticed that unsolicited (not asked for) tips are being circulated in the market rapidly. Here, unsolicited tips mean messages that have investment tips or advice about the listed companies that are sent via calls, SMS, WhatsApp, Telegram, or any other medium by fraudsters or manipulators with an aim to boost/reduce their prices. These are popularly known as Pump & Dump Scams. The circulation of such misleading messages affects investors as they invest their hard-earned money in the market with an objective to earn good returns.

How SEBI is dealing with these unsolicited investment tips?

In light of the increasing circulation of unsolicited or uncalled-for tips, being a market regulator, SEBI takes various measures and drives many awareness programs to protect investors’ interests. Some of them are:

- It has released a notice on 14th October 2020 to create awareness about unsolicited investment tips and advise investors to:

- To follow due diligence means do thorough research about the fundamentals of the company, past records, financial statements, and other related things before making decisions based on these investment tips

- To be aware of misleading advertisements that assure guaranteed returns

- To deal with SEBI registered brokers/advisers only

- To check the registration status of a person/entity before availing of their services

- It verifies and inspects all the complaints received related to unsolicited investment tips

- If an individual or a company is found guilty of acting as an unregistered investment advisor and circulating unsolicited tips, it takes strict legal actions against them like heavy penalties, banning them from the exchange, etc.

- It has created an online complaint cell called ‘SEBI Complaints Redress System (SCORES) where you can complain about unsolicited tips received

- It has also introduced the SEBI (Investment Advisers) Regulations 2013 that has a detailed set of rules with an aim to ensure that investors are treated fairly and receive advice that suits their risk profile

Few of the examples where SEBI has taken strict actions against such individuals/companies:

- Indore-based StarIndia Market Research has been imposed a penalty of ₹40 lac by SEBI as it violated Investment Advisers regulations. The company committed the following offenses:

- Advised high-risk products to investors who didn’t have high-risk appetite

- Products specified for High Net Worth Individuals (HNIs) were offered to non-HNIs

- Charged fees twice or more for the same service during the same period

- SEBI banned Ashish Chourasiya and Shinal Jain and their firms Money Increase and Venture Revenue from the capital markets for providing unauthorized investment tips as well as promising false returns via these firms. As a result, they are not allowed to buy or sell or deal in the securities market or associated with it, directly or indirectly.

- SEBI slapped a fine of ₹75 lac on 15 entities (₹5 lac each on 13 individuals and 2 entities) for manipulating the prices of Timbor Home Ltd. The SMS circulated recommended investors to buy the shares of this company. SEBI during its investigation noticed that trading volumes for the scrip increased soon after the circulation of bulk SMSs. This was done to artificially inflate the prices and later on dump them to get rid of the value of the shares decline.

NSE and BSE actions against these tips

Apart from SEBI, NSE (National Stock Exchange) and BSE (Bombay Stock Exchange) have also taken preventive measures to curb the spread of false information through these tips. Following are the steps taken by NSE and BSE to safeguard the interest of investors:

- These scrips are classified into special lists

- Based on the genuineness of the references for the tips received and pre-defined criteria, the exchanges include stocks in ‘Current Watchlist’, and ‘For Information List’. Here, the Current Watchlist includes scrips that are currently banned by the exchange, and For Information List includes scrips on which there is an ongoing investigation.

- Stocks in both of these categories are actionable as per the guidelines prescribed by the exchange.

- Exchanges from time to time publish the list of stocks that form a part of these above-mentioned lists.

- You can report any unsolicited investment tips on below email IDs

Why should you not blindly follow these investment tips?

A few of the reasons why should investors not trade based on these tips without doing proper research:

- To protect your money from fraudsters

- To avoid being a part of unethical practices unknowingly

- To stay in line with your investment goals

- To save yourself from civil as well as criminal penalties

Steps taken by Angel One to protect investors’ interest

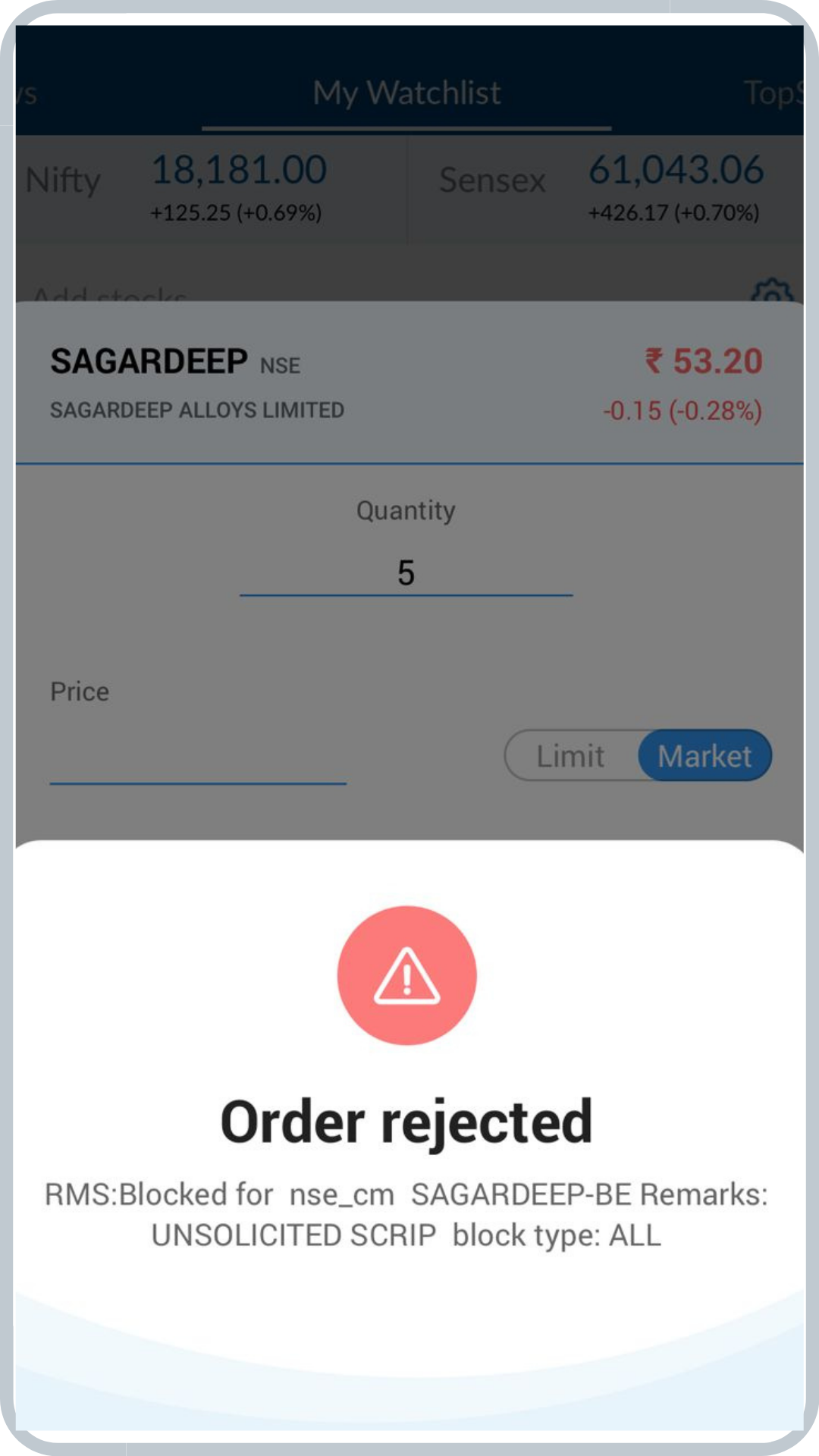

As per the exchange guidelines and our RMS policy, we have restricted trades on unsolicited SMS stocks under the Current Watchlist given by the exchanges. So, even if you go ahead and try to place a delivery/intraday/margin order in Current Watchlist stocks, a pop-up message will appear saying buying/selling is blocked for this scrip as it is an unsolicited scrip as shown in the below screenshot. In case you hold a scrip that is later categorized as an unsolicited scrip and you try to place a sell order for it, you will receive the same pop-up message.

Note: The securities quotes are exemplary and are not recommendatory. Such representations are not indicative of future results.

Conclusion

The nuisance created by the increasing circulation of these unsolicited investment tips has made not only beginners but market-savvy investors also lose their money. Keeping this in mind, exchanges and regulators are taking appropriate measures to put an end to such activities. While market intermediaries are doing what they should, investors like you should remain vigilant, cautious, and avoid falling for such misleading information. It is advisable that you educate yourself so that you have at least working knowledge of the market/company/scrip before you invest.

Explore the Share Market Prices Today

| IRFC share price | Suzlon share price |

| IREDA share price | Tata Motors share price |

| Yes Bank share price | HDFC Bank share price |

| NHPC share price | RVNL share price |

| SBI share price | Tata Power share price |