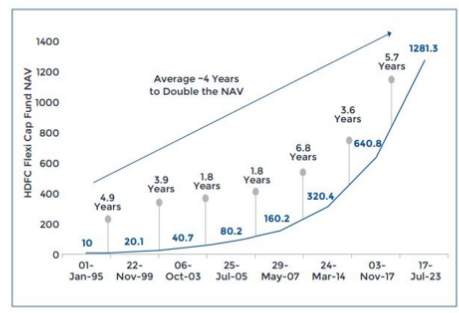

On January 1, 2025, HDFC Flexi Cap Mutual Fund will celebrate 30 years of helping investors achieve their financial goals. As one of the oldest schemes in the mutual fund industry, it has built an impressive legacy with a robust AUM base of approximately ₹66,304 crore as of November 29, 2024.

The fund’s strategy has always focused on investing in reasonably valued stocks and sectors while avoiding aggressive pricing. This disciplined approach has enabled the fund to position itself ahead of market cycles, delivering consistent performance. The ability to capture beneficiaries of the next market cycle, coupled with the conviction to hold investments during volatile periods, has resulted in significant long-term alpha generation.

Note: The above data is based on the Regular Plan – Growth Option. NAV as of November 29, 2024, stands at ₹1883.672.

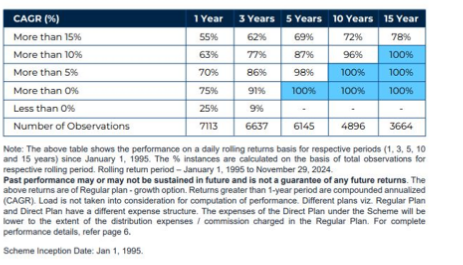

Rolling Returns: A Testament to Consistency

The rolling returns of the fund further reinforce its performance consistency:

Ensure steady returns with systematic withdrawals! Estimate your withdrawals with our SWP Calculator and manage your finances seamlessly.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Mutual Fund investments are subject to market risks, read all scheme-related documents carefully

Published on: Dec 31, 2024, 3:27 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates