In the dynamic landscape of India’s waste management sector, Antony Waste Handling Cell Limited, a prominent member of the esteemed ‘Antony’ group, has emerged as a frontrunner, marked by remarkable growth and unwavering dedication to environmental conservation.

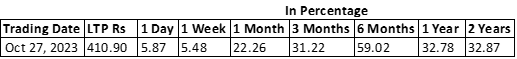

As of now, the market price of Antony Waste Handling Cell Ltd shares stands at Rs 406.35.

Let’s delve into the historical performance of the company’s stock:

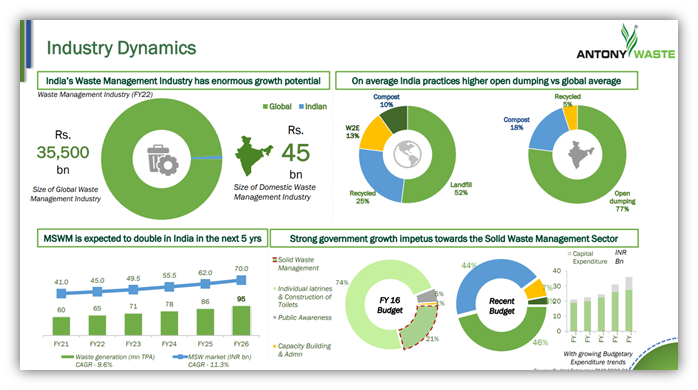

Antony Waste Handling Cell Limited offers a wide range of municipal solid waste (MSW) management services. Its services encompass solid waste collection, transportation, processing, and disposal, making it a one-stop solution for municipalities and private players across India. Notably, the company has been at the forefront of MSW collection and transportation and has garnered expertise in landfill construction and management.

The company’s impressive portfolio comprises more than 25 projects, with 18 of them currently underway. These projects include MSW collection and transportation, MSW processing, and mechanized sweeping initiatives. This diversity highlights Antony Waste Handling Cell’s capacity to handle large-scale projects efficiently.

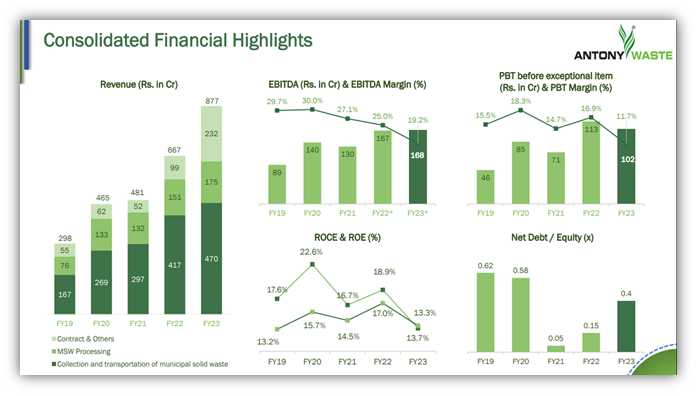

In terms of financial performance, the company has demonstrated its prowess.

In Q1FY2024, it reported a revenue of Rs 227 crore, with an EBITDA of Rs 52 crore, reflecting an EBITDA margin of 27.2%, an increase of 1.3 percentage points from the previous year. Profit after tax (PAT) stood at Rs 23 crore, signifying robust financial stability.

Source- Antony Waste Handling Cell Ltd Investor Presentation

Among the prominent projects the company is currently involved in, the Municipal Corporation of Greater Mumbai, the Navi Mumbai Municipal Corporation, and the Thane Municipal Corporation are notable municipal partners. Additionally, Antony Waste Handling Cell is engaged with several other municipalities and organizations, including the North Delhi Municipal Corporation, the Ulhasnagar Municipal Corporation, and the Greater Noida Industrial Development Authority.

The company also plays a significant role in MSW-based Waste to Energy (WTE) initiatives, contributing to India’s evolving waste management landscape. Past collaborations with entities such as the Municipal Corporation of Delhi, Municipal Corporation, Gurgaon, Amritsar Municipal Corporation, Kalyan Dombivali Municipal Corporation, and Jaipur Municipal Corporation reflect its enduring relationships with customers.

Source- Antony Waste Handling Cell Ltd Investor Presentation

Antony Waste Handling Cell Limited envisions itself as a valued partner to its customers and a key contributor to environmental preservation. The company aims to address India’s growing need for a comprehensive solid waste management solution. By implementing innovative strategies and technologies, it strives to fulfil its vision and make a meaningful impact on environmental sustainability.

Despite its success, Antony Waste Handling Cell Limited faces certain concerns. Profit margins have been deteriorating, and returns on equity (ROE) and returns on capital employed (ROCE) have been declining. The company has also seen an increase in net debt, from 0.15 in FY2022 to 0.4 in FY2023.

Antony Waste Handling Cell Limited, an integral part of the ‘Antony’ group, has emerged as a formidable player in India’s waste management industry. With a rich history, a diverse portfolio of projects, and a strong commitment to environmental sustainability, the company is poised to continue making a significant contribution to India’s waste management landscape.

As the country’s waste generation continues to grow, Antony Waste Handling Cell’s expertise, innovative approach, and strong partnerships position it as a crucial player in the quest for a greener and more sustainable future. Despite some financial concerns, the company’s strong foundation and vision make it a noteworthy contender in the waste management sector.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Oct 31, 2023, 12:51 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates