Let's probe into the recent performance of a select basket of MNC stocks, analysing their returns and dividend yields against key market benchmarks.

Multinational Corporation (MNC) stocks, renowned for their global footprint and diverse revenue streams, continue to captivate the attention of investors. These companies, operating across international borders, often bring a unique blend of stability and growth to investment portfolios. Understanding the performance of MNC stocks is crucial for investors seeking a balanced and rewarding investment strategy.

With this context, let’s delve into the recent performance of a select basket of MNC stocks, analysing their returns and dividend yields against key market benchmarks such as the Nifty 50 and Nifty MNC Index. This data provides valuable insights into the comparative strengths and weaknesses of these stocks, shedding light on their potential as lucrative investment options.

Amidst the MNC stocks, a curated basket has emerged, known as the Nifty MNC Index, showcasing an impressive weighted average 1-year return of 13.94% and an average return of 15.09%. This signals a compelling performance that outpaces the broader Nifty 50.

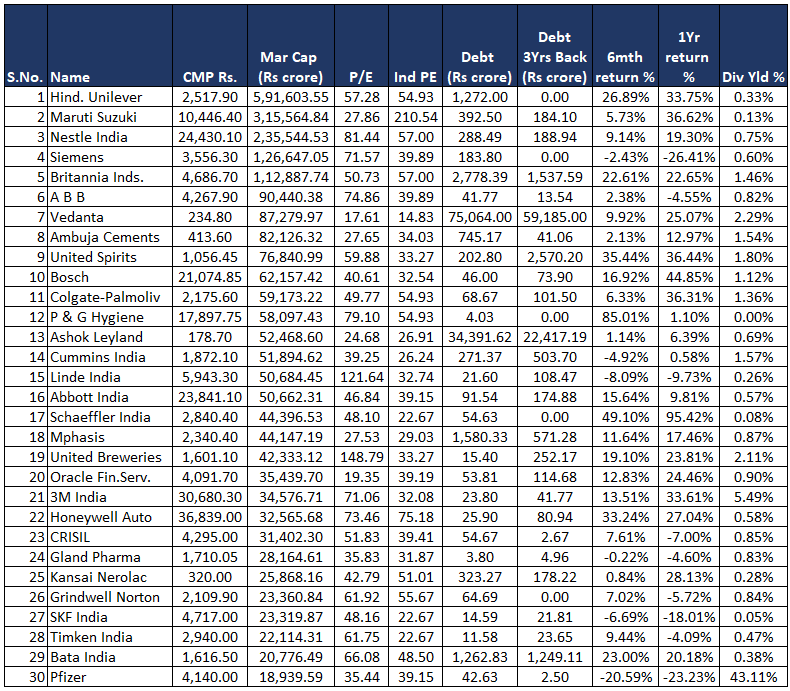

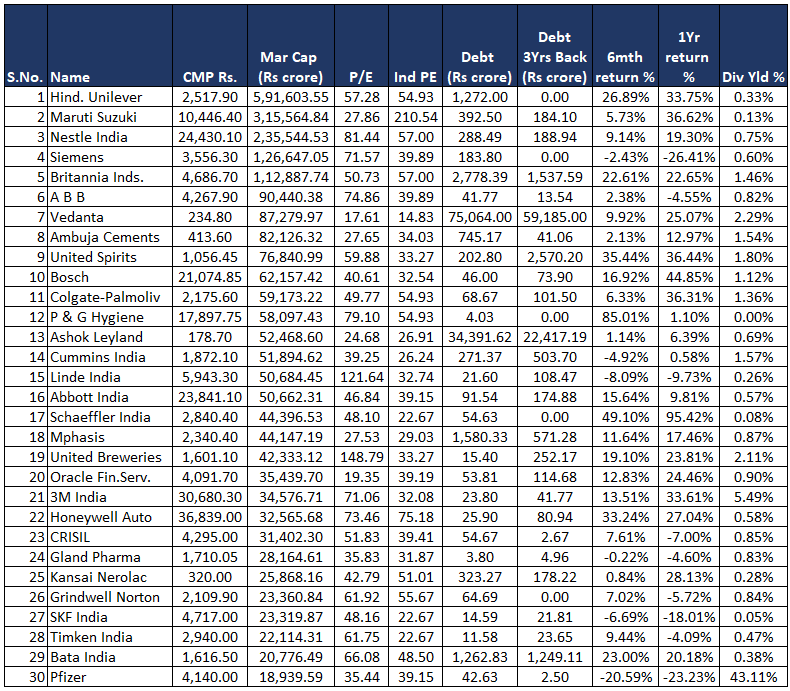

Following are the constituents of the Nifty MNC Index and their respective information:

- Weighted Average 1-Year Return:

The basket of stocks has a weighted average 1-year return of 13.94%. This metric suggests the average return of the individual stocks in the basket, considering their respective weights. It provides a comprehensive view of the overall performance.

- Average 1-Year Return:

The average 1-year return of the basket stands at 15.09%. This figure represents the simple arithmetic mean of the individual stock returns in the basket. It’s another measure to understand the collective performance.

Benchmark Comparison

- Nifty 50 1-Year Return:

The Nifty 50, a benchmark index representing the top 50 companies in the National Stock Exchange of India, has a 1-year return of 8.11%. This serves as a benchmark for the broader market performance.

- Nifty MNC Index 1-Year Return:

The Nifty MNC Index, which focuses specifically on multinational corporations, recorded a 1-year return of 12.67%. This index provides insights into the performance of MNCs within the Nifty framework.

Consideration for Investors

Image taken from NSE Indices website

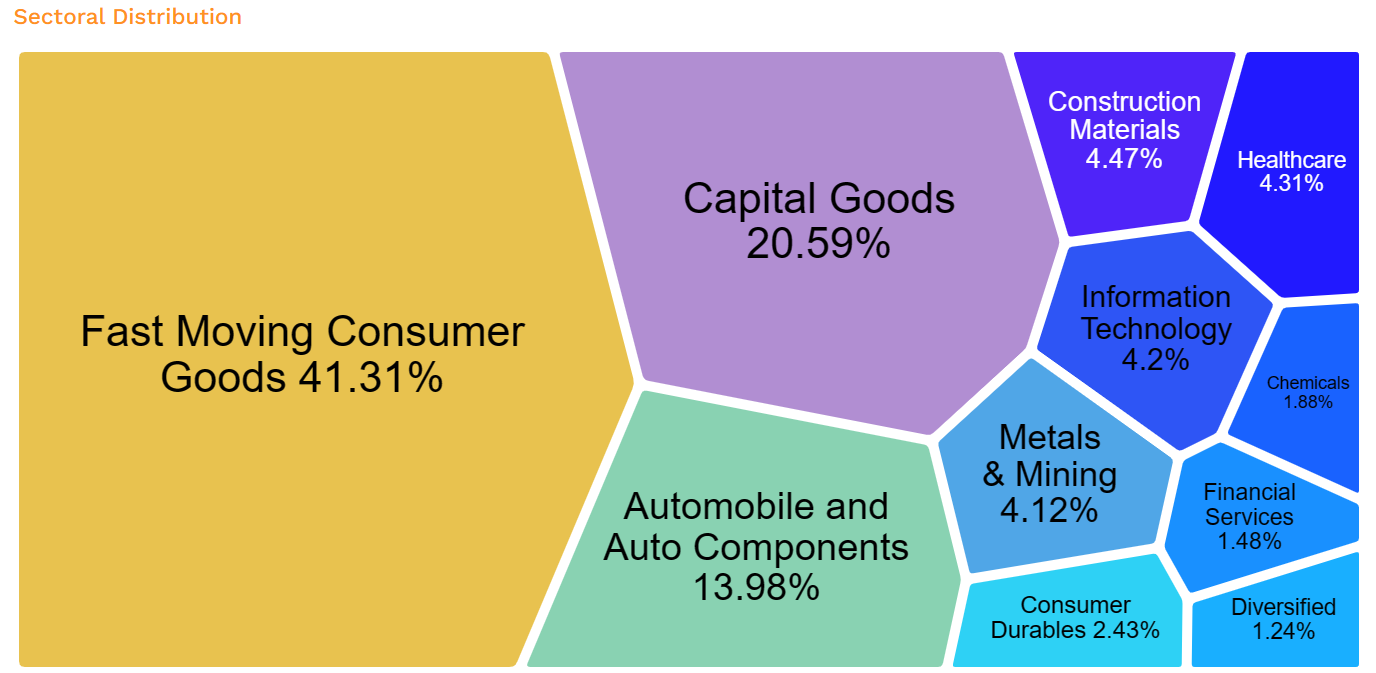

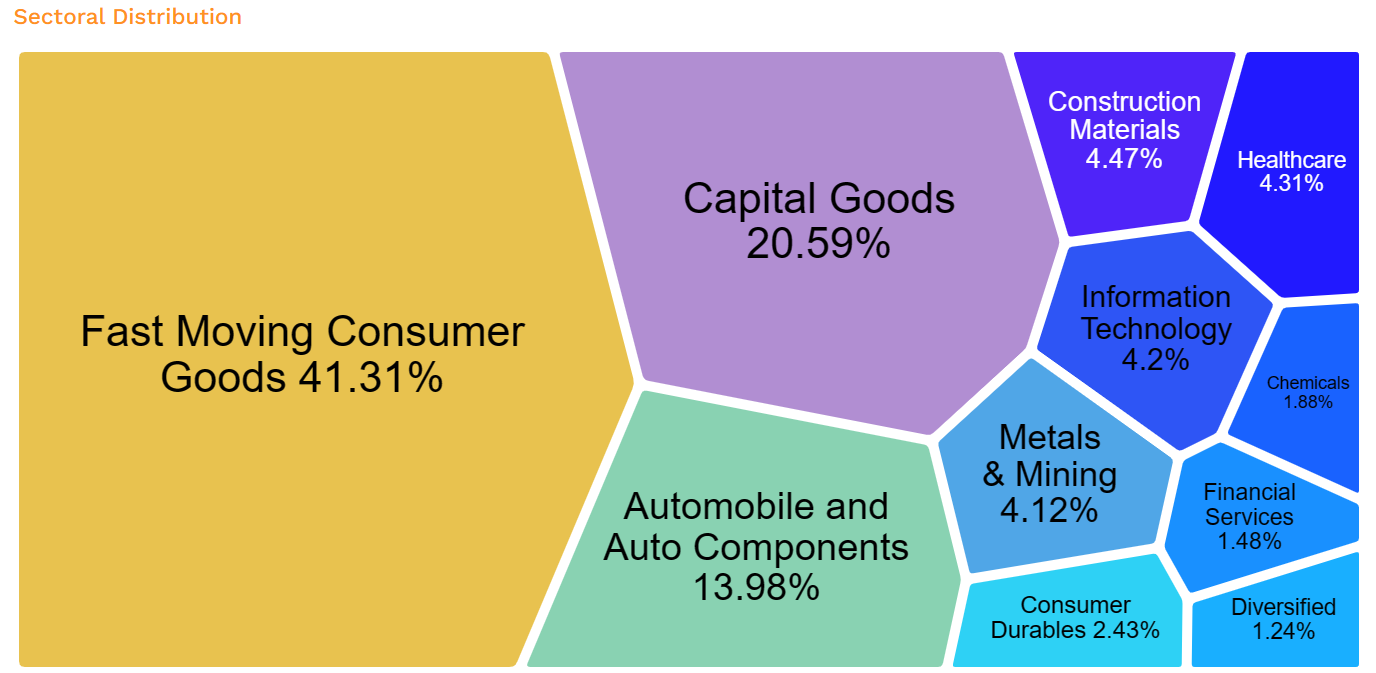

- Diversification Benefits: Investors might find value in analysing the individual stocks within the basket to identify which ones are driving the outperformance. Diversification across various sectors and industries could contribute to the overall positive returns.

- Risk-Adjusted Returns: While higher returns are appealing, investors should also assess the risk associated with the basket’s constituents. Understanding the risk-adjusted returns can provide a more comprehensive evaluation of the portfolio’s performance.

- Nifty 50 vs. Nifty MNC Index Dividend Yields:

As of October 31, 2023, The Nifty 50 has a 1-year dividend yield of 1.41%, while the Nifty MNC Index has a higher yield at 2.23%. Dividend yield reflects the annual dividend income as a percentage of the stock’s current market price. A higher yield is generally considered favorable for income-seeking investors.

- Market Sentiment:

The outperformance against Nifty 50 Index may indicate favorable market sentiment towards the specific stocks in the basket. Investors should stay vigilant to changing market conditions that might impact these sentiments.

- Income Generation:

While the basket has demonstrated strong capital appreciation, investors in Nifty MNC Index stocks may have enjoyed a slightly higher income stream through dividends. This adds a layer of stability to their overall returns, appealing to income-focused investors.

Conclusion

The data underscores the appeal of MNC stocks as a compelling investment option. The curated basket, represented by the Nifty MNC Index, showcases a robust weighted average 1-year return of 13.94%, outpacing the broader Nifty 50. The superior performance, coupled with a higher dividend yield compared to the Nifty 50, suggests potential income generation for investors.

Diversification benefits and favourable market sentiment further contribute to the attractiveness of MNC stocks. However, investors should judiciously assess risk-adjusted returns and align their investment strategy with individual financial objectives, considering the nuanced dynamics of both capital appreciation and dividend income.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.