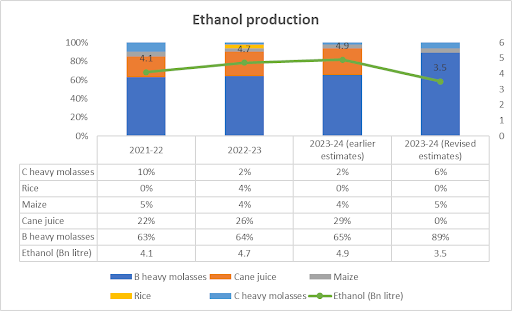

On December 7, 2023, the government limited the use of sugarcane juice and sugar syrup for ethanol production in ethanol supply year 2023-24 (November 2023 to October 2024). However, ethanol supply from existing bids received by oil marketing organisations from B heavy molasses, C heavy molasses, and cereals will continue.

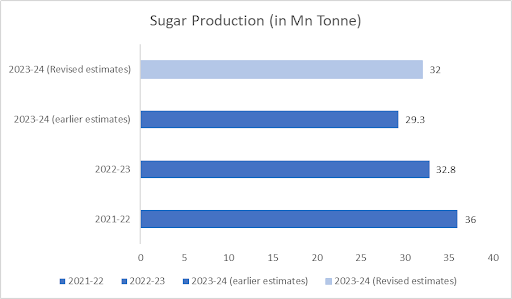

The sugarcane and sugar production forecasts indicate an anticipated 9% decline in sugarcane and a 3% decrease in sugar due to inadequate rainfall in key producing states like Maharashtra and Karnataka. As of September 2023, closing sugar inventories were only sufficient for a two-month consumption period, contrasting with the previous five-year average of four months. In response to the diminished sugarcane and sugar supplies, the government implemented various measures, including extending restrictions on sugar exports beyond October 2024 to October 2023. Additionally, in July, the Food Corporation of India ceased rice supplies for ethanol production due to supply concerns.

Due to low rainfall in key sugarcane-growing states like Maharashtra and Karnataka, sugarcane production is expected to drop by about 9% from October 2023 to September 2024. As sugarcane is crucial for making both sugar and ethanol, the shortage is forcing producers to choose between the two. To manage domestic sugar prices amidst volatility in staple food prices and upcoming elections, the government has taken action. It has banned the immediate production of ethanol directly from sugarcane juice but allows ethanol production from B-heavy molasses and C-heavy molasses.

Previously, cane juice contributed to 25-30% of the country’s ethanol, while B-heavy molasses accounted for 60-65%. Now, sugar mills will focus more on producing molasses-based ethanol, boosting sugar production by around 2.5 million tonnes for the period.

Source: CRISIL Reports

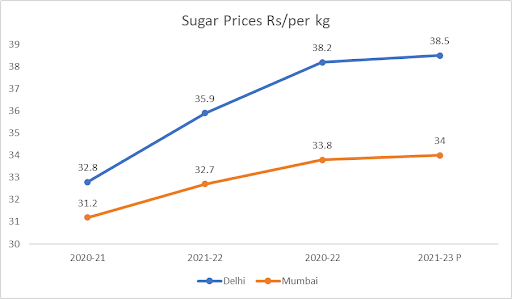

Sugar prices are likely to go down because there will be more sugar available. In the last two sugar seasons (2021-22 and 2022-23), prices went up by 7% and 5%, reaching Rs 40 per kg in northern India by the end of 2022-23. This happened because there was less sugarcane available, and more of it was used for making ethanol. The amount of sugar stored was enough for only 2 months of consumption, compared to the usual 4 months in the last 5 years.

Looking ahead to 2023-24, the sugar supply is expected to increase by 2-2.5 million tonnes, causing prices to go up by a modest 3-4%. The stored sugar would then be enough for more than 3 months of consumption, ensuring there is plenty for the country.

Sugar prices are still going up, but the increase is happening more slowly in the 2023-24 sugar season.

Source: CRISIL Reports

Source: CRISIL Reports

The government’s ambitious goal of achieving 20% ethanol-blended petrol by the end of the fiscal year 2024-25 and 30% by 2029-30 is likely to face setbacks in the upcoming fiscal year 2023-24. The discontinuation of ethanol production from sugarcane juice during this period is expected to hinder progress.

Despite achieving a blending rate of 12% in the previous fiscal year 2022-23 and anticipating a rate of 13-15% in 2023-24, the implementation of new regulations is projected to result in a blending rate below 10%. This decline is attributed to an estimated 20% decrease in ethanol production, while petrol consumption is anticipated to rise by 5% during the same period.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. The information is based on various secondary sources on the internet and is subject to change. Please consult with a financial expert before making investment decisions.

Published on: Dec 14, 2023, 1:25 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates