Real Estate Investment Trusts (REITs) have been gaining traction in the Indian stock market, offering investors a unique opportunity to diversify their portfolios with exposure to real estate. While REITs may not have performed as impressively as other sectors, it’s always interesting to see which stocks lead within their sector. Over the past year, one REIT has stood out as the best performer, significantly outpacing its peers.

A REIT is a company that owns, operates, or finances income-producing real estate. They allow individual investors to earn a share of the income produced through commercial real estate ownership without having to buy, manage, or finance properties themselves. REITs are required to distribute at least 90% of their taxable income to shareholders in the form of dividends. This structure provides a consistent income stream for investors, making REITs an attractive investment option.

| Name | Current Price (Rs) | Market Capitalization (Rs Crore) |

| Embassy Off.REIT | 360.55 | 34,176.32 |

| Nexus Select | 151.37 | 22,932.57 |

| Mindspace Business | 338.42 | 20,068.90 |

| Brookfield India | 266.22 | 12,778.98 |

(source: screener)

In India, there are four listed REITs:

(source: tijori finance)

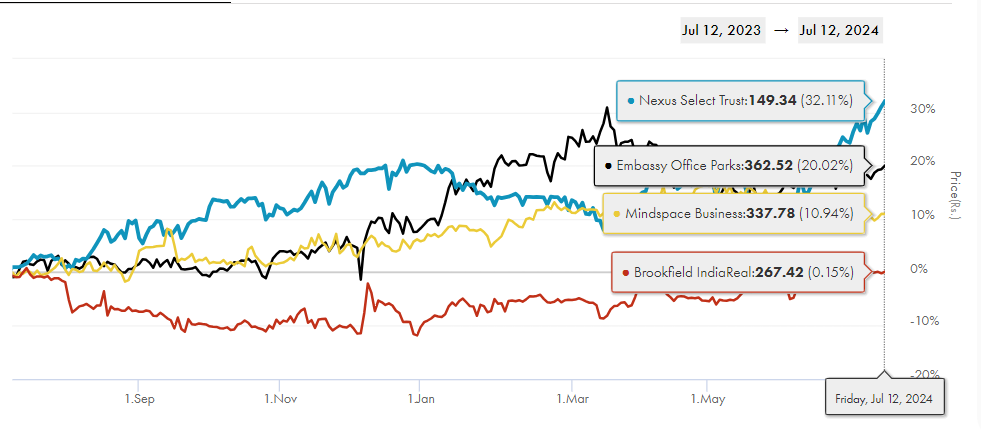

Among these, Nexus Select Trust has emerged as the top performer over the past year, delivering a remarkable 32% return. The second-best performer, Embassy Office Parks, achieved a 20% return.

Nexus Select Trust is India’s first retail REIT and a leading Grade-A consumption centre platform. Here’s a closer look at what makes Nexus Select Trust a standout in the Indian retail real estate market:

Geographic Reach:

Retail Portfolio:

Operational Metrics:

Financial Metrics:

This extensive portfolio, coupled with high occupancy rates and strong financial performance, positions Nexus Select Trust as a leading player in the Indian retail real estate market.

One of the key metrics highlighting Nexus Select Trust’s success is its occupancy rate of 97.6%, significantly higher than Embassy Office Parks’ 64%. Nexus Select Trust achieved its FY24 guidance with a Net Operating Income of Rs 16.1 billion and has set an ambitious target of Rs 17.6 billion for FY25, aiming for a retail occupancy of over 98%.

Nexus Select Trust’s robust portfolio, high occupancy rates, and strong financial performance underscore its leadership in the Indian REIT sector. As the first retail REIT in India, it has set a high benchmark for others to follow, offering investors an attractive option for diversifying their portfolios.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Jul 15, 2024, 6:57 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates