China’s economy is facing a multi-faceted challenge, with a sluggish property sector, soaring youth unemployment, and a global economic slowdown weighing heavily. To combat these issues and stimulate growth, China’s central bank recently took a significant step by cutting the key benchmark lending rate used to price mortgages.

China has been grappling with a prolonged property sector downturn, exacerbated by the global economic slowdown and rising youth unemployment. These factors have dampened demand for goods from the world’s second-largest economy and slowed down growth.

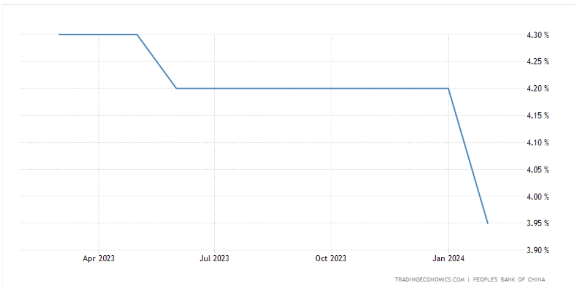

In a bid to boost growth and rescue the housing market, the People’s Bank of China announced a cut in the five-year loan prime rate (LPR) from 4.2% to 3.95%. This is the first cut since June and the largest since the rate was introduced in 2019.

5-Year LPR (China)

The rate cut is aimed at encouraging commercial banks to offer more credit at better rates, which could stimulate borrowing and spending. It comes at a time when most major economies are raising rates to curb inflation, highlighting China’s unique economic challenges.

China’s economy recorded one of its worst annual growth rates in 2023 since 1990, and deflationary pressures have been mounting. Consumer prices fell sharply in January, prompting the government to take more aggressive measures to revive the economy.

At the heart of China’s economic woes is the real estate crisis, with major firms like Evergrande and Country Garden facing financial troubles. This has led to buyer mistrust, unfinished housing developments, and falling prices, severely impacting consumer confidence and spending.

To combat deflation and boost economic activity, policymakers have announced various measures, including infrastructure spending and consumption-boosting initiatives. These efforts, including interest rate cuts and reserve requirement ratio reductions, aim to stimulate lending and spending.

Despite the economic challenges, there have been some positive signs, such as a rebound in consumption during the recent Chinese New Year holidays, exceeding pre-pandemic levels. This indicates a potential for recovery, albeit gradual.

With the economy still facing headwinds, more rate cuts and supportive measures are expected in the future to bolster growth and stabilise the housing market.

In conclusion, China’s recent rate cut reflects a bold move by the central bank to address the country’s economic challenges and revive the housing market. While the road to recovery may be challenging, the government’s proactive measures signal a commitment to stimulating growth and restoring stability.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Feb 20, 2024, 11:52 AM IST

We're Live on WhatsApp! Join our channel for market insights & updates