DMart witnessed significant store expansion in FY24, increasing its network from 155 stores in FY18 to 365 stores. This growth reflects DMart’s commitment to geographical diversification and reaching new customer segments.

The following table showcases DMart’s year wise store count

| Year | Dmart Stores |

| FY20 | 214 |

| FY21 | 234 |

| FY22 | 284 |

| FY23 | 324 |

| FY24 | 365 |

Additionally, revenue per square foot in the retail business area recovered to pre-pandemic levels in FY24, reaching Rs 32,941. This suggests a return of customer footfall to levels similar to FY20 indicating a successful post-lockdown recovery.

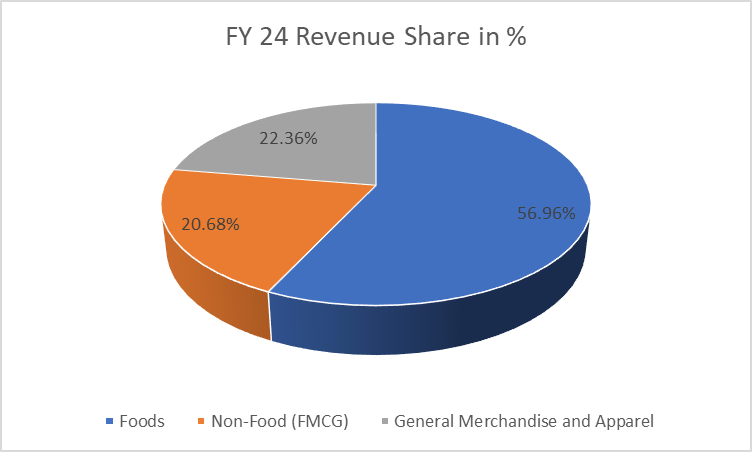

DMart’s revenue from operations rose 18.40% in FY24 to Rs 49,533 crore from Rs 41,833 crore in FY23. The company’s food segment remained the dominant contributor, accounting for 56.96% of revenue in FY24, followed by non-food FMCG (20.68%) and general merchandise & apparel (22.36%).

| Department | FY 23 Revenue Share in % | FY 24 Revenue Share in % | % Change |

| Foods | 56.03% | 56.96% | 0.93% |

| Non-Food (FMCG) | 20.93% | 20.68% | -0.25% |

| General Merchandise and Apparel | 23.04% | 22.36% | -0.68% |

Interestingly, the food segment witnessed a slight increase in its revenue share (0.93%), while the non-food and general merchandise segments experienced marginal declines (-0.25% and -0.68%, respectively).

DMart’s profitability metrics exhibited mixed results in FY24. While revenue grew steadily, EBITDA rose only 12% to Rs 4,099 crore from Rs 3,659 crore in FY23. This translates to an EBITDA margin decline of 400 basis points (bps) from 8.7% in FY23 to 8.3% in FY24. Similarly, profit after tax witnessed a 12% increase to Rs 2,659 crore in FY24 from Rs 2,556 crore in FY23, with a PAT margin decline of 700 bps compared to the previous year. These margin pressures suggest rising input costs or increasing operational expenses that DMart is yet to fully pass through to consumers.

However, DMart’s cash flow generation remained robust. Net cash flow from operations increased by 7.38% to Rs 3,343 crore in FY24 from Rs 3,113 crore in FY23. This healthy cash flow generation indicates DMart’s ability to meet its financial obligations and invest in future growth initiatives. The company’s debt-to-equity ratio also improved, declining from 0.03 in FY23 to 0.02 in FY24, further strengthening its financial position.

DMart’s FY24 performance reflects a tale of two sides. The company’s store expansion and recovering customer footfall are positive indicators for future growth. However, margin pressures raise concerns about DMart’s ability to maintain profitability amidst a potentially rising cost environment. Going forward, investors will be keenly interested in DMart’s strategies to mitigate these pressures and ensure sustainable profitability while capitalizing on its strong operational cash flow and healthy financial position.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. The information is based on various secondary sources on the internet and is subject to change. Please consult with a financial expert before making investment decisions.

Published on: May 9, 2024, 3:41 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates