The inclusion of India into key global bond indexes has triggered a wave of cash inflows, reshaping the country’s markets and challenging its traditional stance on managing foreign investments. Since JPMorgan Chase & Co.’s announcement in September, foreign investors have poured approximately 780 billion rupees ($9.4 billion) into eligible sovereign bonds, with significant implications for various asset classes.

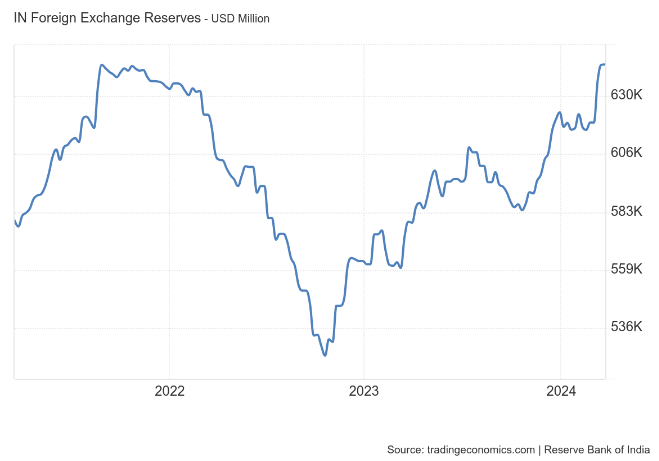

The substantial inflows are already leaving a mark on India’s financial landscape. Corporate bonds, for instance, are outperforming their peers, while the country’s foreign exchange reserves have surged to a record high. Despite a broader strengthening of the dollar, the Indian rupee has remained resilient, thanks to the influx of foreign investment.

The influx of funds is expected to provide significant support for the rupee, with inflows of around $25 billion projected for Indian bonds by the middle of next year. This influx of funds is already benefiting Indian Fully Accessible Route (FAR) bonds, set to join the global indexes, which have returned 2.76% in dollar terms this year, making them one of the best performers in local currency emerging market government debt in 2024.

The Reserve Bank of India (RBI) has been quick to respond to the surge in inflows, intervening in the foreign exchange market to manage the impact on the rupee. The central bank has been buying the incoming dollar flows, leading to a record-high foreign exchange reserve of $642.5 billion.

According to Bloomberg, the inflows into government debt have also benefited corporate bonds, as they are largely priced off sovereign notes. The yield on top-rated 10-year notes has declined by about 30 basis points since the index announcement, reflecting the positive sentiment in the market.

Conclusion

India’s inclusion in global bond indexes has brought about significant changes in its financial markets, with foreign inflows reshaping asset performance and market dynamics. The surge in cash inflows has not only supported the rupee but also boosted corporate bonds, indicating a positive outlook for India’s bond market in the coming months.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Apr 1, 2024, 6:49 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates