Union Finance Minister Nirmala Sitharaman presented the Economic Survey 2025 in Parliament on January 31. The report highlights India’s expected GDP growth of 6.3-6.8% in FY26, despite global uncertainties. It also projects controlled inflation, stable financial markets, and strong contributions from all major sectors.

This survey follows the Economic Survey 2024, which was presented in July 2024 after the General Election. Prepared by the Department of Economic Affairs under Chief Economic Advisor V. Anantha Nageswaran, the report provides an overview of India’s economic performance and outlook for the upcoming financial year.

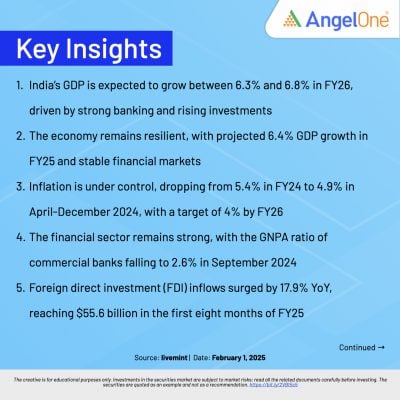

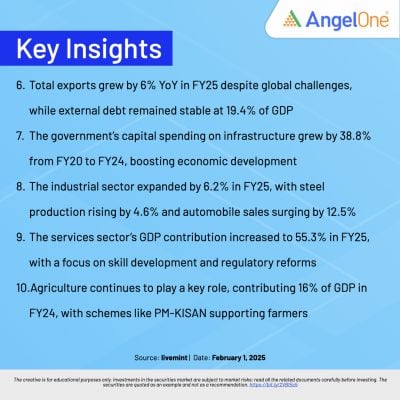

Here are the key highlights of the Economic Survey 2025:

India’s economy is projected to grow at 6.4% in FY25, close to the 10-year average. The expected GDP growth for FY26 is between 6.3% and 6.8%. The Gross Value Added (GVA), which measures overall economic productivity, is also set to grow by 6.4% in FY25.

Retail inflation dropped from 5.4% in FY24 to 4.9% in April-December 2024. Despite food inflation challenges due to supply disruptions and extreme weather, the government’s buffer stock policies and market interventions have helped stabilise prices. The Reserve Bank of India (RBI) and IMF expect inflation to reach 4% by FY26.

The survey emphasises removing regulatory hurdles to support India’s long-term growth. It calls for “Ease of Doing Business 2.0”, focusing on simplifying business rules and reducing government interference.

The service sector’s contribution to GDP increased from 50.6% in FY14 to 55.3% in FY25. The survey stresses skill development and simplifying regulations to boost both manufacturing and services.

The Economic Survey 2025 presents a positive outlook for India’s economy despite global uncertainties. Controlled inflation, strong banking health, rising investments, and infrastructure growth are expected to support GDP expansion. The government’s focus on deregulation, skill development, and agriculture will further strengthen India’s growth trajectory in FY26.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. This does not constitute a personal recommendation/investment advice. It does not aim to influence any individual or entity to make investment decisions. Recipients should conduct their own research and assessments to form an independent opinion about investment decisions.

Investments in the securities market are subject to market risks, read all the related documents carefully before investing.

Published on: Jan 31, 2025, 3:01 PM IST

Kusum Kumari

Kusum Kumari is a Content Writer with 4 years of experience in simplifying financial market concepts. Currently crafting insightful content at Angel One, She specialise in breaking down complex topics into easy-to-understand pieces, blending expertise in market fundamentals and technical analysis.

Know MoreWe're Live on WhatsApp! Join our channel for market insights & updates