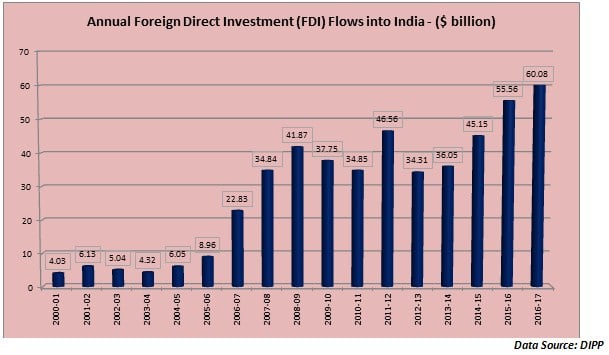

When the NDA government assumed power 3 years ago in the summer of 2014, India’s FDI flows were $36 billion. Over the last 3 years, India has emerged as the largest recipient of FDI flows, pushing China to the second place. For the financial year 2016-17, total FDI flows into India was at $60 billion and for the second year in succession India was the largest recipient of FDI flows (above China). The chart below captures the annual FDI flows since 2001…

Note: Total FDI flows includes reinvestment of earnings and miscellaneous capital flows”

Before we get into the details of the reasons for the spurt in FDI flows and the future trajectory, let us look at some of the key reforms initiatives that have been instrumental in giving a boost to FDI…

Some specific initiatives of the government to push FDI flows…

For a very long time, the standard refrain was that India relies on hot portfolio flows while China was getting billions of dollars from expat Chinese through the FDI route. As we shall see in the subsequent paragraph, the argument of FPI being more important than FDI is not necessarily true in the Indian context. But first some specific initiatives that the government consciously took to give a boost to FDI…

Firstly, in the last 3 years the government has eased a total of 87 FDI rules across 21 sectors. This has been a major sentimental boost for FDI. Apart from opening up railways, defence and insurance in a bigger way to FDI investments, the government also initiated large scale FDI reforms in the field of financial services and the construction sector. Thirdly, some of the erstwhile sensitive sectors that were kept out of the FDI ambit were opened up. These sectors include broadcasting, retail trade and civil aviation. These contributed specifically to the big thrust to FDI. In fact, judging by the current pipeline of negotiations and deals in the offing, the fiscal year 2017-18 could see FDI flows to the tune of $70 billion.

Getting back to the FDI versus FPI question for India…

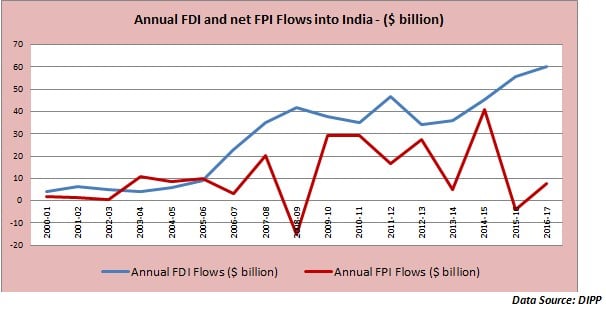

The trade-off between hot money and long term money is as old as the reforms process in India. For a long time, the Indian economy did rely heavily on FPI inflows to bridge its fiscal deficit. However, post 2006, it is FDI that has played a more critical and sustainable role in the overall scheme of things. The chart below captures the FDI / FPI comparison since 2001…

From the above chart it is quite evident that FDI has played a much more important role in bridging India’s fiscal deficit than the FPI flows have. Of course, the FPI flows are on a net basis but then it still gives a fairly indicative picture. In fact, post 2006, the clear domination of FDI has been very evident and FPI flows have played a smaller role in the overall capital inflows. Therefore the argument of hot money may not hold in the Indian context, especially with the sharp growth in FDI inflows in the last 3 years.

To put things in perspective, let us also look at the stock of FPI and FDI investments in India. From the year 2000 till date, the stock of FDI investment into India stands at $484 billion whereas the stock of FPI flows into India stands at a mere $194 billion. That probably settles the debate of FDI versus FPI flows into India.

With easing of FDI norms and an improvement in the “Ease of Doing Business” in India, we could see the FDI stock growing consistently and that would ensure that the gap with FPI is maintained. That will surely be a more sustainable method of managing the fiscal deficit.

Published on: Jun 6, 2017, 12:00 AM IST

We're Live on WhatsApp! Join our channel for market insights & updates