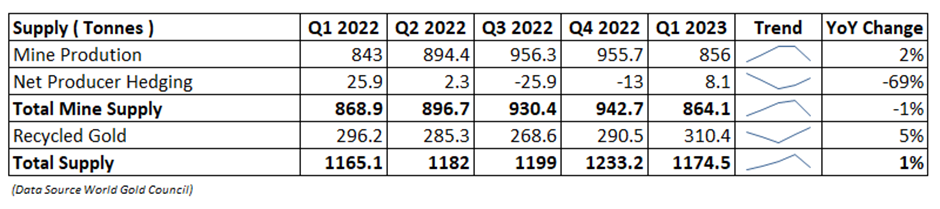

During Q1 2023 Total Gold supply was up by 1% from 1165.1 to 1174.4 tonnes. This was driven by strong mine production of 856 tones and higher recycling of 310 tonnes. Whereas Net Producer Hedging was declined by 69% from 25.9 to 8.1 tonnes but still higher than last 2 quarters. While Recycled Gold supply is increased by 5% YoY from 296.2 tonnes to 310.4 tonnes, also up from last quarter demand.

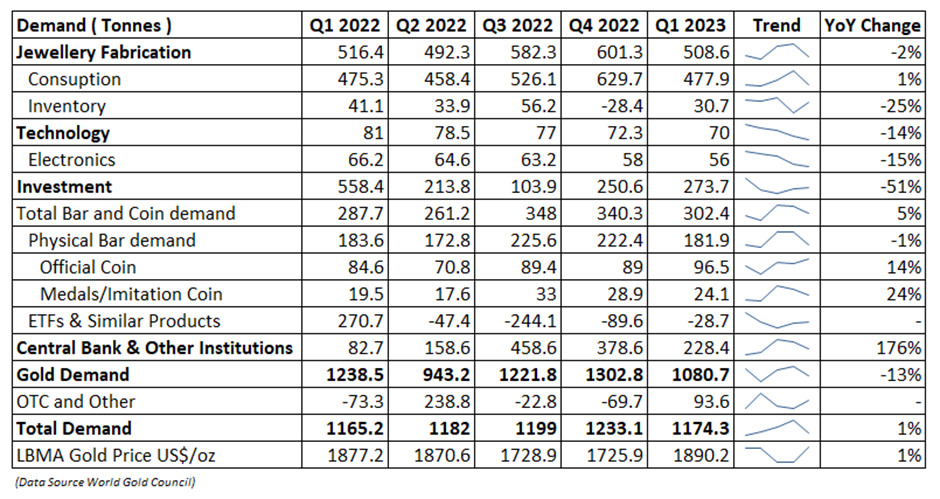

Looking at demand side Total Gold demand has increased by 1% (Including OTC and other) YoY from 1165.1 to 1174.4 tonnes amid recovery of OTC demand in Q1’23 from -69.7 to 93.6 tonnes. Excluding OTC markets seen a decline of 13% YoY from 1238.5 to 1080.8 tonnes.

Global Jewellery consumption demand for Q1’23 is at 478 tones up by 1% YoY, almost exactly in line with that of Q1’22. This was 5% lower than the 5-year quarterly average of 501 tonnes. China was clear out performer during this quarter demand up by 11% YoY at 198 tonnes from 177 tonnes. In India demand quashed by record local gold prices. In India demand jewellery consumption demand stood at 78 tonnes down by 17% from 94.2 tonnes in Q1’22. The historic high gold prices create a further obstacle to demand. 18K jewellery was in demand during this quarter particular in young and more budget conscious consumers.

Technology sectorregistered week demand for gold during Q1 from 81 tonnes to 70 tonnes down by 13%. The demand for Electronics, Other Industrial and Dentistry fell by 15%, 3%, 12% respectively.

Investments demand in Gold stood at 274 tonnes up by 9% on the previous quarter, but down 51% YoY. In India, record high and volatile local global price in Q1 seen a decline of 17% YoY from 41.3 tonnes to 34.4% and a steep drop in 40% QoQ. Demand was 14% below five-year quarterly average. Bar coin investment in Turkey reached phenomenal levels in Q1 breaching 50t for the first time on record. Q1 bar and gold investment soared in China.

Central Banks demand for Gold makes a record-breaking start to 2023. Central bank demand up up by 176% from 82.7 to 228.4 tonnes even lower than last two quarters. Turkey was again a big buyer during this quarter reserves rose by 30 tonnes. RBI also added modest 7 tonnes in Q1 lifting its gold reserves to 795 tonnes.

Despite the declines experienced in the first quarter, the World Gold Council remains optimistic about investment in gold for the rest of the year. They believe that global gold ETF demand requires a catalyst to experience significant gains but expects positive demand and potential for growth due to recession risks and decreasing interest rates.

While demand for bars and coins is expected to continue at a favourable pace, with strong sales in the US, South-East Asia, and the Middle East compensating for subdued demand in Europe and India.

They also anticipate that Central bank buying will remain robust, the new buying rate in Q1 sets the tone for a higher midpoint for out full-year estimate

While Fabrication (jewellery and technology), is more subdued. As global growth slows down, there is a predicted impact on demand throughout the year.

Published on: May 29, 2023, 12:05 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates