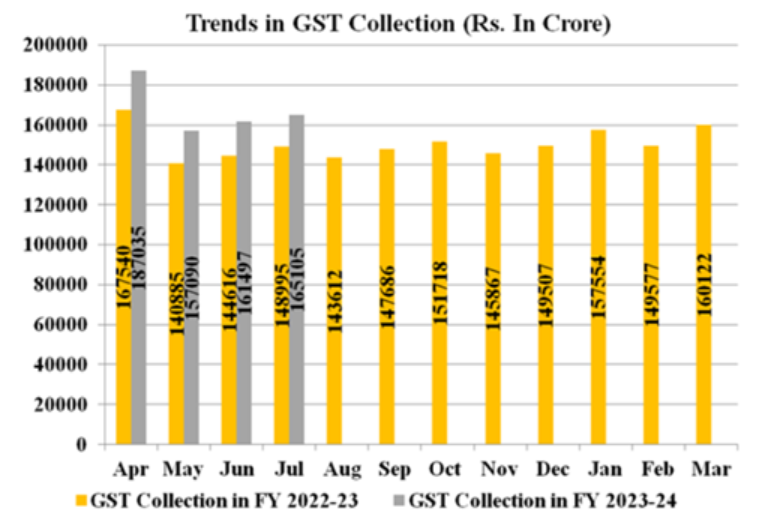

The GST collection for the month of July amounted to Rs 1,65,105 crore reported by the Ministry of Finance, marking the fifth time since the introduction of the goods and services tax that it has surpassed the Rs 1.6 lakh crore mark. The revenue for July showed an 11% YoY increase compared to the GST revenues in the corresponding month of the previous year.

Out of the gross GST revenue collected, the amount of Rs 1.6 lakh crore comprises Rs 29,773 crore CGST, Rs 37,623 crore SGST, Rs 85,930 crore IGST (including Rs 41,239 crore from imports), and Rs 11,779 crore as cess (including Rs 840 crore from imports).

Moreover, out of the IGST collection, the government settled Rs 39,785 crore to CGST and Rs 33,188 crore to SGST. After the regular settlement, the total revenue for the Centre was Rs 69,558 crore for CGST and Rs 70,811 crore for SGST in July 2023.

Compared to the same month last year, the revenues for July 2023 were 11% higher. Additionally, domestic transaction revenues (including import of services) for the month saw a 15% increase compared to the same month in the previous year. This marked the fifth time the gross GST collection has exceeded the Rs 1.60 lakh crore threshold said in a statement from the finance ministry.

Among the large state economies, Delhi, Uttar Pradesh, Maharashtra, Karnataka, and Tamil Nadu recorded double-digit revenue growth in July, while Gujarat recorded a single-digit growth.

Delhi witnessed an impressive 25% annual increase in GST revenue, reaching Rs 5405 crore. Uttar Pradesh reported a substantial 24% jump in revenue, amounting to Rs 8802 crore. Maharashtra experienced an 18% improvement in revenue collection, totalling Rs 26,024 crore, while Karnataka recorded a 17% increase, reaching Rs 11,505 crore. Tamil Nadu’s GST revenue collection for July amounted to Rs 10,022 crore, showing a substantial improvement of 19%. However, Gujarat’s revenue growth in July was modest, standing at 7% reached to Rs 9,787 crore.

When examining the states with the highest and lowest growth in terms of GST revenue, Mizoram showed an impressive 47% growth, increasing from Rs 27 crore to Rs 39 crore. On the other hand, Manipur experienced a negative growth of 7%, with its revenue declining from Rs 45 crore to Rs 42 crore in the same month.

The GST revenue for the previous month was Rs 1,61,497 crore, representing a 12% YoY increase. Nevertheless, it marked a significant decrease from the record-high GST collection of Rs 1.87 lakh crore in April and a substantial increase from the GST collection of Rs 1,57,090 crore in May.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet, and is subject to changes. Please consult an expert before making related decisions.

Published on: Aug 1, 2023, 6:57 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates