The VIX acts as a mood ring for the market, reflecting investor sentiment and potential for short-term swings. A higher VIX reading suggests greater anticipated volatility, often interpreted as fear prevailing among investors. Conversely, a lower India VIX indicates a calmer market environment with less expected price swings. By analysing historical data and its behaviour, we can glean valuable insights for making informed investment decisions.

In February and March of 2020, as the Indian government announced a nationwide lockdown due to COVID-19, anxieties surged. This collective fear translated into a historical high for the VIX, reaching nearly 85 points. This extreme reading mirrored the deep uncertainty surrounding the pandemic’s economic impact.

Interestingly, the data also reveals a fascinating characteristic of the VIX – its mean-reverting nature. This means that after periods of heightened volatility (high VIX readings), the index tends to move back toward its historical average. The 2020 example is a case in point. As fear in the market subsided, reflected by a declining VIX, the Indian stock market embarked on a recovery trajectory.

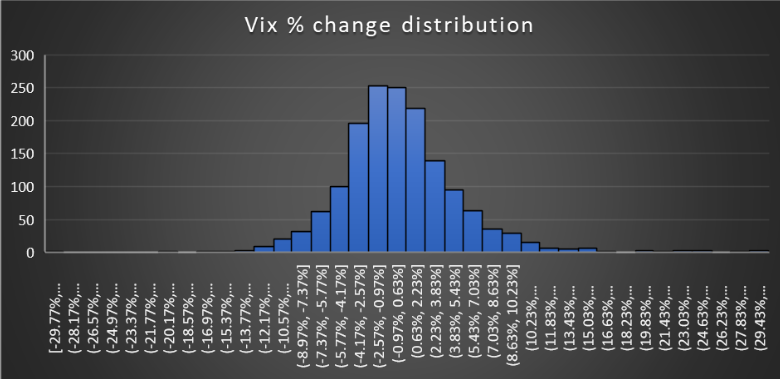

Examining daily VIX changes since 2018, the data suggests that these movements are typically range-bound. The majority of daily changes fall within a band of -2.57% to +2.23%. This highlights the VIX’s relative stability during normal market conditions.

Understanding the VIX’s behaviour can be advantageous for investors. Historically, periods of high VIX have often been followed by market corrections, creating entry points for undervalued stocks. However, careful analysis and a long-term perspective are crucial during volatile periods.

Check: India Vix Decline

On the other hand, if the VIX remains consistently low, it could mean that investors are feeling comfortable or relaxed. While this can suggest a healthy market environment, it’s essential to remain vigilant and maintain a diversified portfolio to weather any unexpected downturns.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. The information is based on various secondary sources on the internet and is subject to change. Please consult with a financial expert before making investment decisions.

Published on: Apr 25, 2024, 6:39 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates