InterGlobe Aviation Ltd (IndiGo), India’s largest passenger airline, was in the spotlight today. IndiGo commenced operations in August 2006 with a single aircraft and has now become the third-largest airline company by market capitalization today.

Today, IndiGo share price garnered considerable investor interest during the trading session, rallying over 5%. Shares of IndiGo opened the day at Rs 3689.95 per share and reached intraday highs and lows of Rs 3815.10 and Rs 3680, respectively, eventually concluding the day at Rs 3806.85, representing a gain of 4.82% compared to Tuesday’s closing price on the BSE.

Furthermore, the company’s shares touched a level of Rs 3800 per share for the first time ever, not only touching it but also closing the day above this significant level on the BSE. The current market capitalization of the company stands at Rs 146936.30 crore on the BSE. Additionally, the company’s shares have delivered an impressive return of around 100% in the past year.

Moreover, IndiGo has become the third-largest airline company in the world by market capitalization today. Let’s explore the top five airline companies in the world, their respective countries, and their returns in the past year.

| Airlines | Country | M Cap $ Billion | Price $ | 1-Year Return % |

| Ryanair | Ireland | 33.75 | 148.08 | 57.53 |

| Delta Airlines | USA | 30.44 | 47.32 | 39.30 |

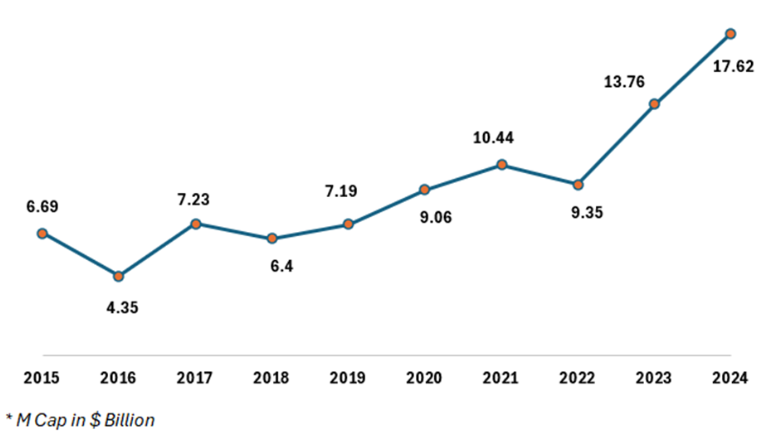

| InterGlobe Aviation | India | 17.62 | 45.66 | 100.09 |

| Southwest Airlines | USA | 17.37 | 29.05 | -9.70 |

| Air China | China | 14.47 | 1.03 | -37.20 |

As shown in the data above, IndiGo has become the third-largest airline company in the world, surpassing Southwest Airlines, which belongs to the USA. Furthermore, the shares of IndiGo have outperformed all the other players mentioned above from around the world. In December 2023, Indigo surpassed United Airlines to become the sixth-largest airline in the world.

In Q3 FY24, Indigo reported a revenue of Rs 19,452 crore, representing a year-on-year growth of 30.26% from Rs 14,933 crore in the same quarter last year. The operating profit of the company stands at Rs 5,144 crore, with an operating profit margin of 26% compared to Rs 3,114 crore in the same quarter last year. The net profit of the company stood at Rs 2,998 crore in the December quarter, a significant improvement compared to a net profit of Rs 1,418 crore.

In terms of ownership, the promoters hold 57.29% of the company, while FIIs (Foreign Institutional Investors) and DIIs (Domestic Institutional Investors) hold 23.66% and 15.03% respectively. Public shareholders hold 3.95% of the company.

Investors must keep this stock on their radar.

Disclaimer: This post has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Apr 10, 2024, 6:27 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates