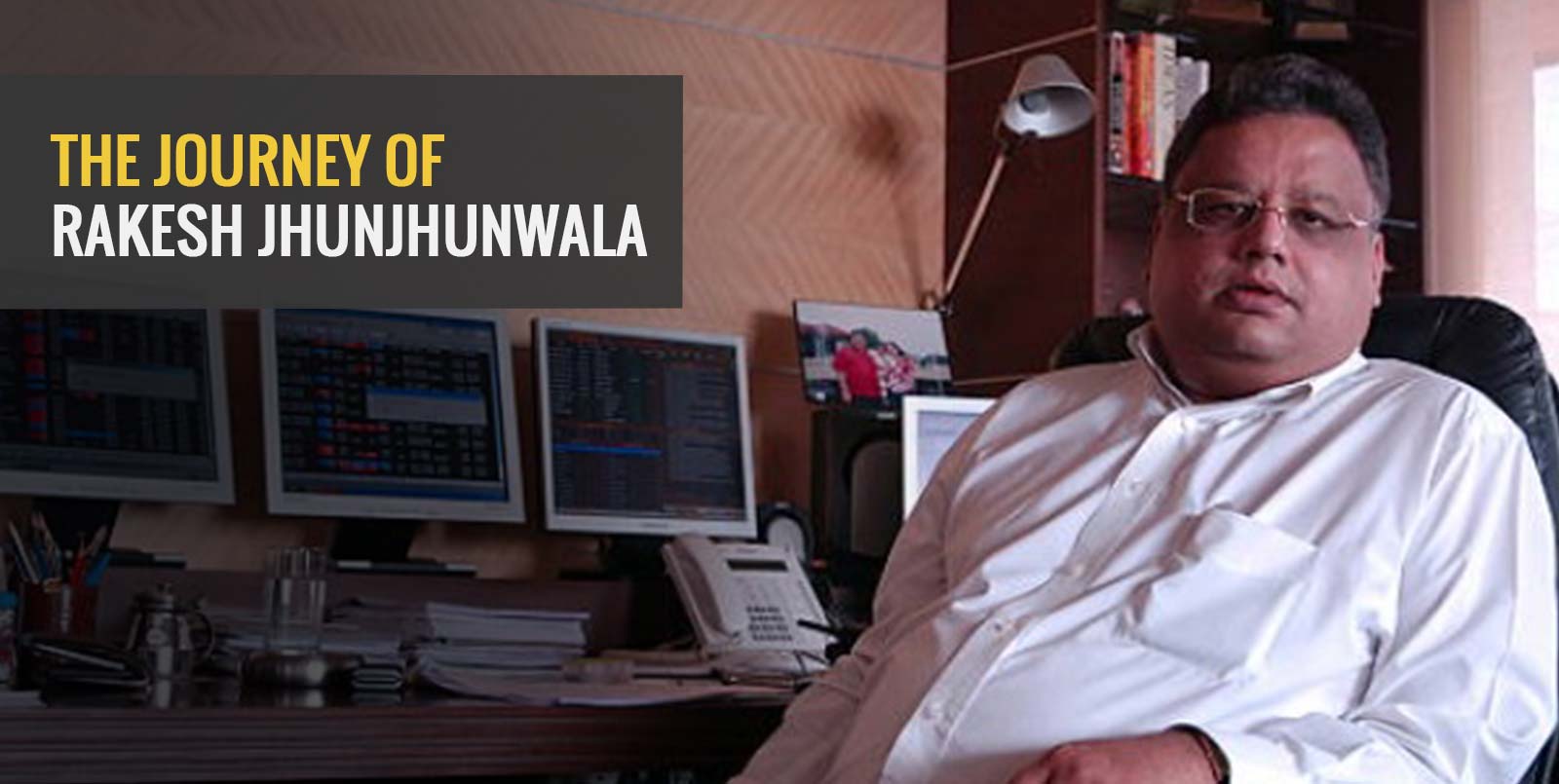

On the early morning of August 14, 2022, India was shocked by the news of Rakesh Junjhunwala’s demise. He was India’s ace investor and fondly called the big bull of Dalal Street. Let’s look at the life and legacy of Rakesh Jhunjhunwala and try to take a leaf or two from his investment book.

Rakesh Juhnjhunwala was born in Mumbai on July 5, 1960, to a middle-class family. His father was an Indian Income Tax Department official. After graduating from Sydenham College in 1985, he joined the Institute of Chartered Accountants of India. His father was a stock market enthusiast and an active investor, which got Rakesh interested in share investment.

His success story in the Indian stock exchange has earned him many nicknames, like Warren Buffet of India.

Rakesh Junjhunwala started his investor’s journey with only Rs. 5000. He bought Tata Tea stocks at Rs 43, which he sold later in 1986 at Rs. 143. Between 1986 and 1989, he made Rs. 2-2.5 million on Sesa Goa (currently Vedanta) stocks.

It becomes news whenever Rakesh Jhunjhunwala buys or sells stocks in the market. What he holds in his portfolio can give a new investor a lesson on investment.

Some of the brightest stars of Rakesh Jhunjhunwala’s portfolio were – Titan, Star Health and Allied Insurance Company, Metro Brands, Tata Motors, and Crisil. The total value invested in these stocks is more than Rs. 1,000 crore to Rs 11,000 crore.

Rakesh Jhunjhunwala’s portfolio held stocks of thirty-two publicly traded companies for a total valuation of Rs 32,000 crore in August 2022. The Titan and Crisil stocks he purchased in 2015 are 77% of his portfolio.

| Companies | Investment value in USD |

| Titan | 1.4 billion |

| Star Health | 884 million |

| Metro Brands | 281 million |

| Tata Motors (shares & DVRs) | 262 million |

| Crisil | 164 million |

| Fortis Healthcare | 113 million |

Rakesh Jhunjhunwala’s asset management firm, RARE Enterprise, purchased 42.5 lakh shares of Singer India at Rs. 53.35. Since all his investments always make news, Singer India shares rallied for two consecutive trading sessions.

Besides investing in large-cap listed companies like Titan and CRISIL, Rakesh Jhunjhunwala had made several investments in unlisted companies. However, he agreed that half his investments in these companies have failed. His most significant investment in unlisted companies was Nazara Technologies, which launched a successful IPO in 2021, and Star Health, Concord, and Metro. He invested in twenty unlisted companies, amid which Rakesh Jhunjhunwala’s shareholding in ten companies had failed.

When asked about his successful investments as a private equity investor, he said it was because he was patient and his investment horizon was long.

RARE Enterprise is an asset management company owned by Rakesh Jhunjhunwala. It managed all his investments. The company’s name is derived from the first two letters of his name and two letters of his wife’s name, Rekha, also an investor.

Aakasha Airlines is an ultra-low-cost airline backed by Rakesh Jhunjhunwala. He invested Rs. 247.50 crore in the project. It was co-founded by Rakesh Jhunjhunwala and the Former CEO of Jet Airways, Vinay Dube.

Rakesh Jhunjhunwala had arranged to pass his wealth of Rs. 46,000 crore – direct holdings in listed and unlisted companies and immovable properties to his wife and three children.

The untimely death of Rakesh Jhunjhunwala has once again highlighted the question of mentioning a nominee in your Demat.

In case of the investor’s death, the nominee receives the holdings on producing an attested death certificate. If a nominee is not registered, then the deceased’s heir needs to submit any of the following documents to make his claim.

A nominee is a trustee and not the owner. If there is a will, the holdings will be dealt with according to its terms. Otherwise, the shares will be distributed among legal heirs following Hindu Succession Act.

Also Read – How to add Nominee in Demat Account

The online Demat account opening process facilitates adding a nominee to your Demat account.

Wrapping up

Rakesh Jhunjhunwala’s journey will always remain an inspiration for all investors. It won’t be wrong to say that no one understood the Indian stock market better than him.

Published on: Aug 18, 2022, 1:31 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates