On Monday, the Nifty closed with gains of 189.40 points or 0.86%, forming a Dragonfly Doji candlestick pattern on the daily timeframe. This bullish pattern was supported by a broad market rally, with most sectors participating, led by PSU Banks and Pharma.

Looking ahead, the Nifty’s immediate resistance is expected to be between 22,400 and 22,430. Despite this resistance, the market is expected to see stock-specific action on Dalal Street. In this context, one standout stock to watch is LIC Housing Finance, which gained nearly 3% on Monday.

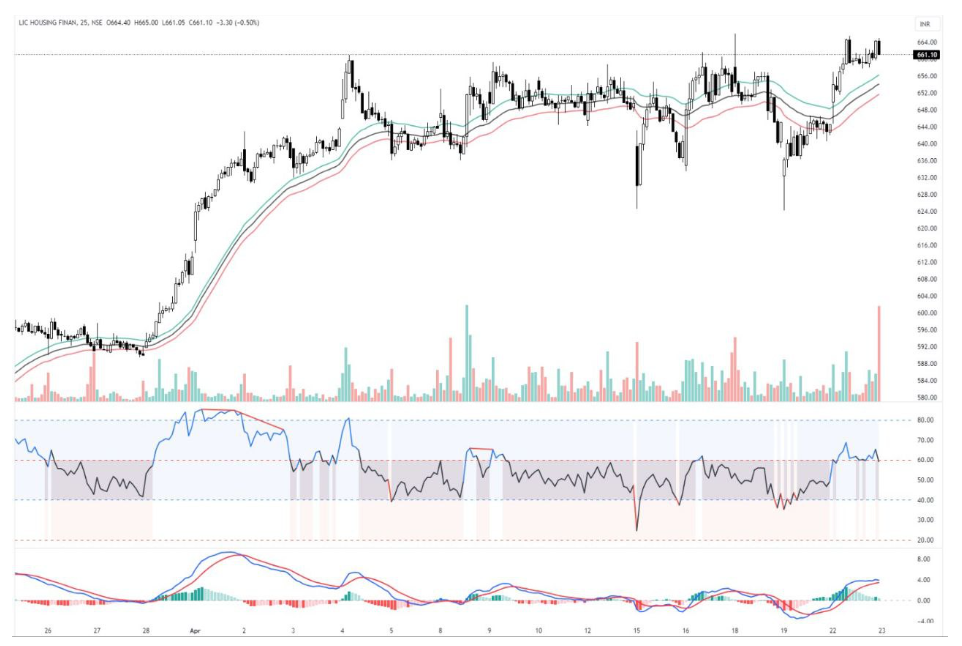

LIC Housing Finance stock closed at a parallel resistance level, hinting at a complex inverted head-and-shoulder pattern. A strong bullish candle accompanied by above-average volume on Monday suggests significant buying interest.

The stock is showing robust bullish signals across several technical indicators. It has closed at its highest level since September 2017 and is above all key moving averages. The moving average ribbon indicates an uptrend, with the stock trading 6.04% above the 50-day moving average. Elder’s Impulse System has formed a strong bullish bar, while the MACD suggests increasing bullish momentum. The RSI has entered a strong bullish zone, indicating positive momentum. Additionally, the KST and Stochastic RSI both suggest further upward movement, with the Stochastic RSI nearing a bullish signal.

Given these technical indicators, LIC Housing Finance is poised for a multi-year breakout. A move above Rs.664 could lead to a test of Rs.695. For risk management, maintain a stop-loss at Rs.650.

Traders should keep LIC Housing Finance on their radar, as it is demonstrating strong bullish technical signals and could be poised for a significant breakout. Don’t miss the action!

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Apr 23, 2024, 10:09 AM IST

We're Live on WhatsApp! Join our channel for market insights & updates