The Indian Mutual Funds industry has made history by achieving a significant milestone, surpassing the mark of Rs 50 lakh crore in net assets under management (AUM). Notably, SIPs continued to establish new records, with December seeing Rs 17,610 crore flowing in through SIPs compared to Rs 17,073 crore in November. Additionally, over 4 million new SIP accounts were opened during the month.

The assets under management (AUM) of the Indian mutual funds industry have surpassed Rs 50 lakh crore for the first time. This achievement was accompanied by a notable surge in flows via systematic investment plans (SIPs) in December. As reported by the Association of Mutual Funds in India (AMFI), the industry’s total AUM has registered a growth of around 3.5%, surpassing the previous month’s AUM of Rs 49.05 lakh crore.

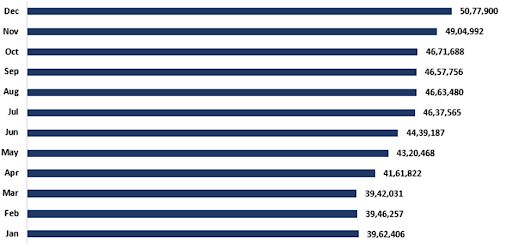

At the outset of the calendar year 2023, the AUM in January stood at Rs 39.62 lakh crore. Throughout the year, negative growth was observed in only three months: February, March, and September. The remaining months exhibited positive month-on-month growth. The most substantial growth of 5.6% MoM was recorded in April 2023, followed by a 4.5% MoM increase in July.

Comparatively, in December 2022, the total AUM of the Indian Mutual Funds Industry was Rs 39.88 lakh crore. Remarkably, there was an impressive growth of 27.30% leading to a substantial rise, reaching Rs 50.77 lakh crore.

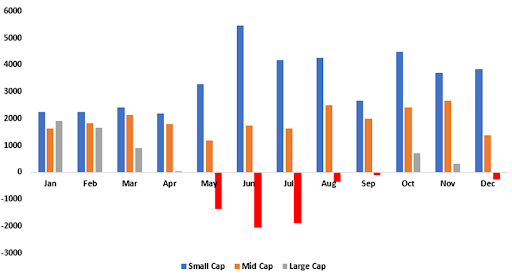

Category-wise Inflows Trend:

| Particulars | Monthly Inflows/Outflows in 2023 (Amount Rs in Crore) | |||||||||||

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| Small Cap | 2255.85 | 2246.3 | 2430.04 | 2182.44 | 3282.5 | 5471.75 | 4171.44 | 4264.82 | 2678.47 | 4495.13 | 3699.24 | 3857.5 |

| Mid Cap | 1628.06 | 1816.66 | 2128.93 | 1790.98 | 1195.65 | 1748.51 | 1623.33 | 2512.34 | 2000.88 | 2408.92 | 2665.73 | 1393.05 |

| Large Cap | 1901.99 | 1651 | 911.29 | 52.63 | -1362.28 | -2049.61 | -1880 | -348.98 | -110.6 | 723.81 | 306.7 | -280.94 |

The chart above illustrates that Small-cap funds, among all equity-oriented schemes including Large and Mid-cap funds, have displayed exceptional performance by consistently experiencing substantial inflows throughout the year. In 2023, the total inflow in Small-cap funds amounted to Rs 41,035 crore, nearly 1.8 times higher than the inflow in Mid-cap funds, which stood at Rs 22,913 crore for the entire year.

Conversely, within the Large Cap category, there were several months marked by outflows, resulting in a net outflow of approximately Rs 485 crore over the year.

Within the Small-cap category, the highest inflow was recorded in June 2023, reaching Rs 5,471.75 crore, while the lowest inflow occurred in April, amounting to Rs 2,182.4 crore. Notably, no month experienced outflows in this category. On the other hand, within the Mid-cap category, the peak inflow was observed in November, totalling Rs 2,665.73 crore, whereas the lowest inflow was in May, amounting to Rs 1,195.65 crore.

AMFI’s Chairman, Navneet Munot, outlined the mutual fund industry’s trajectory, aiming for a Rs 100 lakh crore AUM and 10 crore investors in the near future. Reflecting on the industry’s rapid growth, AMFI’s Chief Executive, Venkat Chalasani, highlighted the significant leap from Rs 40 lakh crores to Rs 50 lakh crores AUM within just over a year.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Jan 8, 2024, 6:42 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates