The objective of the Nifty 1D Rate Index is to measure the returns generated by market participants lending in the overnight market with government securities as underlying collateral. The index uses the overnight rate published on the “Triparty Repo Dealing System (TREPS)”, platform of CCIL, with government securities as underlying, for computation of index values, Source: NSE Indices Ltd.

Performance – Nifty 1D Rate Index

| Period | 7 Days | 15 Days | 1 Month | 3 Months | 6 Months | 1 Year |

| Returns (%) | 6.2% | 6.2% | 6.3% | 6.5% | 6.5% | 6.7% |

Source: MFI

Performance as on February 28, 2025

Returns less than 1 year are simple annualised and equal to or more than 1 year are compounded annualised. Past performance is not indicative of future returns and may or may not be sustained in future. The performance figures pertain to the index and do not in any manner indicate the returns/performance of the scheme.

Note: The data provided above is for illustrative purposes only and should not be construed as any kind of recommendation.

This ETF mirrors the Nifty 1D Rate Index, which measures returns from overnight lending in the money market backed by government securities. Returns are tracked via NAV movements, eliminating the need to track fractional interest earnings.

Investors can use this ETF to park idle money lying with the broker and earn income on the same. This can be useful in the interim period between exiting from existing stock investment and deploying funds in other stock at a later date.

| Name of the Scheme | Angel One Nifty 1D Rate Liquid ETF – Growth |

| Scheme Benchmark | Nifty 1D Rate Index |

| Fund Manager | Mr. Mehul Dama and Mr. Kewal Shah |

| Minimum Application Amount (During NFO) | Minimum amount of Rs.1,000/- and in multiples of Re. 1 thereafter |

| Exit Load | NIL |

| Listing | NFO Units offered pursuant to NFO to be listed on NSE within 5 working days from the date of allotment |

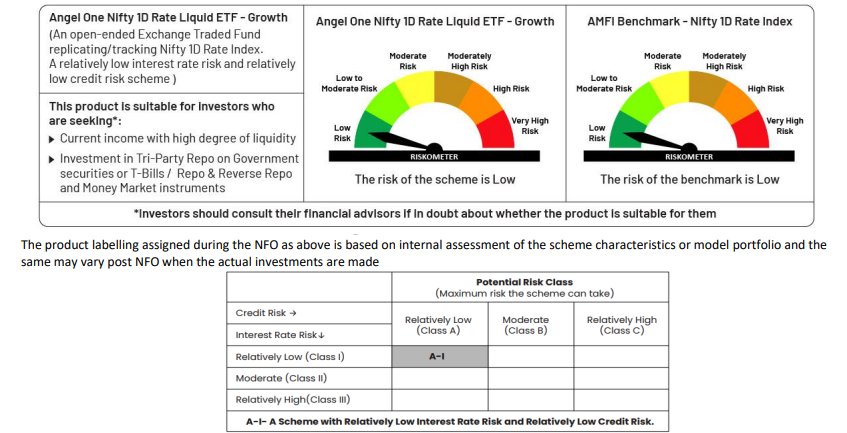

Product Label:

The product labelling assigned during the NFO is based on internal assessment of the scheme characteristics or model portfolio and the same may vary post NFO when the actual investments are made.

NSE Indices Ltd. Disclaimer: The Angel One Nifty 1D Rate Liquid ETF – Growth – Growth offered by Angel One Asset Management Company Limited or its affiliates is not sponsored, endorsed, sold or promoted by NSE INDICES LTD and its affiliates. NSE INDICES LTD and its affiliates do not make any representation or warranty, express or implied (including warranties of merchantability or fitness for a particular purpose or use) to the owners of Angel One Nifty 1D Rate Liquid ETF – Growth or any member of the public regarding the advisability of investing in securities generally or in the Angel One Nifty 1D Rate Liquid ETF – Growth linked to Nifty 1D Rate Index or particularly in the ability of the Nifty 1D Rate Index to track general stock market performance in India. Please read the full Disclaimers in relation to the Nifty 1D Rate Liquid Index in the Scheme Information Document.

NSE Stock Exchange Disclaimer: It is to be distinctly understood that the permission given by NSE should not in any way be deemed or construed that the Scheme Information Document has been cleared or approved by NSE nor does it certify the correctness or completeness of any of the contents of the Draft Scheme Information Document. The investors are advised to refer to the Scheme Information Document for the full text of the ‘Disclaimer Clause of NSE’.

Ensure steady returns with systematic withdrawals! Estimate your withdrawals with our SWP Calculator and manage your finances seamlessly.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully. http://bit.ly/420IhgK

Published on: Mar 19, 2025, 10:56 AM IST

Akshay Shivalkar

Akshay Shivalkar is a financial content specialist who strategises and creates SEO-optimised content on the stock market, mutual funds, and other investment products. With experience in fintech and asset management, he simplifies complex financial concepts to help investors make informed decisions through his writing.

Know MoreWe're Live on WhatsApp! Join our channel for market insights & updates