Nifty is surprising not only to Indian investors but also to global market participants by breaking its own records. In today’s pre-opening session, it settled directly above the significant level of 22,000, reflecting a 0.72% or 158.6 points increase from Friday’s closing level of 21,894.55. During the intraday session, it reached an intraday high of 22,081 and a low of 21,963. As of writing this article, it is currently trading at 22,021.

If we trace the journey from the significant milestone of 20,000, it initially reached this level for the first time on September 11, 2023. Subsequently, it peaked at 20,222 on September 15, 2023. However, it experienced a decline of approximately 1400 points, reaching a low of 18,838 on October 26, 2023. Emerging from this low point, it not only surpassed but also closed above its previous peak of 20,222 on December 01, 2023, marking a rally of around 1450 points or 7.7%.

The momentum continued, and today it has achieved a significant milestone of 22,000, a level eagerly anticipated for quite some time. Notably, from the low point of 18,838, it rallied over 3200 points, representing a gain of 17.20%, all within a span of approximately 82 days.

Nifty every 1000 points:

| Date | 05-Feb-21 | 03-Aug-21 | 31-Aug-21 | 11-Oct-21 | 28-Jun-23 | 11-Sep-23 | 08-Dec-23 | 15-Jan-24 |

| Days | – | 180 | 29 | 42 | 626 | 76 | 89 | 39 |

| Levels | 15000 | 16000 | 17000 | 18000 | 19000 | 20000 | 21000 | 22000 |

Upon observation, the highest number of days taken to cover 1000 points is 626 days, observed during the ascent from 18,000 to 19,000, spanning almost two years. In contrast, the shortest duration to cover the same 1000 points is remarkably shorter, requiring only 29 days, witnessed during the climb from 16,000 to 17,000. This time, it marks the second-best duration as it takes 39 days to cover and reach 22,000 from 21,000.

When comparing the strength of the market, reaching from 20,000 to 21,000 took approximately 89 days, while this time, the market has covered almost half that duration, achieving the same 1000 points in just 39 days.

Brokerage Firms Targets:

Observing the robustness of the Indian markets, several brokerage firms have unveiled their respective targets for Nifty in the days ahead. Among these, three prominent brokerage firms—Jefferies with a target of 24,000, Goldman Sachs projecting 23,500, and ICICI Direct forecasting 25,000—have presented their outlooks for the Nifty in the upcoming days.

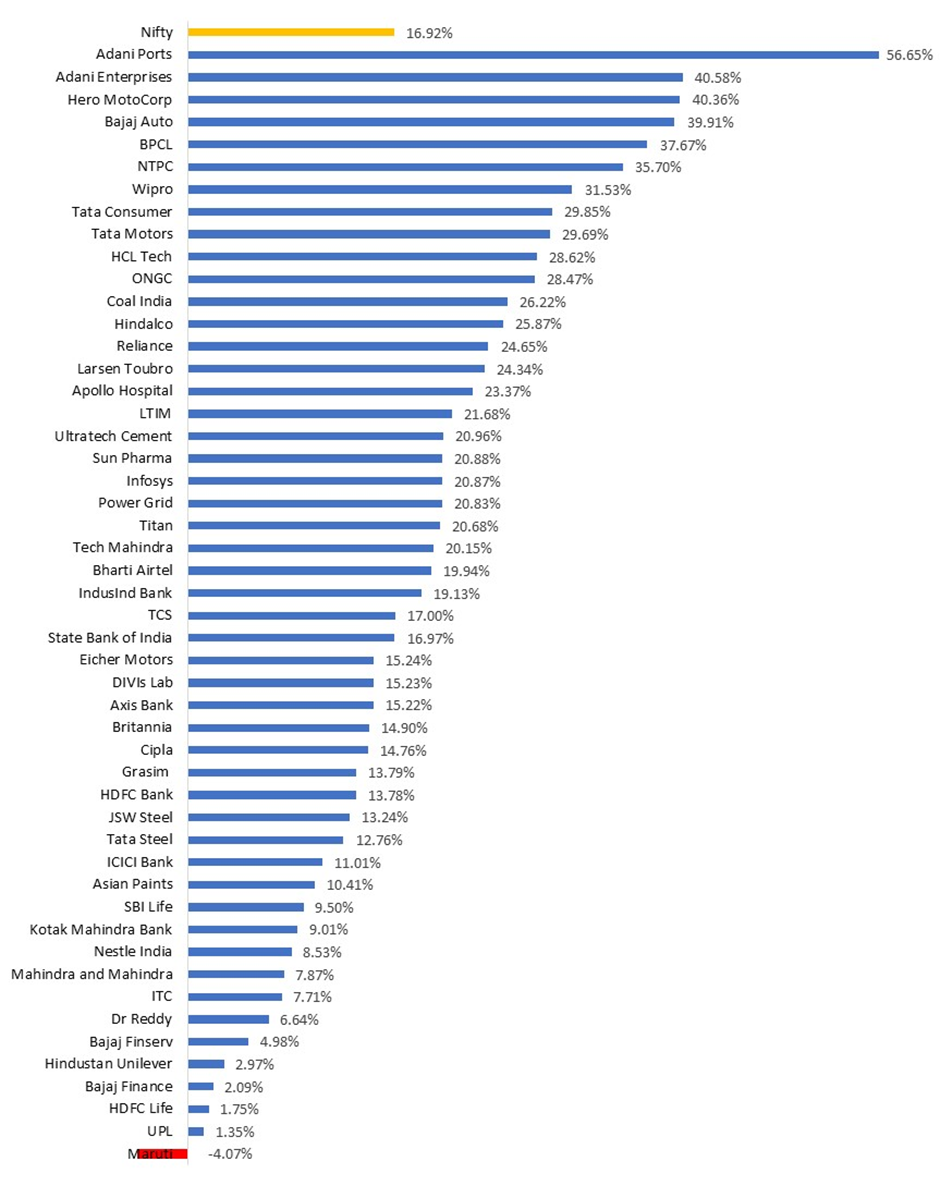

Top 10 Gainers

These top stocks have not only contributed to Nifty reaching a significant level but have also outperformed the Index by generating returns surpassing those of Nifty. Within this selection of 10 stocks, there are an additional 18 stocks that have demonstrated outperformance compared to the index during the specified period, as detailed in the table below.

| Stocks | 26-10-2023 | 15-01-2023 | % Change |

| Nifty50 | 18857.25 | 22048.00 | 16.92% |

| Adani Ports | 770.30 | 1206.65 | 56.65% |

| Adani Enterprises | 2203.00 | 3097.00 | 40.58% |

| Hero MotoCorp | 3111.95 | 4367.90 | 40.36% |

| Bajaj Auto | 5259.35 | 7358.10 | 39.91% |

| BPCL | 335.00 | 461.20 | 37.67% |

| NTPC | 231.65 | 314.35 | 35.70% |

| Wipro | 378.25 | 497.50 | 31.53% |

| Tata Consumer | 880.35 | 1143.15 | 29.85% |

| Tata Motors | 626.55 | 812.55 | 29.69% |

Nifty 50 Stocks Performance:

Analysing the data above, it is evident that the sole stock that has not contributed to the Nifty50’s rally during the mentioned period is Maruti Suzuki, exhibiting a negative return of approximately 4%. On October 26, 2023, it was trading at Rs 10,424 per share, and today it is trading at around Rs 10,000 per share, reflecting a decline of almost 424 points. In contrast, during the same period, Nifty witnessed a rally of 3,200 points.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Jan 15, 2024, 2:23 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates