The NSE benchmark Nifty50 index has rebounded by over 150 points from the day’s low and is hovering near the day’s high, around the 22,450 mark, up by 0.22%. This strong recovery has drawn attention to the Nifty PSE Index, which has hit a new high and, notably, has broken out of an ascending triangle pattern.

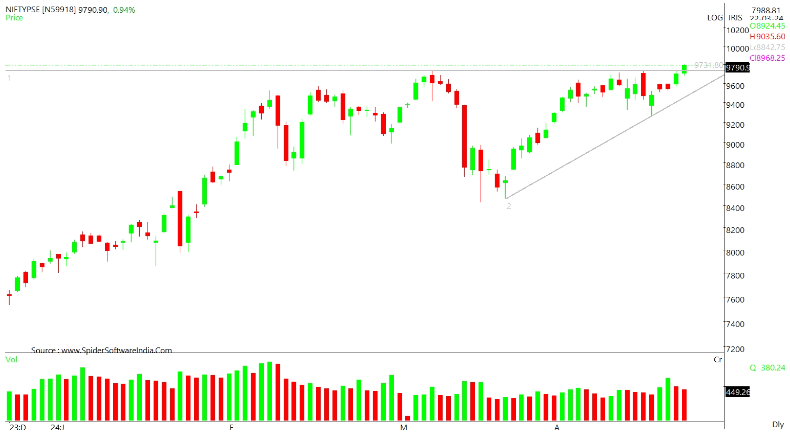

The Nifty PSE Index is currently trading at 9777, up by 0.82%. In March, it reached a high of 9732 before correcting by about 13.4% in a short span. This correction retraced approximately 78% of the prior rally (7971 to 9732). After this retracement, the index rebounded, surpassing its previous high of 9732, but failed to sustain the momentum, leading to a decline. The price action created a horizontal resistance line at the top and a higher low, forming an upward sloping trendline, which resulted in a formation of ascending triangle-like pattern.

On Thursday, the index broke out of the ascending triangle pattern. According to the pattern target, the index has the potential to reach the 11,000 mark in the medium term. Supporting this positive outlook, the daily MACD rebounded from its nine-period average, indicating a positive bias, while the daily RSI generated a bullish crossover, signaling a rising trend.

| Stock Name | Weight in % |

| NTPC | 14.07 |

| Power Grid Corporation of India | 11.13 |

| Oil & Natural Gas Corporation of India | 9.22 |

| Coal India | 8.73 |

| Bharat Electronics | 6.37 |

| Hindustan Aeronautics | 5.49 |

| Indian Oil Corporation | 5.43 |

| Bharat Petroleum Corporation | 5.07 |

| Power Finance Corporation | 5 |

| REC | 4.92 |

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Apr 25, 2024, 5:10 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates