Let’s start this expiry outlook with analysis of: Monthly, Weekly, Daily, And Hourly time-frames.

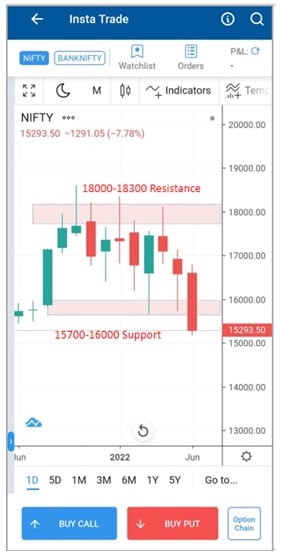

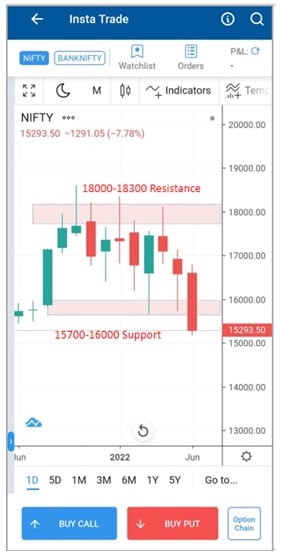

Monthly time-frame

- Major resistance zone 18000-18300, got rejected several times from this zone.

- Nifty found support at 15700-16000 zone twice in March & May Month.

- Nifty falling with Red candle in last 2 months, but was getting support from 15700 levels.

- Current month (June) candle has broken the major support zone, signalling a big sell-off.

- Monthly time-frame indicates complete bearishness in market, as price has broken the major support zone with big red candle.

Weekly Time-frame

- Nifty was falling in Lower High – Lower Low pattern since past months.

- Latest fall from 18100 levels up-to the support zone of 15700-16000.

- Bounced back from support zone to 16800 level, from where it resumed down-trend with hammer pattern formation at 16800 levels.

- After testing support zone of 15700-16000, In last two week bears gripped the market with full power, broken the major support zone. Hence on weekly timeframe, Outlook is bearish.

Daily Time-frame Analysis

- From the resistance level of 16800, it keeps falling, with some hesitation on 16400-16500 zone, but in past week, Bears took complete charge.

- On Mon , Tues, Wed, bears respected the major support zone of 15700, but on Thursday Nifty fell more that 472 points in single day, with big red decisive candle.

- On Friday, Nifty was mostly sideways, but overall outlook is Bearish.

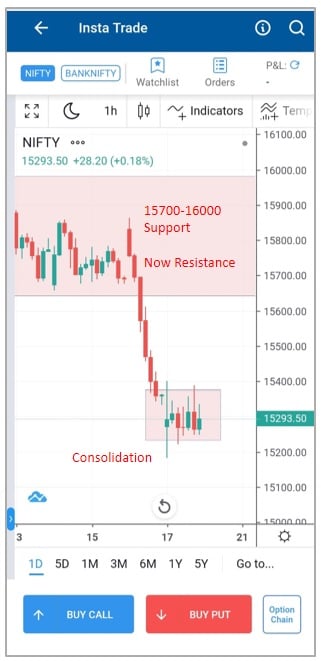

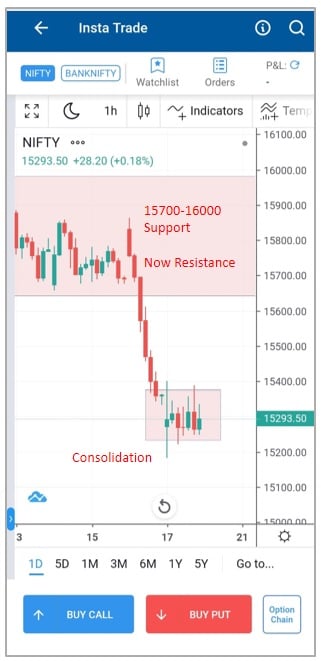

Hourly Time-frame Analysis

- From the resistance level of 16800, Bears kept hammering Nifty with lower-high, lower low pattern.

- However, there was some sideways movement at 15700 zone.

- But, on Friday Bulls lost their 15700 territory & Bears took market to 15300 levels.

Concluding Analysis :

- Bears took charge; from the level of 16800 they dragged Nifty to 15700 zones (1100 pts).

- From 15700, Bulls struggled for 2 days, but again bears dragged market to 15300 zones. (400pts)

- So it’s clear, Bears are in full charge of Nifty, breaking all the major support zones.

- However, if Bulls are able to take Nifty above 16600, which is less likely, in next week, that can give new hope to Bulls to end this sell-off.

- As long as Nifty is below 15700, Nifty is at Sell on Rise state, where every rise will be hammered by Bears. However 15000 can act as support in near terms which is ready to be tested.

Support & Resistance Zone

| Range |

Support |

Resistance |

| Narrow Range |

14900 |

15860 |

| Broader Range |

14500 |

16480 |

Try Insta Trade

The easiest Options Trading platform! Get Charts, Watchlist, Positions & live P&L in single screen

Trade Now