In the ever-connected world of finance, global events often send ripples across markets. One such event that consistently captures the attention of Indian investors is the surge in US bond yields. But why does this seemingly distant development send shockwaves through the Indian financial landscape?

Before we delve into the concerns, let’s clarify what a surge in US bond yields means. A surge implies that the yields on US government bonds, particularly the benchmark 10-year Treasury yield, have risen significantly. Bond yields move inversely to bond prices, so when yields rise, bond prices fall. This uptick in yields often indicates expectations of higher interest rates in the United States.

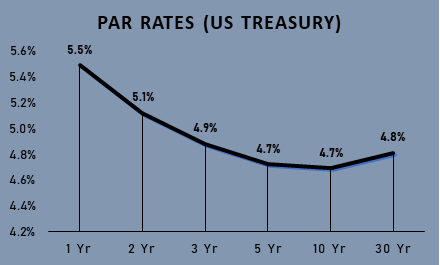

US TREASURY YIELD CURVE (PAR RATES):

With the current earnings yield (1/PE) of Nifty standing at 4.54%, and the US 10-year treasury yield at 4.7%, Nifty appears comparatively less appealing to Foreign Institutional Investors (FIIs). This discrepancy has resulted in recent sell-offs. However, the market remained relatively stable, thanks to domestic factors providing a cushion against external pressures

While a surge in US bond yields might cause momentary panic, it’s essential for Indian investors to maintain a long-term perspective. Here are a few strategies to navigate these turbulent times:

In conclusion, while a surge in US bond yields might rattle Indian investors, it’s crucial to remember that panic rarely leads to wise investment decisions. Instead, consider these moments of uncertainty as opportunities to reassess and fine-tune your investment strategy. With vigilance, diversification, and a long-term perspective, Indian investors can navigate these global economic tides and emerge stronger on the other side.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Oct 23, 2023, 3:55 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates